Premium Chocolate Market By Type of chocolate (Dark chocolate, Milk chocolate, White chocolate); By Source of cocoa beans; By Production method (Traditional or Artisanal Methods, Modern Production Techniques); By Ingredient quality; By Brand; By Region - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

Premium Chocolate Market Insights

Several significant details concerning the market for premium chocolate include:

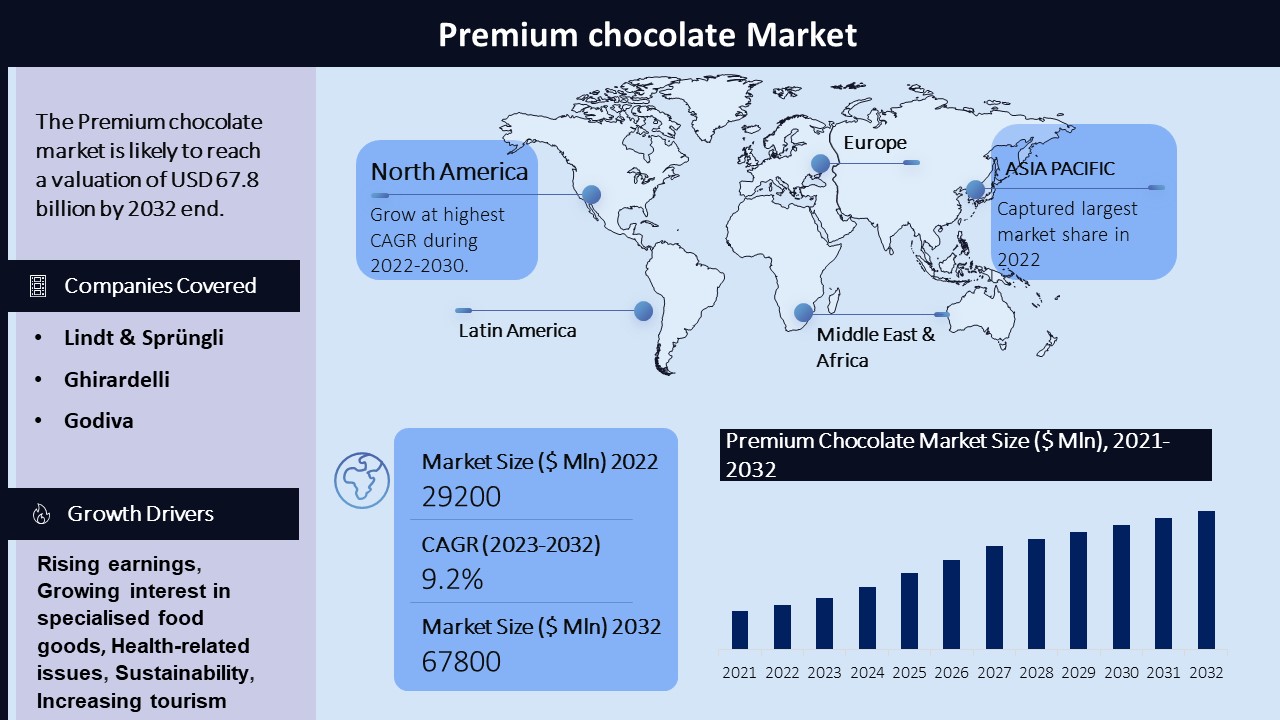

- The market is expanding: The market for premium chocolate is still modest, but it is expanding. Demand for premium chocolate is anticipated to increase as consumer incomes rise and interest in speciality foods grows. The global premium chocolate market size was valued at USD 29.2 billion in 2022 and is expected to grow USD 67.8 billion at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2032.

- Customers are prepared to pay the price for high-quality chocolate items since premium chocolate is typically seen as a luxury good. This is particularly true of chocolate goods created with uncommon or speciality ingredients or manufactured in a traditional or artisanal manner.

- The demand is quite competitive, with several companies vying for a share of the economic decorative chocolate market share. Businesses in this industry that are successful usually offer high-quality products, have strong brands, and prioritise innovation and distinctiveness.

- As customers become more aware of the health benefits of cocoa and chocolate, the demand for decorative chocolate is rising. As a consequence, people are seeking for decorating chocolate products that are free of chemicals and preservatives, made with premium cocoa sap. Consumer demand for premium chocolate products made with all-natural, premium ingredients has increased as a result of this trend.

Trends in the Premium Chocolate Market

Some of the newest trends in the market for premium chocolates are:

- Sustainability: Customers are increasingly interested in luxury chocolate products that are created and obtained in a way that minimises negative effects on the environment and society. A greater number of chocolate manufacturers are now obtaining cocoa beans from smallholder farmers utilising ethical and sustainable methods as a result of this trend.

- Reliability and vigour: People are becoming increasingly concerned about the health benefits that cocoa and chocolate offer, therefore they are seeking for decorating chocolate products that are made from premium cocoa sap and are free of chemicals and preservatives. Due to this trend, there are more expensive chocolate products being marketed as "natural" or "healthy."

- Small-batch and artisanal production: A growing tendency towards artisanal and small-batch products has been observed in the decorative chocolate industry. Customers want distinctive, artisanal chocolate products that are made using traditional techniques and have a sense of provenance.

- Creativity and solitude Businesses are constantly seeking for ways to distinguish their products from rivals and stand out in a highly competitive market. This has raised the demand for decorating chocolate products with novel tastes, unique ingredients, or innovative production techniques.

- Online bargains The shift to internet shopping spurred on by the COVID-19 outbreak has not been entirely positive for the luxury chocolate industry. A increase in online sales has been observed by various chocolate manufacturers as more individuals turn to e-commerce sites to purchase tangible culinary items.

Driving Forces in the Premium Chocolate Market

The market for premium chocolate is expanding as a result of numerous causes, including:

- Rising earnings: Consumers are better able to purchase luxury goods like fine chocolate when incomes grow, particularly in emerging nations. The market for luxury chocolate has recently grown as a result of this.

- Increasing demand for speciality foods: There has been a rise in recent years in the attention paid to finer cuisine details as visitors' interest in unique, high-quality goods grows. This tendency has benefited the decorative chocolate industry since consumers are willing to pay a premium for high-quality chocolate products.

- Concerns relating to health: Customers are becoming more wary of the health benefits of cocoa and chocolate and are searching for high-quality chocolate products made from premium cocoa sap that are free of chemicals and preservatives. As a result of this propensity, there is a greater demand for high-end chocolate.

- Sustainability: Consumers are seeking less and less for products that were produced and obtained responsibly as their awareness of the environmental and social benefits of their purchases increases. This practise has benefited the decorating chocolate industry because many high-end chocolate products are made using immorally obtained cocoa sap.

- Boosting Travel: Because fine chocolate is consistently seen as a luxury commodity, tourists are willing to pay more for fine chocolate details. This tendency has increased demand for high-end chocolate, especially in tourist destinations.

Challenges in the Premium Chocolate Market

The market for luxury chocolate is faced with a number of obstacles:

- Competition: there is tremendous rivalry among several companies for a share of the upscale chocolate market. Businesses in this industry that are successful usually offer high-quality products, have strong brands, and prioritise innovation and distinctiveness.

- Pricing Sensitivity: Even while customers are often willing to pay more on premium chocolate products, they may become sensitive to price increases or changes in consumer spending habits. This can be delicate for companies who produce premium chocolate.

- Supply Chain Issues: The cocoa sector is intricate and is susceptible to a range of supply chain problems, including price swings, political unrest in the nations that produce the crop, and problems with sustainability and working conditions. These problems may affect the pricing and availability of premium cocoa beans, which may be difficult for businesses competing in the high-end chocolate industry.

- Sustainability Issues: As customers look for items that are created and obtained sustainably, sustainability is a major problem in the luxury chocolate industry. However, as it calls for tackling concerns like cocoa production practises, waste reduction, and ethical sourcing, attaining sustainability can be difficult for businesses in the chocolate sector.

- 5. Food Safety Worries: Because chocolate products are perishable and susceptible to contamination, ensuring food safety is a major problem in the chocolate sector. In order to assure the safety of their products, firms in the premium chocolate industry must abide by stringent standards and laws governing food safety.

Premium chocolate Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

9.3% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Regional Synopsis of the Premium Chocolate Market Area

The demand for high-quality chocolate products is significant throughout most of the world, making the premium chocolate industry a worldwide one. Key details regarding the local market for premium chocolate include the following:

• North America: The decoration chocolate assiduity is well- established in North America, where there's a large demand for decoration chocolate goods. The largest request in the area for decoration chocolate is the United States, followed by Canada.

• Europe: The desire for luxury chocolate goods in nations like the United Kingdom, Germany, and France makes Europe a significant request for the commodity. The demand for specialised foods among European guests has fueled the expansion of the decoration chocolate assiduity on the mainland.

• Asia: With rising demand for high-quality chocolate goods in nations like China, Japan, and South Korea, the premium chocolate market in Asia is expanding. Demand for premium chocolate is anticipated to increase as incomes rise and interest in speciality foods grows in the area.

• Latin America. The area's assiduity with chocolate decorations is growing. A key market for cocoa is Latin America. In countries like Brazil and Mexico, there is a considerable market for premium chocolate, and as imports increase and consumer interest in specialty foods rises, the demand is expected to increase.

• Africa Even though it's still a tiny market, Africa is seeing an increase in requests for decorative chocolate as a result of growing demand in countries like South Africa and Nigeria. As inflows increase and the region's interest in specialty foods rises, the demand for decorating chocolate is predicted to expand.

Premium Chocolate Market segmentation

The premium chocolate market can be segmented in a number of ways, including by:

- Type of chocolate: Premium chocolate products can be segmented by the type of chocolate used, such as dark chocolate, milk chocolate, white chocolate, and others.

- Source of cocoa beans: Premium chocolate products can be segmented by the source of the cocoa beans used, such as specific cocoa-producing countries or regions.

- Production method: Premium chocolate products can be segmented by the production method used, such as traditional or artisanal methods, or modern production techniques.

- Ingredient quality: Premium chocolate products can be segmented by the quality of the ingredients used, such as the grade of cocoa beans or the quality of other ingredients.

- Brand: Premium chocolate products can be segmented by brand, with consumers often loyal to particular brands or companies.

- The price Consumers that are prepared to pay a higher price for high-quality chocolate goods can be divided into pricing segments for premium chocolate products.

- Distribution route Some premium chocolate goods are sold through conventional retail routes like supermarkets and specialty shops, while other items are sold online or through direct-to-consumer routes.

Premium Chocolate Market Key Players

Some key players in the premium chocolate market include:

- Lindt & Sprüngli Known for its premium chocolate products, this Swiss chocolate retailer is well-known. The company has a substantial global presence and is well-known for manufacturing chocolate goods of the highest quality using only the best ingredients.

- Ghirardelli Ghirardelli is an American chocolatier known for making premium chocolate products. The company is well-known in the US for its premium chocolate goods made with ingredients for decorations and enjoys a sizable following there.

- Godiva The high-end chocolate immolations made famous by Godiva, a Belgian chocolatier. The company has a substantial global presence and is well-known for manufacturing chocolate goods of the highest quality using only the best ingredients.

Research Methodology

Market Definition and List of Abbreviations

1. Executive Summary

2. Growth Drivers & Issues in Global Chocolate Market

3. Global Chocolate Market Trends

4. Opportunities in Global Chocolate Market

5. Recent Industry Activities, 2017

6. Porter's Five Forces Analysis

7. Market Value Chain and Supply Chain Analysis

8. Global Chocolate Market Size (USD Million), Growth Analysis and Forecast, (2017-2023)

9. Global Chocolate Market Segmentation Analysis, By Type

9.1. Introduction

9.2. Market Attractiveness, By Type

9.3. BPS Analysis, By Type

9.4. Dark Chocolate

9.5. Milk Chocolate

9.6. White Chocolate

10. Global Chocolate Market Segmentation Analysis, By Sales

10.1. Introduction

10.2. Market Attractiveness, By Sales

10.3. BPS Analysis, By Sales

10.4. Everyday Chocolate

10.5. Premium Chocolate

10.6. Seasonal Chocolate

11. Global Chocolate Market Segmentation Analysis, By Distribution Channel

11.1. Introduction

11.2. Market Attractiveness, By Distribution Channel

11.3. BPS Analysis, By Distribution Channel

11.4. Hypermarket

11.5. Confectionary Stores

11.6. Online Stores

12. Geographical Analysis

12.1. Introduction

12.2. North America Chocolate Market Size (USD Million) & Volume, 2017-2023

12.2.1. By Type

12.2.2. By Sales

12.2.3. By Distribution Channel

12.2.4. By Country

12.2.4.1. Market Attractiveness, By End-user

12.2.4.2. BPS Analysis, By End-User

12.2.4.3. U.S. Market Size (USD Million) 2017-2023

12.2.4.4. Canada Market Size (USD Million 2017-2023

12.3. Europe Chocolate Market Size (USD Million) & Volume, 2017-2023

12.3.1. By Type

12.3.2. By Sales

12.3.3. By Distribution Channel

12.3.4. By Country

12.3.4.1. Market Attractiveness, By Country

12.3.4.2. BPS Analysis, By Country

12.3.4.3. Germany Market Size (USD Million) 2017-2023

12.3.4.4. United Kingdom Market Size (USD Million) 2017-2023

12.3.4.5. France Market Size (USD Million) 2017-2023

12.3.4.6. Italy Market Size (USD Million) 2017-2023

12.3.4.7. Spain Market Size (USD Million) 2017-2023

12.3.4.8. Russia Market Size (USD Million) 2017-2023

12.3.4.9. Rest of Europe Market Size (USD Million) 2017-2023

12.4. Asia Pacific Chocolate Market Size (USD Million), 2017-2023

12.4.1. By Type

12.4.2. By Sales

12.4.3. By Distribution Channel

12.4.4. By Country

12.4.4.1. Market Attractiveness, By Country

12.4.4.2. BPS Analysis, By Country

12.4.4.3. China Market Size (USD Million) 2017-2023

12.4.4.4. India Market Size (USD Million) 2017-2023

12.4.4.5. Japan Market Size (USD Million) 2017-2023

12.4.4.6. South Korea Market Size (USD Million) 2017-2023

12.4.4.7. Indonesia Market Size (USD Million) 2017-2023

12.4.4.8. Taiwan Market Size (USD Million) 2017-2023

12.4.4.9. Australia Market Size (USD Million) 2017-2023

12.4.4.10. New Zealand Market Size (USD Million, 2017-2023

12.4.4.11. Rest of Asia Pacific Market Size (USD Million) 2017-2023

12.5. Latin America Chocolate Market Size (USD Million) 2017-2023

12.5.1. By Type

12.5.2. By Sales

12.5.3. By Distribution Channel

12.5.4. By Country

12.5.4.1. Market Attractiveness, By Country

12.5.4.2. BPS Analysis, By Country

12.5.4.3. Brazil Market Size (USD Million) 2017-2023

12.5.4.4. Mexico Market Size (USD Million) 2017-2023

12.5.4.5. Rest of Latin America Market Size (USD Million, 2017-2023

12.6. Middle East & Africa Chocolate Market Size (USD Million) 2017-2023

12.6.1. By Type

12.6.2. By Sales

12.6.3. By Distribution Channel

12.6.4. By Geography

12.6.4.1. Market Attractiveness, By Geography

12.6.4.2. BPS Analysis, By Geography

12.6.4.3. GCC Market Size (USD Million) 2017-2023

12.6.4.4. North Africa Market Size (USD Million) 2017-2023

12.6.4.5. South Africa Market Size (USD Million) 2017-2023

12.6.4.6. Rest of Middle East & Africa Market Size (USD Million) 2017-2023

13. Competitive Landscape

13.1. Market Share of Key Players

13.2. Market Positioning of Major Players in Global Chocolate Market

13.3. Company Profiles

13.3.1. Nestle SA

13.3.1.1. Vehicle Offered

13.3.1.2. Business Strategy

13.3.1.3. Financials

13.3.1.4. SWOT Analysis

13.3.1.5. Market Share Analysis

13.3.1.6. Key Achievements & Developments

13.3.2. Mars Inc

13.3.3. Cadbury

13.3.4. Moonstruck Chocolatier Co

13.3.5. Ghirardelli Chocolate Co

13.3.6. Ferrero Group

13.3.7. Hershey Foods Corp

13.3.8. Barry Callebaut

13.3.9. Amul (GCMMF)

13.3.10. GODIVA

13.3.11. Other Major & Niche Key Players

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -