Pharmaceutical Isolator Market By Type (Aseptic Isolators, Containment Isolators, Bio Isolators, Sampling And Weighing Isolators, Active Pharmaceutical Ingredient (API) Manufacturing Isolators, Radiopharmaceutical Isolators, Production Isolators, Others); By System Type (Closed System, Open System); By Pressure (Positive Pressure, Negative Pressure), By Configuration (Floor Standing, Modular, Mobile, Compact, Table Top, Portable, Others); By Application (Sterility Testing, Manufacturing, Sampling/ Weighing/ Distribution, Medical Device Manufacturing); By End User (Hospitals, Diagnostic Laboratories, Academic And Research Institutes, Pharmaceutical And Biotechnology Companies, Contract Research Organizations, Others); By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

Pharmaceutical Isolator Market Size and Overview

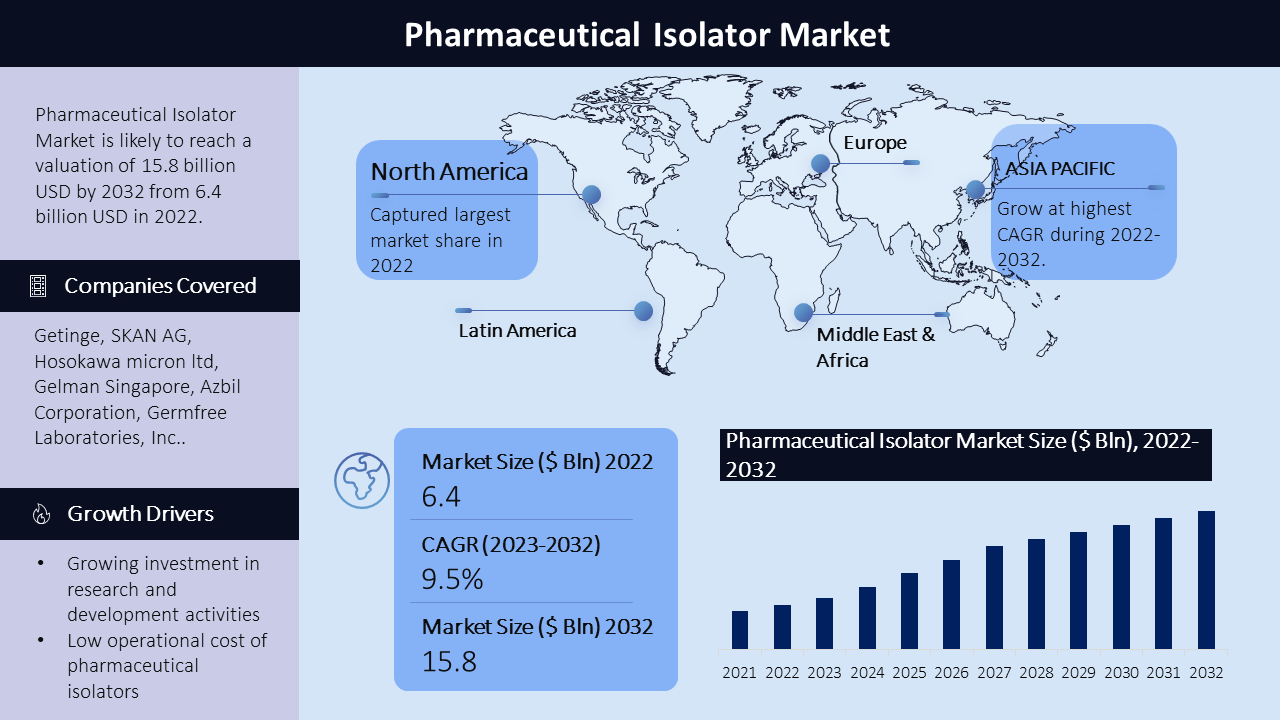

The pharmaceutical isolator market has witnessed significant growth, with a compound annual growth rate (CAGR) of 9.5% from 2023 to 2032, reaching a market value of USD 15.8 million in 2032. This growth can be attributed to the increasing demand for contamination-free barrier systems in the pharmaceutical industry. The use of pharmaceutical isolators has become essential in activities such as microbiological testing, cell therapy processing, advanced pharmaceutical manufacturing, and sterile product packaging and distribution. The market comprises various types of isolators, including aseptic isolators, containment isolators, bio isolators, sampling and weighing isolators, and others. With stringent regulatory requirements and the need for maintaining sterility in pharmaceutical processes, key players in the market are focused on developing advanced isolator technologies to meet the evolving needs of the industry.

|

Pharmaceutical Isolator Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

9.5% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Pharmaceutical Isolator Market Segmentation

By Type

- Aseptic Isolators

- Containment Isolators

- Bio Isolators

- Sampling and Weighing Isolators

- Active Pharmaceutical Ingredient (API) Manufacturing Isolators

- Radiopharmaceutical Isolators

- Production Isolators

- Others

By System Type

- Closed System

- Open System

By Pressure

- Positive Pressure

- Negative Pressure

By Configuration

- Floor Standing

- Modular

- Mobile

- Compact

- Table Top

- Portable

- Others

By Application

- Sterility Testing

- Manufacturing

- Sampling/ Weighing/ Distribution

- Medical Device Manufacturing

- Others

By End-Users

- Hospitals

- Diagnostic Laboratories

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations

- Others

By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Aseptic Isolators: The aseptic isolators segment holds a significant market share in the pharmaceutical isolator market. This can be attributed to the growing demand for aseptic processing of pharmaceutical drugs and the need for maintaining sterility in pharmaceutical production. Aseptic isolators provide a categorized aseptic environment for activities such as sterile testing, handling of tissues, and production of biological systems, contributing to the growth of this segment.

Hospitals: The hospital sector is a major end-user of pharmaceutical isolators. With the increasing focus on patient safety and infection control, hospitals are adopting pharmaceutical isolators for activities such as sterility testing and medical device manufacturing. The demand for isolators in hospitals is expected to continue growing as healthcare facilities strive to maintain a sterile environment and prevent contamination.

Pharmaceutical Isolator Market Regional Analysis

North America, region has a well-established market for pharmaceutical isolators, driven by the presence of key players and stringent regulatory requirements. The emphasis on maintaining sterile conditions in pharmaceutical manufacturing and testing processes contributes to the market's dominance in this region. In Europe, countries like Germany, France, and the United Kingdom hold significant market shares, with a strong focus on research and development activities in the pharmaceutical industry. The European market also showcases a growing interest in advanced isolator technologies and aseptic processing. In the Asia Pacific region, the pharmaceutical isolator market is experiencing rapid growth, driven by the increasing pharmaceutical market and rising investments in healthcare infrastructure.

Countries like China and India are leading contributors to the market's expansion, with a focus on domestic pharmaceutical manufacturing and research activities. Latin America demonstrates steady growth, propelled by the increasing demand for pharmaceutical products and the need for maintaining sterility in manufacturing processes. Brazil, Mexico, and Argentina are key markets within the region. The Middle East and Africa exhibit a developing market with a growing emphasis on healthcare infrastructure and the adoption of advanced pharmaceutical technologies. The United Arab Emirates, Saudi Arabia, and South Africa are notable contributors to the market's growth in this region.

Pharmaceutical Isolator Market Growth Drivers

Several factors drive the growth of the pharmaceutical isolator market. Firstly, the increasing demand for contamination-free barrier systems in the pharmaceutical industry is a major driver. Pharmaceutical isolators provide a controlled and sterile environment for various activities, such as sterility testing, manufacturing, and distribution, ensuring product safety and preventing contamination.

Furthermore, the stringent regulatory requirements and guidelines for pharmaceutical manufacturing and testing processes create a significant demand for pharmaceutical isolators. Compliance with Good Manufacturing Practices (GMP) regulations and the need for maintaining aseptic conditions drive the adoption of isolator technologies.

Moreover, the growing investment in research and development activities in the pharmaceutical industry fuels the demand for advanced pharmaceutical isolators. The development of innovative treatments and therapies requires a sterile and controlled environment, driving the market growth. Low operational cost of pharmaceutical isolators drives the demand for pharmaceutical isolators in biopharmaceutical manufacturing.

Additionally, the rising demand for biopharmaceuticals and the need for maintaining sterility in the production of biological systems contribute to the market expansion. Growing sterilized procedures is driving the market growth the increasing prevalence of chronic diseases and the growing focus on personalized medicine drive the demand for pharmaceutical isolators in biopharmaceutical manufacturing.

Pharmaceutical Isolator Market Challenges

One of the key challenges in the pharmaceutical isolator market is the lack of skilled expertise. Handling and operating pharmaceutical isolators require specialized knowledge and training. The shortage of skilled professionals poses a challenge in the selection, development, and operation of isolators, impacting the overall market growth.

Pharmaceutical Isolator Market Key Companies

The pharmaceutical isolator market is highly competitive, with several key players operating in the industry. Some of the leading companies in the market include Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco S.R.L., Comecer S.P.A., Hecht Technologie Gmbh, Steriline S.R.L., Envair Limited, Tema Sinergie S.P.A, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi S.p.A., LAF Technologies, ISO Tech Design, Cytiva, and Esco Pharma among other players.

These companies have a strong market presence and offer a wide range of pharmaceutical isolators catering to the diverse needs of the industry. Their competitive strategies include product innovation, partnerships, and expansions to enhance their market share and meet the evolving demands of customers.

June 2022, Jacomex announced a partnership with Medical Supply Company (MSC) to market and service Jacomex equipment to the pharmaceutical and biotechnology industries in Ireland. This strategic collaboration aims to expand the company's presence and strengthen its position in the market.

January 2022, Clario partnered with XingImaging to conduct PET imaging clinical trials in China, combining resources and neuroscience expertise to expedite research and drug discovery.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -