Immunoglobulin Market Analysis 2022 By Statistics, Growth Rate, Trends Forecast to 2032

Immunoglobulin Market Dynamics

Immunoglobulin Market by Product Type (IgG, IgA, IgM, IgE, and IgD), Application (Hypogammaglobulinemia, Chronic Inflammatory Demyelinating Polyneuropathy, Immunodeficiency Disease, Myasthenia Gravis, Multifocal Motor Neuropathy, Idiopathic Thrombocytopenic Purpura, Inflammatory Myopathies, Specific Antibody Deficiency, Guillain-Barre Syndrome, and Others), Mode of Delivery (Intravenous and Subcutaneous) and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032.

Market Size and Overview: Size and Share

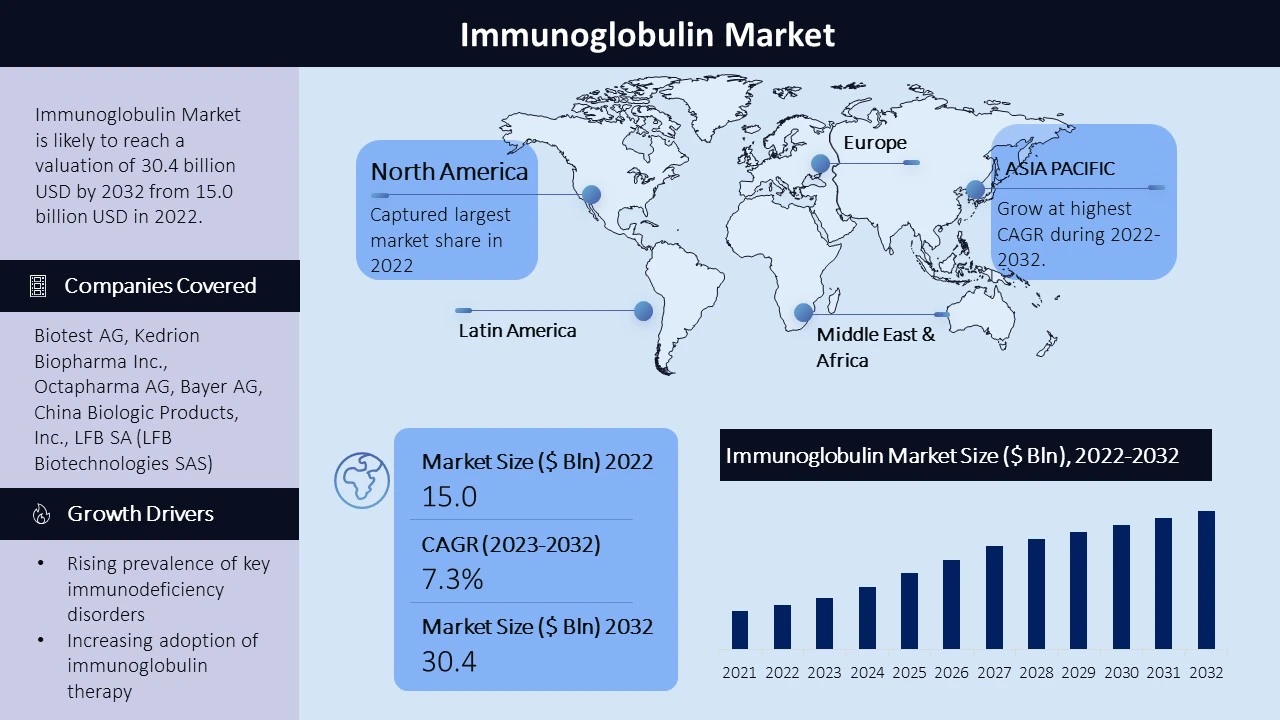

The immunoglobulin market has experienced significant growth, with a compound annual growth rate (CAGR) of 7.3% from 2023 to 2032, reaching a market value of $30.4 billion by 2032. This growth can be attributed to the increasing prevalence of immunological and neurological diseases, driving the demand for immunoglobulin therapies. Additionally, advancements in technology and improved immunoglobulin production techniques have enhanced the efficacy of treatments, further boosting market growth. The market offers various classes of immunoglobulins, such as IgG, IgA, IgM, IgE, and IgD, catering to different therapeutic applications. Immunoglobulins are administered through intravenous and subcutaneous modes of delivery, providing flexibility and convenience to patients. Despite the favorable market outlook, stringent government regulations and potential side effects associated with immunoglobulin usage remain as challenges that might hamper the market's growth.

|

Immunoglobulin Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

7.3% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Market Segmentation:

Product Type

- IgG

- IgA

- IgM

- IgE

- IgD

Application

- Hypogammaglobulinemia

- Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

- Immunodeficiency Disease

- Myasthenia Gravis

- Multifocal Motor Neuropathy

- Idiopathic Thrombocytopenic Purpura (ITP)

- Inflammatory Myopathies

- Specific Antibody Deficiency

- Guillain‐Barré Syndrome

- Others

Mode of Delivery

- Intravenous

- Subcutaneous

Geographic Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

IgG is the most dominant segment in the immunoglobulin market, owing to its extensive therapeutic applications in various immunological disorders. Furthermore, hypogammaglobulinemia is the leading application segment, accounting for the largest market share, attributed to the increasing incidence of the disorder worldwide.

In terms of mode of delivery, the intravenous segment holds the highest revenue share due to its rapid absorption rate and high bioavailability. The remarkable growth of the intravenous mode of delivery for immunoglobulins can be attributed to its superior advantages, such as high bioavailability and rapid absorption rate. These factors significantly contribute to the robust expansion of the intravenous mode of delivery market

Regional Analysis:

North America, region boasts one of the largest and most mature markets, primarily driven by the United States. The increasing prevalence of immunodeficiency disorders, favorable reimbursement policies, and robust healthcare infrastructure contribute to the market's dominance in this region. In Europe, countries like Germany, France, and the United Kingdom hold significant market shares. The presence of a well-established pharmaceutical and biotechnology industry, along with rising investments in research and development, fuels the growth of the immunoglobulin market in Europe. In the Asia Pacific region, rapid urbanization, an aging population, and an increasing burden of immunological disorders are driving market expansion. China, India, and Japan play pivotal roles in the Asia Pacific market, with increasing healthcare spending and growing awareness about immunoglobulin therapies. Latin America demonstrates steady growth, propelled by improvements in healthcare facilities and increased accessibility to immunoglobulin therapies. Brazil, Mexico, and Argentina stand out as key markets within the region. The Middle East and Africa exhibit a developing market with a focus on improving healthcare infrastructure. The rising prevalence of immunodeficiency disorders and autoimmune diseases in this region, along with efforts to enhance medical facilities, contribute to the market's growth.

Growth Drivers:

The immunoglobulin market is experiencing robust growth driven by several key factors. Firstly, the rising prevalence of key immunodeficiency disorders, such as leukemia, hepatitis, multiple myeloma, and others, has created a significant demand for effective treatment options like immunoglobulin. As these disorders become more prevalent globally, the market for immunoglobulin witnesses a substantial boost.

Moreover, the increasing adoption of immunoglobulin therapy contributes to the market's expansion. Healthcare providers and patients alike are recognizing the therapeutic benefits of immunoglobulin, leading to a growing preference for this treatment approach.

Additionally, the market's growth is propelled by the growing research and development activities in the field of immunoglobulin. Ongoing studies and advancements in medical research have resulted in improved formulations and more targeted therapies, driving the market's progress.

Challenges:

Stringent government regulations are one such obstacle that companies operating in this market need to navigate carefully. Furthermore, the high cost associated with immunoglobulin therapy poses a limitation to its widespread adoption.

Key Companies:

The immunoglobulin market is led by prominent companies, including Biotest AG, Kedrion Biopharma Inc., Octapharma AG, Bayer AG, China Biologic Products, Inc., LFB SA (LFB Biotechnologies SAS), Baxter International Inc., Grifols S.A., CSL Limited, Takeda Pharmaceutical Company Limited, Bio Products Laboratory Ltd., Shanghai RAAS, and China Biologic Products Holdings, Inc. (Taibang Biologic Group) among other players.

In March 2023, Takeda Pharmaceutical Company Limited made a significant announcement, outlining its plan to invest approximately USD 910.7 million in the construction of a new state-of-the-art manufacturing facility dedicated to producing plasma-derived therapies in Japan. This strategic move aims to expand the company's manufacturing capacity and cater to the increasing demand for immunoglobulin therapies.

In another development in March 2023, Advanced Infusion Care (AIC) entered into a distribution agreement with Kendrion S.p.A. This collaboration is focused on the distribution of GAMMAKED, an important immunoglobulin treatment used in the management of immune thrombocytopenia (ITP) in both adults and children, as well as chronic inflammatory demyelinating polyneuropathy (CIDP) in adults.

These key market players demonstrate a strong commitment to enhancing their presence in the immunoglobulin market through strategic investments, distribution agreements, and product expansions. Their focus on innovation and catering to diverse customer needs positions them as leading contributors to the growth and advancement of the immunoglobulin market.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -