Stem Cell Manufacturing Market Size and Share Segmented by product (instruments, consumables), application (research, clinical), end-user (pharmaceutical, biotechnology), and region - Global Demand and Growth Analysis Research Report ( 2023 - 2032 )

Stem Cell Manufacturing Market Dynamics

Stem Cell Manufacturing Market by Product (Consumables, Instruments, Stem Cell Lines), Application (Research Applications, Clinical Application, Cell & Tissue Banking Applications), End-user Industries (Pharmaceutical & Biotechnology Companies, Academic Institutions, Research laboratories & contract research organizations, Hospitals & surgical centers, Cell & tissue banks, Other end users), and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032.

Stem Cell Manufacturing Market Size and Overview:

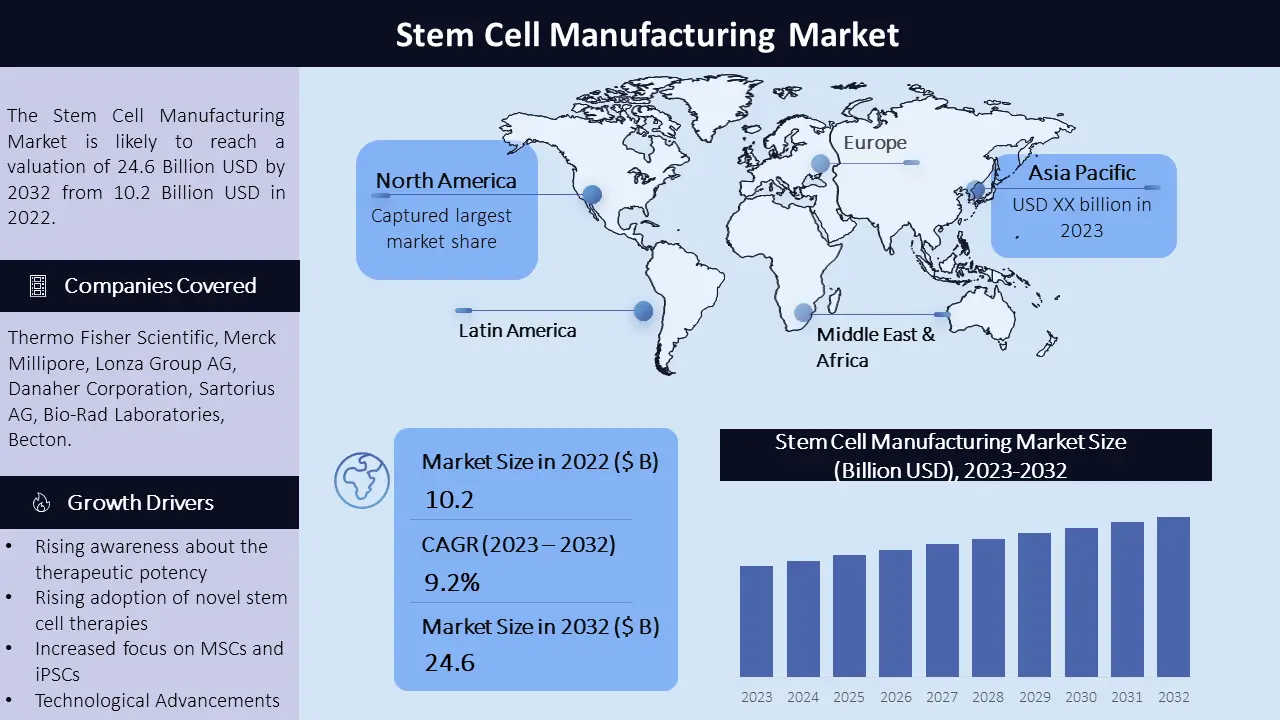

As KD Market Insights reports, the stem cell manufacturing market is expected to display a steady growth pattern over the period of 2023 to 2032, with a compound annual growth rate (CAGR) of 9.2%. By 2032, the market value of Stem Cell Manufacturing Market reached USD 24.6 billion. This growth can be attributed to the robust research infrastructure in the region, rising public awareness related to the therapeutic potential of stem cells in effective disease management, and rising adoption of novel stem cell therapies.

|

Stem Cell Manufacturing Market Report Scope |

|

|

Base Year Market Size |

2022 USD 10.2 billion

|

|

Forecast Year Market Size

|

2032 USD 24.6 billion |

|

CAGR Value

|

9.2% from 2023 to 2032 |

|

Segmentation

|

•By product •By application •By end-user industries •By geography

|

|

Challenges

|

•High operational cost •Difficult techniques •Hard to scale up production |

|

Growth Drivers

|

•Rising awareness about the therapeutic potency •Rising adoption of novel stem cell therapies •Increased focus on MSCs and iPSCs •Technological Advancements |

Stem Cell Manufacturing Market Segmentation:

Product:

- Consumables:

- Culture Media

- Other Consumables

- Instruments:

- Bioreactors and Incubators

- Cell Sorters

- Other Instruments

- Stem Cell Lines

- Hematopoietic stem cells (HSC)

- Mesenchymal stem cells (MSC)

- Induced Pluripotent stem cells (iPSC)

- Embroyonic stem cells (ESC)

- Neural Stem cells (NSC)

- Multipotent adult progenitor stem cells

Application:

- Research Applications

- Life science research

- Drug discovery and development

- Clinical Application

- Allogenic stem cell therapy

- Autologous stem cell therapy

- Cell & Tissue Banking Applications

End-user Industries:

- Pharmaceutical & Biotechnology Companies

- Academic Institutions, Research laboratories & contract research organizations

- Hospitals & surgical centers

- Cell & tissue banks

- Other end users

Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Stem Cell Lines: Based on the product, the stem cell lines segment is the fastest-growing segment. The market is driven by the growing demand for functional potent stem cell lines in research, the rising approval of stem cell-based therapeutic products in the United States, Europe, and Asia, and the development of innovative stem cell culture & preservation techniques.

Clinical Application: Based on application, the clinical application segments hold the largest share. Factors such as the rising awareness regarding the therapeutic potency of stem cells in effective disease management, technological advancements in genome-based cell analysis, and improving infrastructure related to stem cell processing and preservation are supporting the market growth for the stem cell manufacturing market.

Regional Analysis in Stem Cell Manufacturing Market:

North America holds the largest share of the stem cell manufacturing market. The market is driven by the robust research infrastructure in the region, rising public awareness related to the therapeutic potential of stem cells in effective disease management, and rising adoption of novel stem cell therapies in the United States.

The European region is also growing significantly, with the United Kingdom being a significant market. The market is expected to grow during the forecast period. The Asia-Pacific market is also growing appropriately. China, Japan, and South Korea are the significant markets of the region. The government is investing in these therapies, which is influencing the market for stem cell manufacturing.

Stem Cell Manufacturing Market Growth Drivers:

The factors driving the stem cell manufacturing market are the rising awareness about the therapeutic potency of stem cell products and the rising adoption of novel stem cell therapies. Stem cell therapy is increasingly being recognized as a promising therapy for the replacement or regeneration of damaged tissues. The demand for these products is increasing due to the increasing awareness about the therapeutic efficacy of stem cell products.

Furthermore, there is an increased focus on the manufacturing of MSCs and iPSCs due to their safety profiles and therapeutic efficacies. These cells do not need donor matching and so can be used for immediate treatment. Technological advancement is also one of the growth drivers for the stem cell manufacturing market.

Challenges in Stem Cell Manufacturing Market:

Stem Cell Manufacturing is associated with high operational costs as it requires special techniques. Moreover, the manufacturers face a lot of difficulties due to these techniques that hinder the growth of the market in terms of cost as well. Due to this, it makes it difficult for the manufacturers to scale up their production as it is extremely challenging.

Key Companies in Stem Cell Manufacturing Market:

- Thermo Fisher Scientific

- Merck Millipore

- Lonza Group AG

- Danaher Corporation

- Sartorius AG

- Bio-Rad Laboratories

- Becton

- Dickinson and Company

- Stemcell Technologies

- Fujifilm Holdings Corporation

- Miltenyi Biotec

- Others

In January 2021, Thermo Fisher Scientific acquired Henogen SA to strengthen its capabilities for cell and gene vaccines and therapies.

In November 2020, Lonza Group AG signed an agreement with Fujifilm Cellular Dynamics to expand the use of its non-exclusive license to its innovative Nucleofector technology.

In March 2020, Danaher acquired the Biopharma business from General Electric Company’s Life Sciences division and renamed it Cytiva.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -