Medical Fiber Optics Market By fiber type (single mode optical fiber and multimode optical fiber); By application (endoscopic imaging, laser signal delivery, biomedical sensing, illumination); By end user (hospital, specialty clinics, ambulatory surgical centers, diagnostic laboratories, and others) and geographic regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Global Market Analysis, Trends, Opportunity and Forecast, 2023-2032

Medical Fiber Optics Market Size and Overview

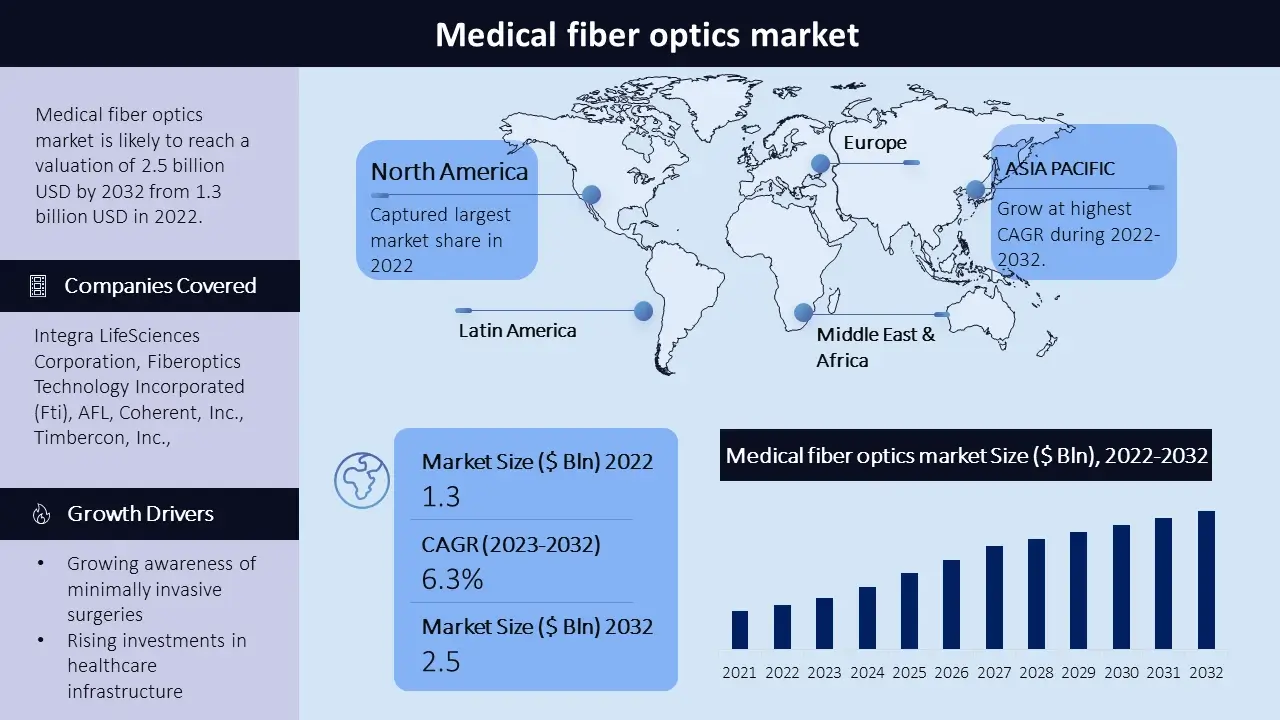

The medical fiber optics market size is poised to reach USD 2.5 billion by the end of 2032, growing at a CAGR of 6.3% during the forecast period, i.e., 2023 – 2032. In the year 2022, the industry size of medical fiber optics market was USD 1.3 billion. The reason behind the growth can be attributed to the growing awareness of the benefits of minimally invasive surgeries, the use of lasers in cosmetology and dentistry is on the rise and rising investments in healthcare infrastructure, particularly in emerging economies. The marketplace incorporates a wide range of products, like fiber optic cables, connectors, sensors. The market is highly competitive with key players striving to meet evolving customer demands.

Medical Fiber Optics Market Segmentation

By Fiber Type

- Single Mode Optical Fiber

- Multimode Optical Fiber

By Application

- Endoscopic Imaging

- Laser Signal Delivery

- Biomedical Sensing

- Illumination

- Other Applications

By End User

- Hospital

- Specialty Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

By Geographic Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

On the basis of fiber type in the medical fiber optics market the single mode optical fiber segment accounted the highest market share in 2022. The single mode optical fiber segment holds a sizable marketplace proportion within the scientific fiber optics marketplace. This fiber type is required for long-distance transmission of optical indicators with minimum sign degradation. It widespread application in endoscopic imaging, laser signal delivery, and different high-performance medical procedures where unique and dependable signal transmission is important.

Regional Analysis

North America stands as one of the major markets for medical fiber optics, driven through the presence of advanced healthcare infrastructure. Additionally high adoption rate of medical technologies, increasing demand for minimally invasive procedures make contributions to the region’s dominance. The United States, primarily, is a key contributor on this marketplace.

Europe is one of the leading marketplaces for medical fiber optics because of the region’s advancements in fiber optic technology. The European market showcases a developing interest in healthcare solutions, aiming to enhance overall healthcare.

The Asia Pacific medical fiber optics market is estimated to witness significant growth, during the forecast timeframe led by, Rapid urbanization, increasing healthcare expenditure, and a rising geriatric population. The demand for medical fiber optics is anticipated to rise in countries like China and India, in which increasing number of patient populations.

Latin America and the Middle East and Africa display steady growth inside the medical fiber optics market, fueled via improving healthcare facilities, increasing healthcare investments, and a growing awareness of advanced medical technologies in these regions. Key participants to the market's growth in these areas encompass Brazil, Mexico, the United Arab Emirates, and South Africa.

Medical Fiber Optics Market Growth Drivers

The growing awareness of the benefits of minimally invasive surgeries is an unrivaled driver. Minimally invasive tactics offer advantages which include reduced scarring, faster recuperation times, and lower risks compared to traditional surgical methods. The growing adoption of those techniques in various healthcare settings fuels the demand for clinical fiber optics, consisting of fiber optic strains, sensors, and miniature cameras.

The use of lasers in cosmetology and dentistry is on the upward push. Laser technologies provide specific and efficient treatment options, contributing to the increase of the clinical fiber optics marketplace. Ongoing studies that specialize in biomedical sensors additionally play an extensive function in driving market expansion, as these sensors enable actual-time monitoring of physiological parameters and augment patient care.

The rising investments in healthcare infrastructure, mainly in emerging economies, are propelling the adoption of medical fiber optics. Governments and healthcare corporations are prioritizing the modernization of healthcare centers and the incorporation of superior scientific technology to enhance healthcare delivery.

Medical Fiber Optics Market Challenges

High cost of medical fiber optics is hindering the growth of market. In developing regions, this factor has resulted in limited demand for product. Moreover, the complexity of medical fiber optic devices is also restricting the growth of market.

Medical Fiber Optics Market Key Companies

The medical fiber optics market is poised by several main corporations, each making big contributions to the industry through their sturdy market presence and progressive product offerings. Among these principal players are Integra LifeSciences Corporation, Fiberoptics Technology Incorporated (Fti), AFL, Coherent, Inc., Timbercon, Inc., Gulf Fiberoptics, LEONI, Newport Corporation, SCHOTT, Amphenol Corporation, LEMO, Hirose Electric Co. Ltd., Fischer Connectors SA, ODU GmbH & Co. KG, Smiths Interconnect, and Molex, LLC And other players. These essential players constantly try and revamp their marketplace percentage and meet the desires of a diverse investor base. Their competitive techniques encompass product innovation, forging strategic partnerships, undertaking mergers and acquisitions, and increasing their distribution networks.

In April 2022, Honeywell expanded its spectra medical grade (mg) biofiber portfolio with a blue-hued fiber that provides a strong visual aid in complex surgeries, enhancing safety and accuracy for healthcare professionals.

In April 2021, coractive invested over USD 24 million in the construction of a state-of-the-art fiber optic production facility, showcasing their commitment to technological advancements and market growth.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -