Preclinical Imaging Market Size and Share Analysis by Key Players, 2023-2032

Preclinical Imaging Market Dynamics

Preclinical Imaging Market by Modality (Optical Imaging, Nuclear Imaging, Micro-MRI Systems, Micro-Ultrasound Systems, Micro-CT Systems, Photoacoustic Imaging, Magnetic Particle Imaging), Reagent (Optical Imaging Reagents, Nuclear Imaging Reagents, MRI Contrast Agents, Ultrasound Contrast Agents, CT Contrast Agents) End-Users (Pharmaceutical Companies, Biotechnology Companies, Research institutes) and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa): Industry Trends and Global Forecasts, 2023-2032.

Market Size and Overview: Size and Share

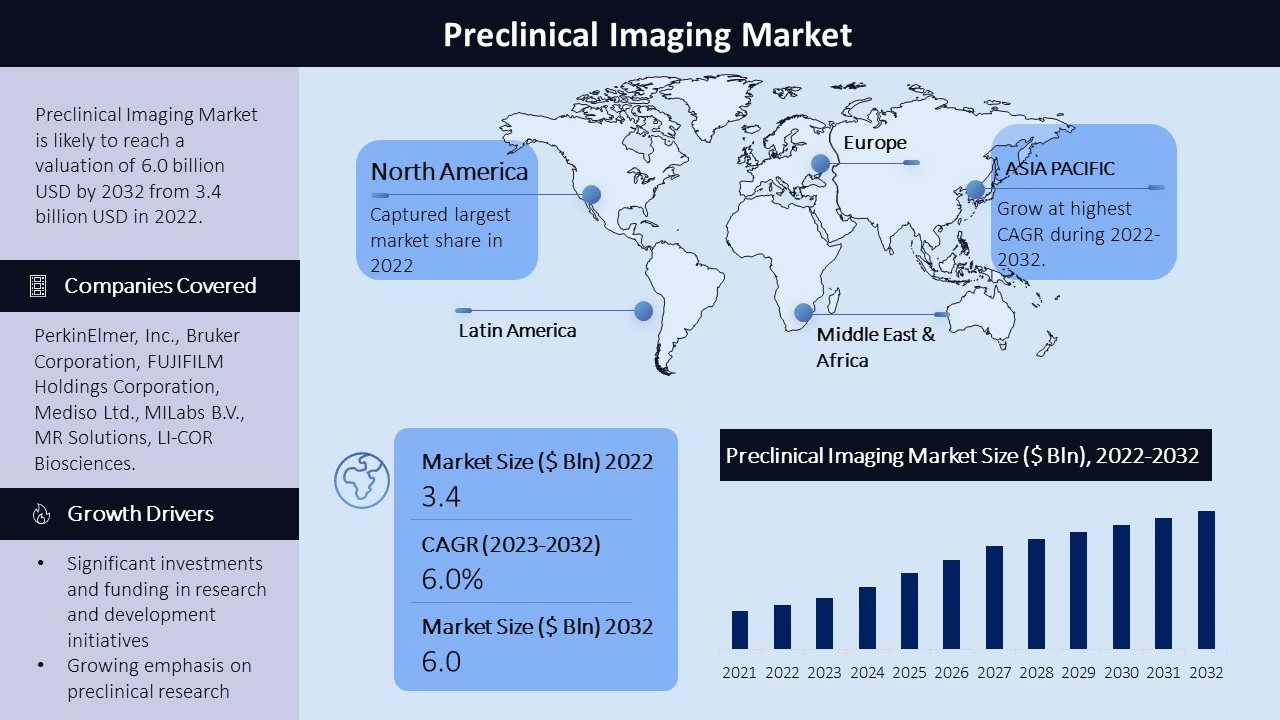

The preclinical imaging market has witnessed substantial growth, with a projected compound annual growth rate (CAGR) of 6.0% from 2023 to 2032, reaching a market value of $6.0 billion in 2032. The market's expansion can be attributed to the rapid technological advancements in molecular imaging, the increasing demand for non-invasive small animal imaging techniques, and the growing support from public-private initiatives and funding for preclinical research. However, strict regulatory frameworks governing preclinical research and significant installation and operational costs associated with preclinical imaging modalities pose challenges to market growth. The development and commercialization of technologically advanced imaging technologies contribute to the market's growth, and key players are continuously adopting growth strategies to strengthen their positions in the global preclinical imaging market.

|

Preclinical Imaging Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

5.4% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Market Segmentation:

Modality

- Optical Imaging Systems

- Nuclear Imaging Systems

- Micro-MRI Systems

- Micro-Ultrasound Systems

- Micro-CT Systems

- Photoacoustic Imaging Systems

- Magnetic Particle Imaging Systems

Reagents

- Optical Imaging Reagents

- Nuclear Imaging Reagents

- MRI Contrast Agents

- Ultrasound Contrast Agents

- CT Contrast Agents

End-Users

- Pharmaceutical Companies

- Biotechnology Companies

- Research institutes

Geographic Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Optical Imaging Systems: The modality segment of optical imaging systems is expected to witness significant growth due to its extensive application in preclinical research studies worldwide. High system costs and the continuous development and commercialization of novel preclinical imaging technologies further drive the demand for optical imaging systems.

Pharmaceutical Companies: Pharmaceutical companies are the major end-users of preclinical imaging solutions. The adoption of preclinical imaging techniques allows these companies to evaluate drug candidates and optimize preclinical research, supporting their drug discovery and development processes.

Regional Analysis:

North America dominates the global preclinical imaging market, driven by robust R&D infrastructure for life science research, fast adoption of novel molecular imaging technologies, and a significant presence of pharmaceutical and biotechnology companies. The region's preference for multimodality systems also contributes to market growth. In Europe, countries like Germany, France, and the United Kingdom hold significant market shares, with a mix of pharmaceutical companies, biotechnology firms, and academic and research institutes contributing to the region's preclinical imaging market. Europe also showcases a growing interest in advanced imaging modalities, such as PET and SPECT, driving the market's growth.

The Asia-Pacific region is expected to exhibit the highest growth rate. This growth is primarily due to continuous government support for pharmaceutical and biotechnology R&D, increasing public-private investments to support radioisotope production and the rising number of translational research activities. Additionally, evolving regulatory scenarios across major Asian countries further contribute to the region's potential for preclinical imaging market expansion.

Latin America demonstrates steady growth, propelled by a rising emphasis on healthcare advancements and a growing interest in preclinical research. Brazil, Mexico, and Argentina stand out as key markets within the region. The Middle East and Africa present a developing market with a focus on improving healthcare infrastructure and increasing research activities.

Growth Drivers:

The preclinical imaging market is experiencing robust growth, driven by various factors that propel the adoption of advanced imaging technologies in research and drug development. Firstly, significant investments and funding in research and development initiatives have spurred the market's expansion. These investments aim to push the boundaries of molecular imaging, fostering the development of cutting-edge imaging systems.

Moreover, the increasing demand for non-invasive small animal imaging techniques has been a key growth driver. Researchers and pharmaceutical companies are increasingly recognizing the value of non-invasive imaging in preclinical studies, enabling them to gain valuable insights into disease models and drug efficacy without harming the subjects.

The growing emphasis on preclinical research, backed by both private and public organizations, has also contributed to the market's growth. The support from funding agencies and research institutions has enabled the implementation of advanced imaging solutions, accelerating the pace of drug discovery and development.

Challenges:

Strict regulations governing preclinical research can pose hurdles for market players. Compliance with these regulations demands rigorous adherence to ethical standards and stringent protocols during preclinical studies. The installation and operational costs associated with preclinical imaging modalities can be a limiting factor for market growth. The high initial investment required to establish imaging facilities may deter smaller research organizations from adopting advanced imaging technologies.

Key Companies:

The preclinical imaging market is driven by several leading companies that have established a strong market presence, extensive distribution networks, and a diverse product portfolio. Among these prominent players are PerkinElmer, Inc., Bruker Corporation, FUJIFILM Holdings Corporation, Mediso Ltd., MILabs B.V., MR Solutions, LI-COR Biosciences, Aspect Imaging, TriFoil Imaging, Miltenyi Biotech GmbH, along with other players. These companies are at the forefront of preclinical imaging technology and continue to shape the market through their competitive strategies.

Product innovation remains a core strategy for these key players, continuously introducing cutting-edge imaging solutions to meet the evolving demands of the preclinical research community.

On January 5, 2023, Worx, a global leader in autonomous mowing, made a significant announcement with the launch of its latest robotic lawn mower, the LANDROID Vision. This innovative mower is equipped with neural network technology, empowered by artificial intelligence trained to distinguish between grass and non-grass, setting new standards in the industry.

Similarly, on May 24, 2022, Toro, a major player in the market, introduced a revolutionary addition to the residential yard care segment. The company unveiled a state-of-the-art robotic mower, exemplifying user-friendly and efficient technology, showcasing Toro's dedication to meeting consumer needs and advancing the outdoor power equipment market.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -