Hemophilia Market - Global Size, Share, Trends, Growth and Forecast Year ( 2022 – 2032 )

Hemophilia Market Dynamics

Hemophilia Market by Type (Hemophilia A, Hemophilia B, Others), By Treatment Type (On-demand, Cure, Prophylaxis), By Therapy (Factor Replacement Therapy, Plasma-derived Factor Concentrates, Recombinant Factor Concentrates, Desmopressin & Fibrin Sealants, Gene Therapy & Monoclonal Antibodies) and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032.

Market Size and Overview:

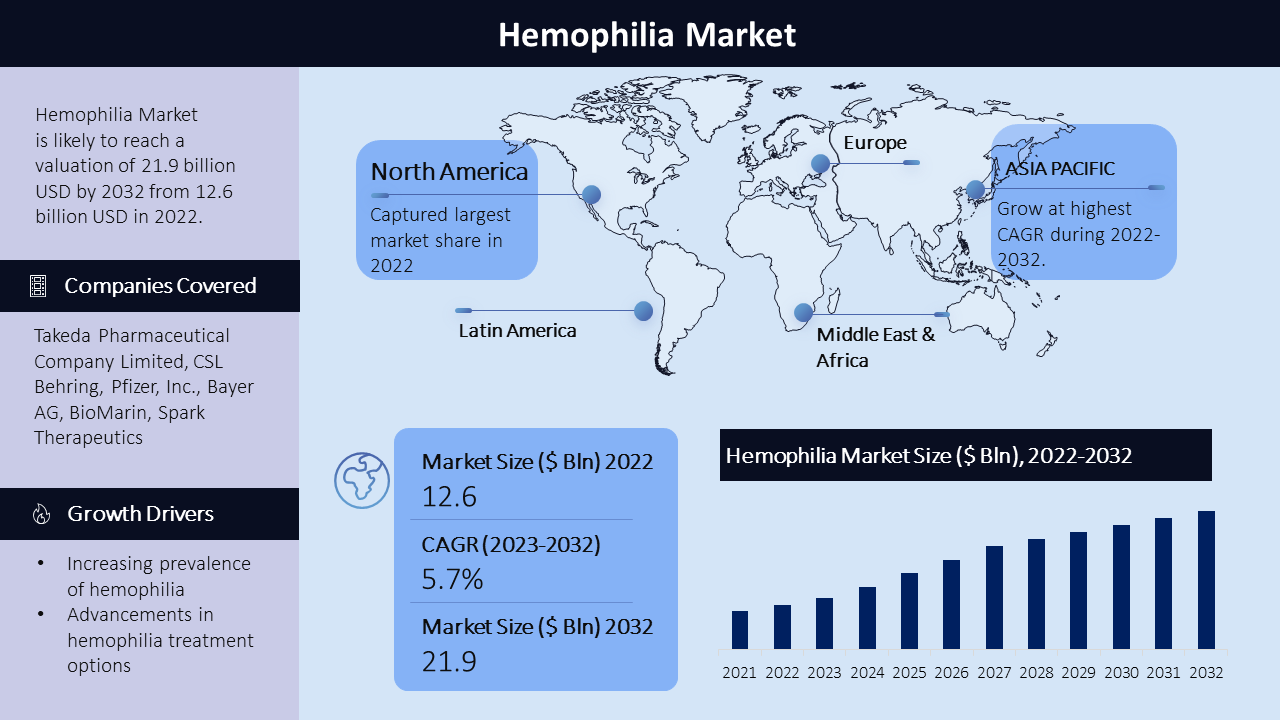

The global hemophilia market has shown robust growth, achieving a significant compound annual growth rate (CAGR) of 5.7% from 2023 to 2032, with a projected revenue of $12.6 billion in 2022, expected to reach $21.9 billion by 2032. This growth can be attributed to various factors, including the increasing prevalence of hemophilia and related bleeding disorders, advancements in hemophilia treatment options, and the rising awareness about the condition. Additionally, the development of novel therapies and gene therapies for hemophilia management has further fueled market expansion. The market comprises a wide range of treatment options, including clotting factor replacements, gene therapies, and non-replacement therapies, among others. The market is highly competitive, with key pharmaceutical companies continuously striving to innovate and meet the evolving needs of patients.

|

Hemophilia Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

5.7% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Market Segmentation:

Type

- Hemophilia A

- Hemophilia B

- Others

Treatment Type

- On-demand

- Cure

- Prophylaxis

Therapy

- Factor Replacement Therapy

- Plasma-derived Factor Concentrates

- Recombinant Factor Concentrates

- Desmopressin & Fibrin Sealants

- Gene Therapy & Monoclonal Antibodies

Geographic Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Hemophilia A: Hemophilia A, characterized by a deficiency of blood clotting factor VIII, accounts for the highest market share. This dominance is driven by the disorder's prevalence in developed regions and supportive government initiatives in major markets like the U.S., Europe, and Japan. Notably, the U.S., India, and Brazil are among the leading countries with high cases of hemophilia A each.

Factor Replacements: The factor replacements segment holds the largest market share in the hemophilia market. This can be attributed to the widespread adoption of clotting factor concentrates for the management of hemophilia A and B. The availability of various factor replacement products and their efficacy in controlling bleeding episodes contribute to the dominance of this segment.

Regional Analysis:

North America, region has one of the largest and most developed markets for hemophilia treatment, primarily driven by the United States. The high prevalence of hemophilia, coupled with favorable healthcare policies, contributes to the market's dominance in North America. In Europe, countries like Germany, France, and the United Kingdom hold significant market shares, with a mix of specialized hemophilia treatment centers and homecare settings. The European market showcases a growing interest in gene therapies and novel treatment options for hemophilia management.

In the Asia Pacific region, rapid advancements in healthcare infrastructure, increasing awareness about hemophilia, and growing government initiatives for better healthcare access contribute to market expansion. India and China play pivotal roles in driving market growth in the region. Latin America demonstrates steady growth, propelled by improving healthcare facilities, rising awareness, and an increasing number of diagnostic and treatment centers for hemophilia. Brazil, Mexico, and Argentina stand out as key markets within the region. The Middle East and Africa exhibit a developing market with a focus on improving healthcare services and access. The increasing prevalence of hemophilia and the establishment of specialized treatment centers contribute to the market's growth in this region.

Growth Drivers:

Several factors drive the growth of the hemophilia market. Firstly, the increasing prevalence of hemophilia and related bleeding disorders is a significant driver. The rising awareness about hemophilia and advancements in diagnostic techniques have led to an early diagnosis and treatment initiation, boosting market growth.

Advancements in hemophilia treatment options, including clotting factor replacements, gene therapies, and non-replacement therapies, have significantly improved patient outcomes. The introduction of extended half-life factor concentrates and personalized treatment approaches has further contributed to market expansion. Secondly, favorable government initiatives and support for hemophilia management contribute to market expansion. Governments across different regions have implemented policies and programs to improve hemophilia care, enhance patient access to treatments, and raise awareness about the disorder.

Additionally, continuous investments in research and development (R&D) activities and the introduction of new products drive the market forward. Biopharmaceutical companies and research institutions are actively engaged in developing advanced therapies and novel treatment options to address the specific needs of hemophilia patients.

Moreover, the adoption of advanced technologies in the hemophilia market offers significant growth potential. Innovations such as gene therapy and monoclonal antibodies have revolutionized the treatment landscape, providing more effective and personalized treatment options for patients.

Challenges:

Despite the significant growth prospects, the hemophilia market faces challenges related to high treatment costs, especially for gene therapies. Additionally, the requirement for lifelong therapy and potential inhibitors in certain patients pose obstacles to achieving optimal treatment outcomes. Another challenge is the lack of awareness regarding advanced technologies for hemophilia treatment.

Key Companies:

The hemophilia market is characterized by the presence of leading companies that play a crucial role in driving advancements and innovations in hemophilia treatments. Prominent players, such as Takeda Pharmaceutical Company Limited, CSL Behring, Pfizer, Inc., Bayer AG, BioMarin, Spark Therapeutics, Inc., Sanofi, F. Hoffmann La-Roche Ltd., Novo Nordisk A/S, and Octapharma AG among other players hold a strong market presence and are actively engaged in strategic initiatives to maintain their competitive edge.

To strengthen their market positions, these companies continually focus on product innovation, leveraging cutting-edge technologies to develop advanced therapies that offer improved outcomes for hemophilia patients. Additionally, strategic partnerships, collaborations, and mergers and acquisitions are part of their competitive strategies, allowing them to expand their geographical reach and broaden their product offerings.

For instance, in February 2023, Sanofi received approval from the U.S. FDA for its once-weekly Factor VIII replacement therapy ALTUVIIIO, designed for on-demand and prophylactic treatment of hemophilia A. This milestone reflects the dedication of these companies in developing groundbreaking treatments to meet the unmet needs of the hemophilia community.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -