United States Distribution Transformer Market

United States Distribution Transformer Market Trend, Opportunity, and Forecast Analysis, 2024-2033

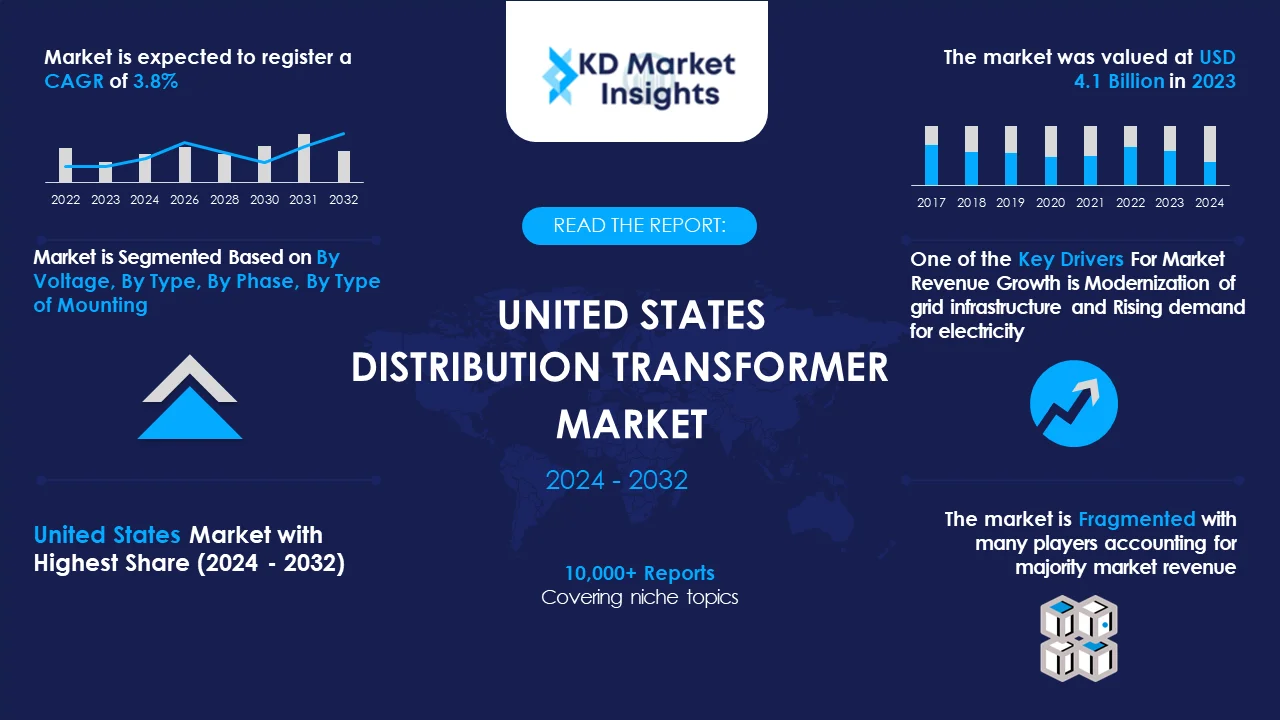

United States Distribution Transformer Market is segmented by Voltage, Type, Phase, and Type of Mounting. KDMI analyst’s growth analysis foresees market revenue to cross USD 5.9 Billion by 2033 by growing with a CAGR of 3.8% during 2024-2033.

United States Distribution Transformer Market Highlights

The United States distribution transformer market is expected to cross a market size of USD 5.9 Billion by the end of 2033. The market size was valued at USD 4.1 Billion in 2023 and is expected to expand at a CAGR of 3.8% between 2024-2033.

- Over the mid-term, the modernization of grid infrastructure is the primary factor anticipated to drive the United States distribution transformer market.

- High Initial Investment and Replacement Costs is a major factor to challenge the market growth.

United States Distribution Transformer Market: Report Scope |

|

|

Base Year |

2023 |

|

Base Year Market Size |

USD 4.1 Billion |

|

Forecast Year |

2024-2033 |

|

Forecast Year Market Size |

USD 5.9 Billion |

|

CAGR Value |

3.8% |

|

United States Distribution Transformer Market Key Trends/Major Growth Drivers |

|

|

Restraint Factors |

|

|

United States Distribution Transformer Market Segmentation |

|

|

United States Distribution Transformer Market Key Players |

Siemens AG, Kirloskar Electric Company Ltd., General Electric Company, Hyundai Electric & Energy Systems Co. Ltd., Schneider Electric SE, Southwest Electric Co., Hitachi Ltd., Emerson Electric Co., Eaton Corporation PLC, Toshiba Corp, and others. |

United States Distribution Transformer Market Outlook

A distribution transformer or service transformer is a transformer that provides a final voltage transformation in the electric power distribution system, stepping down the voltage used in the distribution lines to the level used by the customer. There are various forms of transformers available in the distribution system, such as single-phase, three-phase, pad-mounted, and pole-mounted distribution transformers. These transformers are available in various sizes, insulating oil and efficiencies, to suit project requirements and budgets.

The United States possesses a massive amount of aging electrical grid infrastructure which is undergoing significant modernization efforts. The Department of Energy (DoE) of the United States, stated that 70% of transmission lines in the nation were over 25 years old and were approaching the end of their typical 50-80-year lifecycle. Upgrading outdated transformers with modern, more efficient units is essential to improve grid reliability, reduce energy losses, and enhance overall system performance. Government initiatives and utility investments in grid modernization projects are major growth drivers for the distribution transformer market. Siemens AG, Kirloskar Electric Company Ltd., and General Electric Company are some of the significant parties in the market for United States distribution transformer.

Get More Insights on This Report - Request Free Sample PDF

Get More Insights on This Report - Request Free Sample PDF

United States Distribution Transformer Market Drivers – Analyst’s Observation

According to the analysts at KD Market Insights, some key growth drivers for the United States distribution transformer market are:

- Rising demand for electricity: The rising demand for electricity, driven by population growth, urbanization, and the proliferation of electronic devices and electric vehicles, is necessitating the expansion, and upgrading of the electrical grid. This drives the need for more distribution transformers to ensure efficient power distribution and meet the growing energy demands.

- Technological Advancements: Technological advancements in transformer design and materials are improving the efficiency, reliability, and lifespan of distribution transformers. Innovations such as smart transformers, which allow for real-time monitoring and remote management, and the development of eco-friendly insulating materials are making modern transformers more attractive to utilities and other stakeholders.

Which Probable Factors Could Hamper the Growing United States Distribution Transformer Market Trend?

As per our KD Market Insights analysis, some of the challenges expected to limit the market growth of the United States distribution transformer are:

- High Initial Investment and Replacement Costs: The cost of purchasing and installing new distribution transformers can be high, particularly for advanced models with enhanced features. These high upfront costs can deter utilities and industries from replacing older transformers, especially in regions with budget constraints or limited financial resources.

- Supply Chain Disruptions: The distribution transformer market is susceptible to supply chain disruptions, which can be caused by factors such as geopolitical tensions, trade restrictions, and natural disasters. These disruptions can lead to delays in manufacturing and delivery, increased costs, and shortages of critical components, impacting the timely deployment of new transformers.

How is the United States Distribution Transformer Market Segmented?

Our experts at KD Market Insights have segmented the United States distribution transformer market research report as:

|

By Voltage |

|

|

By Type |

|

|

By Phase |

|

|

By Type of Mounting |

|

Which Key Players Top the United States Distribution Transformer Market Share?

As per our analysts at KD Market Insights, the competitive landscape of the United States distribution transformer market facilitates our readers in identifying their closest competitors. The manufacturers who are associated with United States distribution transformer market are raising their focus on expanding their presence, as well as their market share. The market has also been witnessing an upward movement in the number of collaborations between research institutions and key players, aimed at introducing advanced technologies and innovation of new products. Here is a list of the key players who top the United States distribution transformer market share:

- Siemens AG

- Kirloskar Electric Company Ltd.

- General Electric Company

- Hyundai Electric & Energy Systems Co. Ltd.

- Schneider Electric SE

- Southwest Electric Co.

- Hitachi Ltd.

- Emerson Electric Co.

- Eaton Corporation PLC

- Toshiba Corp

What are the Recent Developments Observed in the United States Distribution Transformer Market?

Over the years, the experts at KD Market Insights have been observing the recent developments associated with the United States distribution transformer market trends. Our expert’s market forecast analysis has recorded the market players adopting plentiful of key strategies including new product launches, mergers & acquisitions, and collaborations.

For instance, Hitachi Energy stated that it would invest USD 10 million for expansion of its distribution transformer facility in Jefferson City in Missouri.

Further, the U.S. Senators launched the Distribution Transformer Efficiency & Supply Chain Reliability Act of 2024 to stabilize the manufacturing of transformers locally.

- Executive Summary

- Market Overview

- Key Findings

- Market Trends

- Market Outlook

- Introduction

- Scope of the Report

- Research Methodology

- Definitions and Assumptions

- Acronyms and Abbreviations

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- United States Distribution Transformer Market

- Market Overview

- Market Size and Forecast

- Market Segmentation

- By Voltage

- By Type

- By Phase

- By Type of Mounting

- Market Segmentation by Voltage

- Low Voltage

- Medium Voltage

- High Voltage

- Market Segmentation by Type

- Oil-Filled

- Dry-Type

- Market Segmentation by Phase

- Single Phase

- Triple Phase

- Market Segmentation by Type of Mounting

- Pole-Mounted

- Pad Mounted

- Competitive Landscape

- Market Share Analysis

- Company Profiles

- Siemens AG

- Kirloskar Electric Company Ltd.

- General Electric Company

- Hyundai Electric & Energy Systems Co. Ltd.

- Schneider Electric SE

- Southwest Electric Co.

- Hitachi Ltd.

- Emerson Electric Co.

- Eaton Corporation PLC

- Toshiba Corp

- Strategic Recommendations

- Appendix

- List of Tables

- List of Figures

- References

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -