Sequencing Reagents Market - Global Size, Share, Trends, Growth and Forecast Year ( 2023 – 2032 )

Sequencing Reagents Market Dynamics

Sequencing Reagents Market by Type (Template Kits, Library Kits, Control Kits, Sequencing Kits, Others) Technology (Next Generation Sequencing, Sanger Sequencing, Third Generation Sequencing), Application (Clinical Investigation, Oncology, Forensics & Agrigenomics, Others) and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032.

Market Size and Overview

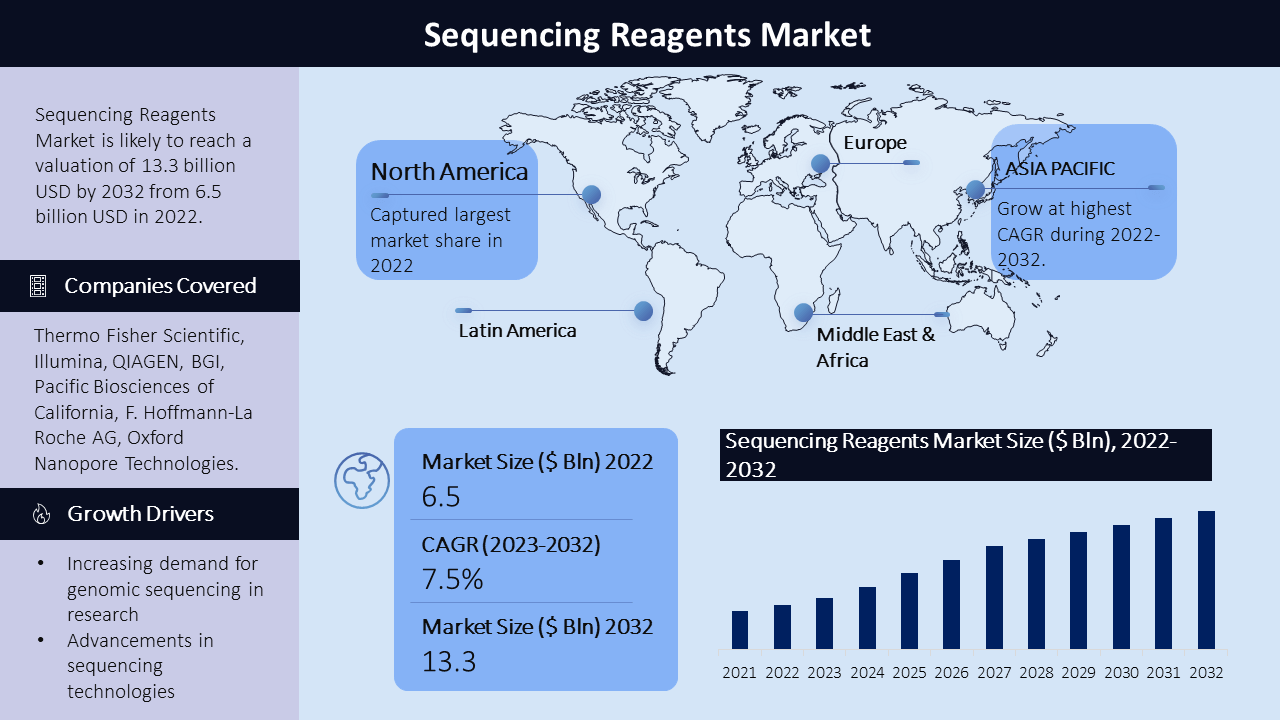

The sequencing reagents market has witnessed significant growth, with a compound annual growth rate (CAGR) of 7.5% from 2023 to 2032, reaching a market value of $13.3 billion in 2032. This growth can be attributed to the increasing demand for sequencing technologies in various applications, including genomics research, diagnostics, and drug discovery. The market comprises a wide range of sequencing reagents, such as polymerases, primers, nucleotides, and enzymes, among others. Key players in the market are continuously innovating to develop advanced sequencing reagents that offer high accuracy, efficiency, and cost-effectiveness. Additionally, collaborations and partnerships between sequencing technology providers and research institutions are driving market growth.

|

Sequencing Reagents Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

7.5% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Market Segmentation:

Type :-

- Template Kits

- Library Kits

- Control Kits

- Sequencing Kits

- Others

Technology :-

- Next Generation Sequencing

- Sanger Sequencing

- Third Generation Sequencing

Application :-

- Clinical Investigation

- Oncology

- Forensics & Agrigenomics

- Others

Geographic Regions :-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In terms of technology, next-generation sequencing (NGS) holds a substantial market share. NGS technology has revolutionized DNA sequencing by enabling faster and more cost-effective sequencing with higher throughput. It has become an indispensable tool for understanding a variety of human disorders, particularly in oncology research. The reduced cost of sequencing and increased throughput has driven the adoption of NGS technology, fueling the growth of this market segment.

The clinical investigation segment currently dominates the global sequencing reagents market. Clinical researchers use sequencing reagents, such as template kits, library kits, and sequencing kits, to study the genomics of various diseases, including cancer, genetic disorders, and rare diseases. By sequencing the genomes of affected individuals, researchers can identify disease-causing mutations, genetic risk factors, and potential therapeutic targets.

Regional Analysis:

North America, region holds a significant market share, primarily driven by the presence of leading biotechnology and pharmaceutical companies, along with well-established research institutes. The increasing focus on precision medicine and genomics research contributes to the market's dominance. Moving to Europe, countries like the United Kingdom, Germany, and France have a strong presence in the sequencing reagents market. The region's well-developed healthcare infrastructure, favorable government initiatives, and significant investments in genomics research fuel market growth. In the Asia Pacific region, rapid advancements in healthcare infrastructure, increasing investments in life sciences research, and the growing awareness of personalized medicine drive market expansion. China, India, and Japan are key contributors to the growth of the sequencing reagents market in the region. Latin America showcases steady growth, driven by the rising adoption of genomic technologies and the presence of a large patient population for clinical studies. Brazil, Mexico, and Argentina are the prominent markets within the region. The Middle East and Africa exhibit a developing market with a focus on enhancing healthcare services and research capabilities. The United Arab Emirates, Saudi Arabia, and South Africa are actively investing in genomics research and infrastructure development, contributing to market growth.

Growth Drivers:

Several factors drive the growth of the sequencing reagents market. Firstly, the increasing demand for genomic sequencing in research, diagnostics, and drug discovery applications propels the market growth. The ability of sequencing technologies to provide comprehensive insights into genetic variations and disease mechanisms drives their adoption in various fields.

Advancements in sequencing technologies and the development of high-throughput platforms have increased the efficiency and speed of sequencing processes. This drives the demand for sequencing reagents that offer high accuracy, sensitivity, and cost-effectiveness. The increasing demand for third-generation sequencing technologies plays a significant role in driving market growth.

Moreover, the growing focus on precision medicine and personalized healthcare has created a surge in demand for sequencing reagents. Genomic sequencing enables the identification of genetic variations and their association with diseases, leading to tailored treatment approaches and improved patient outcomes. The continuous advancements in sequencing technologies have led to significant reductions in the cost of sequencing a genome. This cost reduction has made genetic sequencing more accessible and affordable, enabling researchers and clinicians to perform sequencing-based studies and diagnostics on a larger scale.

Additionally, collaborations between academic research institutions, sequencing technology providers, and pharmaceutical companies have accelerated research and development efforts. These collaborations aim to develop novel sequencing reagents that address specific research needs and enable advancements in areas such as cancer genomics, infectious disease research, and rare genetic disorders.

Challenges:

Limited reimbursement policies and regulations for next-generation sequencing (NGS) can hinder market growth Additionally, ethical and social issues associated with sequencing, such as privacy concerns and the responsible use of genomic data, need to be addressed to ensure the ethical and equitable implementation of sequencing technologies.

Key Companies:

The sequencing reagents market is highly competitive, with several key players dominating the industry. These companies, including Thermo Fisher Scientific, Illumina, QIAGEN, BGI, Pacific Biosciences of California, F. Hoffmann-La Roche AG, Oxford Nanopore Technologies, Agilent Technologies, Fluidigm Corporation, ArcherDX, Takara Bio Inc., and Bioline among other players have established themselves as leaders in the market. They possess a strong market presence, extensive distribution networks, and a diverse range of sequencing reagents to meet the needs of researchers and laboratories worldwide.

In January 2023, Complete Genomics, a leading player in the sequencing reagents market, showcased their advanced sequencing capability at the Biocase 2023. They highlighted their DNBSEQ platform, designed to deliver accurate and flexible sequencing results. Complete Genomics' commitment to innovation and high-quality sequencing reagents positions them as a trusted provider in the market.

Agilent Technologies launched the Magnis NGS Prep System in March 2019, a novel library preparation system for NGS technology specifically designed to enable efficient and accurate assessment of multiple genes and genetic aberrations from genomic DNA.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -