Sterility Testing Market By Product & Service (Kits & Reagents, Instrument, Services), By Test (Membrane Filtration, Direct Inoculation, Other Tests), By Application (Pharmaceuticals And Biologicals, Medical Device Manufacturing, Other Applications), By End User (Pharma, Biotechnology Companies, Others) and By Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Global Market Analysis, Trends, Opportunity and Forecast, 2023-2032

Sterility Testing Market Size and Overview

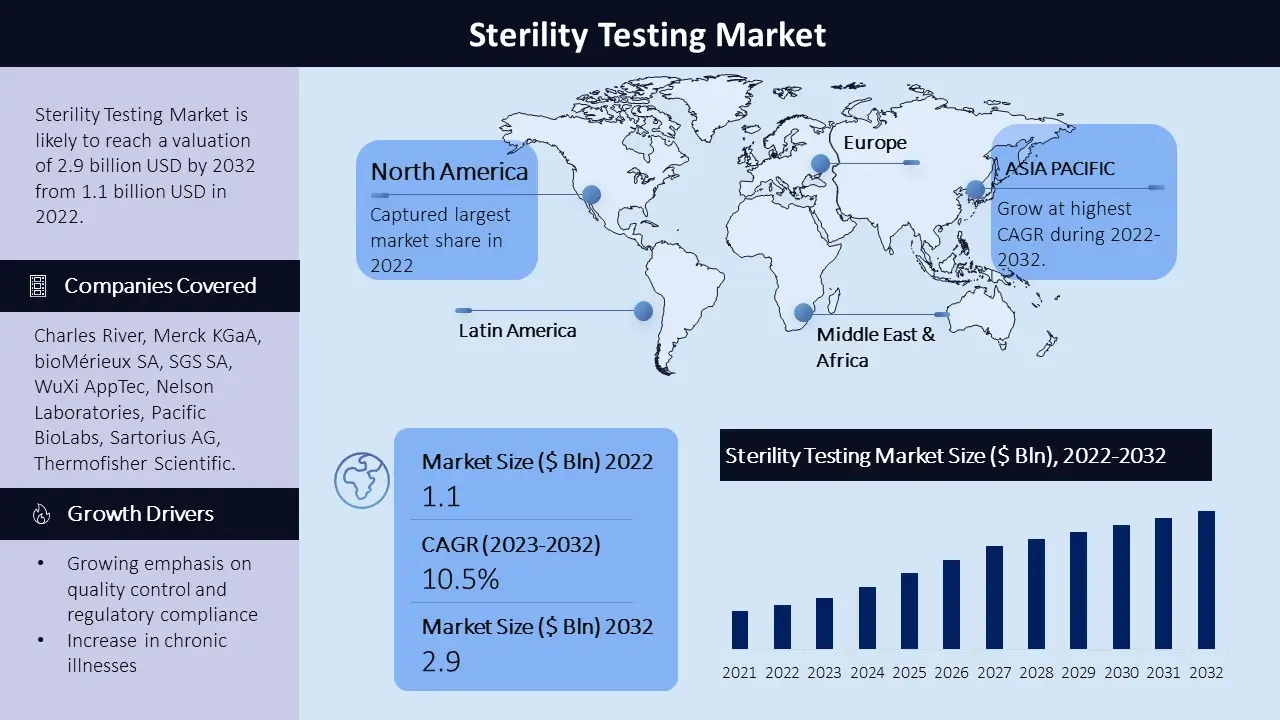

The sterility testing market size is poised to reach USD 2.9 billion by the end of 2032, growing at a CAGR of 10.5% during the forecast period, i.e., 2023 – 2032. In the year 2022, the industry size of sterility testing market was USD 1.1 billion. The reason behind the growth can be attributed to the developing emphasis on quality and regulatory compliance, growth in continual diseases, growing demand for customized medication, increasing healthcare infrastructure in growing regions and developing extensive style of pharmaceutical and biotechnology agencies. The marketplace incorporates a wide range of products, along with services. The market is highly competitive with key players striving to meet evolving customer demands.

Sterility Testing Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

10.5% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Sterility Testing Market Segmentation

Product & Service

- Kits & Reagents

- Services

- Instruments

Test Type

- Membrane Filtration

- Direct Inoculation

- Other Tests

Application

- Pharmaceuticals And Biologicals

- Medical Devices

- Other Applications

End User

- Pharmaceutical Companies

- Biotechnology Companies

- Others

Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

On the basis of product & service in the sterility testing market the kits & reagents segment accounted the highest market share in 2022. The kits and reagents segment accounted for the most important percentage of the worldwide marketplace. The large percentage of this phase can often be attributed to ease of use, customary purchase, and growing choice associated with kits. Kits and reagents are used in all types of sterility testing, and they are an essential constituent of any sterility testing laboratory.

Sterility Testing Market Regional Analysis

North America stands as one of the major markets for sterility testing, driven through the emphasis on quality control. Additionally regulatory compliance in the pharmaceutical and biotechnology industries make contributions to the region’s dominance. The United States, primarily, is a key contributor on this marketplace. Europe is one of the leading marketplaces for sterility testing because of the regions with a mix of pharmaceutical, biotechnology, and medical device companies. The European market showcases a developing interest in rapid microbial detection systems, fueled by the need for faster and more efficient testing methods. The Asia Pacific sterility testing market is estimated to witness significant growth, during the forecast timeframe led by, rapid economic growth, increasing healthcare spending, and a growing demand for personalized medicine. The demand for sterility testing is anticipated to rise in countries like China and India, in which large populations and rising prevalence of chronic diseases. Latin America and the Middle East and Africa display steady growth inside the sterility testing market, fueled via improving access to healthcare services and focus on healthcare infrastructure development, increasing number of pharmaceutical and biotechnology companies in these regions. Key participants to the market's growth in these areas encompass Brazil, Mexico, the United Arab Emirates, and South Africa.

Sterility Testing Market Growth Drivers

The pharmaceutical and biotechnology industries are placing increasing importance, on quality control and regulatory compliance. This is driving the need for reliable methods of sterility testing. Moreover, the rise in illnesses. The demand for personalized medicine necessitates rigorous testing protocols to ensure product safety and effectiveness. There is also a growing demand for more efficient testing methods, including microbial detection systems. The expanding healthcare infrastructure in developing regions is fueling the need for sterility testing. With an increasing number of pharmaceutical and biotechnology companies in these areas there is an emphasis on quality control and regulatory compliance leading to increased sales of sterility testing services and products. In 2022 Novartis (Switzerland) made an investment of USD 300 million to enhance their capabilities in next generation bio therapeutics across Switzerland, Slovenia and Austria. Regulatory bodies like the US Food and Drug Administration (FDA) and European Medicines Agency (EMA) have guidelines for sterility testing of devices and pharmaceutical products which further contributes to market growth. The introduction of technologies such, as automation and robotics has also transformed the market landscape. Automated sterility test structures beautify efficiency and productiveness, reducing the chance of human error and infection. Robotics technology allows excessive-throughput testing, enabling faster and extra effective testing techniques.

Sterility Testing Market Challenges

High cost of sterility testing and Regulatory compliance are hindering the growth of market. In developing regions, this factor has resulted in limited demand for product. Moreover, the Shortage of skilled professionals is also restricting the growth of market.

Sterility Testing Market Key Companies

The sterility testing market is poised by several main corporations, each making big contributions to the industry through their sturdy market presence and progressive product offerings. Among these principal players are Charles River, Merck KGaA, bioMérieux SA, SGS SA, WuXi AppTec, Nelson Laboratories, Pacific BioLabs, Sartorius AG, Thermofisher Scientific, Samsung Biologics And other players. These essential players constantly try and revamp their marketplace percentage and meet the desires of a diverse investor base. Their competitive techniques encompass product innovation, forging strategic partnerships, undertaking mergers and acquisitions, and increasing their distribution networks.

In January, 2023 Charles River Laboratories, Acquired SAMDI Tech, Inc.

In February 2023, Merck KGaA Launched a new automated sterility testing platform, the Visolve AST Platform.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -