Health Sensors Market : Global Share, Size, Growth, Trends & Outlook ( 2023 – 2032 )

Health Sensors Insights:

Electronic devices called health sensors are made to keep an eye on and record data about a person's health and well-being. They can be worn on the body or implanted in different gadgets, for example, cell phones or watches, and can follow an extensive variety of health measurements. These sensors can give significant data about a singular's health and assist them with settling on informed conclusions about their way of life and medical care. Additionally, they can be helpful for healthcare professionals in monitoring patients and making decisions regarding treatment.

The following are some common types of health sensors:

- Fitness trackers that are worn: These are gadgets that can monitor activity levels, heart rate, and sleep patterns and can be worn on the wrist or other parts of the body.

- Glucose metering devices: These are gadgets that action blood glucose levels and are generally utilized by individuals with diabetes.

- Monitors for blood pressure: These gadgets measure pulse and are frequently utilized by individuals with hypertension.

- Beat oximeters: People with respiratory conditions frequently use these devices, which measure blood oxygen saturation.

- ECG devices: Heart patients frequently use these devices, which measure the electrical activity of the heart.

Health Sensors Market

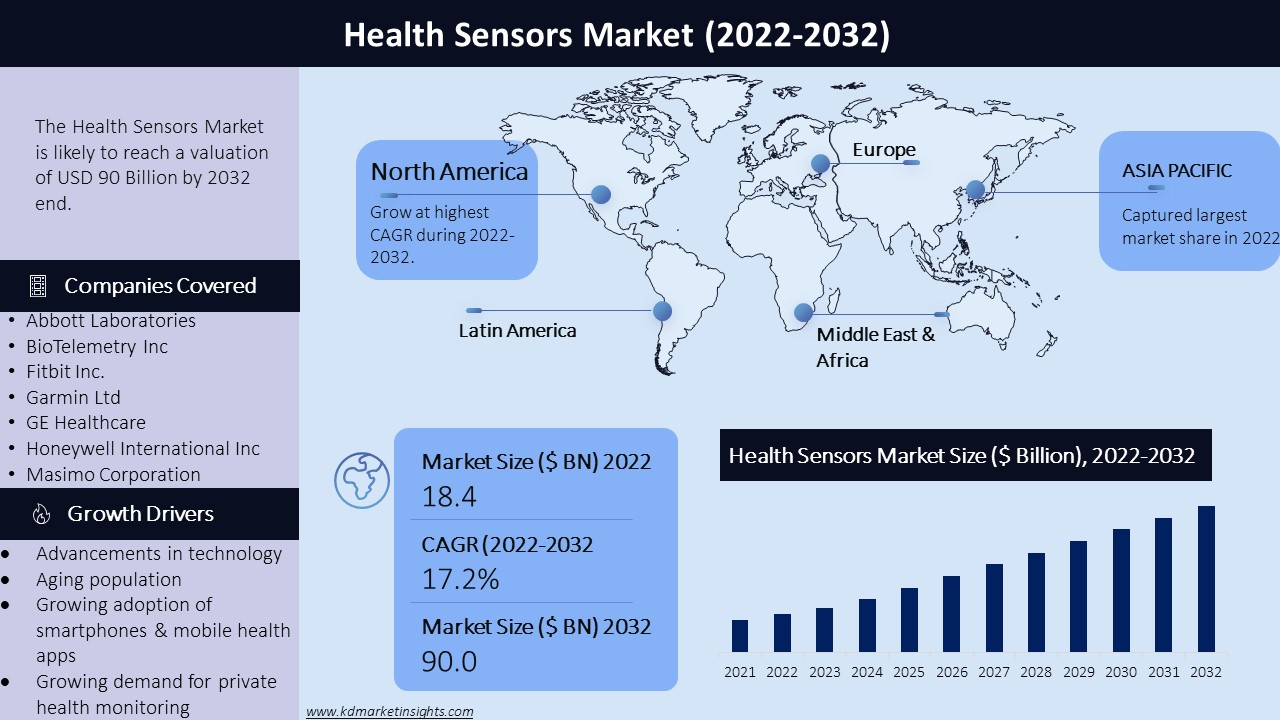

The demand for wearable health monitoring devices, rising healthcare costs, and the rising prevalence of chronic diseases have all contributed to the rapid expansion of the health sensors market in recent years. by 2032, the worldwide marketplace for health sensors is predicted to be worth $90.0 billion, up from an earlier estimate of around $18.4 billion in 2022. This figure represents a CAGR of 17.2% from 2023 to 2032.

Wearable wellness trackers represent the most important piece of the pie due to their fame among buyers and the rising reception of wearable innovation. The event of sensors that are capable of monitoring multiple health metrics and therefore the incorporation of artificial intelligence (AI) and machine learning (ML) into health sensor devices are two technological developments that are driving the market. Due to the high prevalence of chronic diseases and growing consumer awareness of health and wellness, North America is currently the most important marketplace for health sensors. thanks to the rising use of wearable technology, rising healthcare costs, and an expanding elderly population, the Asia-Pacific region is anticipated to be the health sensors market with the fastest growth.

Health Sensors Key Drivers:

The rapidly growing and very competitive health sensors market is being driven by several key factors, including:

- Advancements in technology: The event of the latest and more advanced health sensors, also because the integration of those devices with mobile technology, is making it easier for people to trace their health and fitness data, and share it with healthcare professionals.

- Aging population: The aging population is driving the demand for health sensors, as older adults are more likely to possess chronic health conditions and need regular monitoring.

- Government initiatives: Government initiatives to market healthy lifestyles, like campaigns to market physical activity and healthy eating, also are driving the expansion of the health sensor market.

- Growing adoption of smartphones & mobile health apps: The growing adoption of smartphones and mobile health apps is additionally driving the expansion of the health sensor market, as these devices and apps make it easier for people to trace and manage their health data.

- Growing demand for private health monitoring: The increasing specialization in preventative healthcare and therefore the growing awareness of the importance of monitoring one's health is driving the demand for private health monitoring devices.

- Increasing awareness of health and wellness: The growing awareness of the importance of health and wellness is driving the demand for health sensors, as they allow individuals to watch their health and take proactive steps to enhance their well-being.

- Rising healthcare costs: The high cost of healthcare services is driving the adoption of health sensors, as they will help reduce healthcare costs by enabling remote patient monitoring and early detection of health issues.

- Prevalence of chronic diseases: The rising incidence of chronic diseases like diabetes, cardiovascular diseases, and obesity is driving the demand for health sensors, as these devices can help individuals and healthcare professionals to watch and manage these conditions more effectively.

- Use of health sensors in telemedicine and remote patient monitoring: The utilization of health sensors in telemedicine and remote patient monitoring is growing, because it allows healthcare providers to remotely monitor patients' vital signs and supply timely interventions when necessary.

Health Sensors Market Key Trend & Development:

The health sensors market is experiencing several key trends and developments that are shaping its growth and direction. Some of the key trends and developments include:

- AI and ML integration: The mixing of AI (AI) and machine learning (ML) in health sensors is driving the event of more accurate and personalized health monitoring devices because it can help detect patterns and abnormalities in health data and supply personalized recommendations.

- Development of "smart" clothing and textiles: Companies are developing clothing and textiles embedded with health sensors, like smart shirts and socks which will monitor pulse, blood heat, and other vital signs.

- Health sensors in clinical trials: Health sensors are increasingly getting used in clinical trials to gather data on patient health and behavior, which may help researchers to develop simpler treatments.

- Integration of health sensors with electronic health records (EHRs): Health sensors are being integrated with EHRs to permit real-time data sharing between healthcare providers and patients, which may help to enhance the management of chronic diseases.

- Multiple health metric monitoring: Health sensors are increasingly being developed to watch multiple health metrics, like pulse, vital signs, oxygen saturation, and glucose levels with more advanced health sensors for a comprehensive view.

- Rising demand for wireless sensors: The demand for wireless health sensors is increasing thanks to their convenience and simple use. Wireless health sensors eliminate the necessity for wires and may be easily integrated with smartphones and other devices.

- Wearable technology: Wearable technology enables individuals to watch their health and fitness levels and provides real-time feedback, with wearable fitness trackers and smartwatches

Health Sensors Market Segmentation:

The health sensors market can be segmented into various categories as follows:

- By Product Type

- Wearable Fitness Trackers

- Blood Glucose Monitors

- Blood Pressure Monitors

- Pulse Oximeters

- ECG Monitors

- Temperature Sensors

- By Application

- Fitness & Wellness Monitoring

- Remote Patient Monitoring

- Chronic Disease Management

- By End-user

- hospitals & clinics

- home healthcare

- Ambulatory care centers

- By Region

- North America (U.S., and Canada)

- Europe (U.K., Germany, France, Italy, Spain, Russia, NORDIC, Rest of Europe)

- Asia-Pacific (Japan, China, India, Indonesia, Malaysia, Australia, Rest of Asia-Pacific)

- Latin America (Mexico, Argentina, Rest of Latin America)

- Middle East and Africa (Israel, GCC North Africa, South Africa, Rest of the Middle East and Africa)

Health Sensors Market Regional Synopsis:

North America is one of the most important markets for health sensors, driven by the high prevalence of chronic diseases, increasing healthcare costs, and therefore the adoption of advanced technologies. The market size was valued at $7.0 billion in 2022, with a CAGR of 17.5% during the forecast period (2023-2032) with an expectation of reaching worth $35.1 billion by 2032.

Europe is a significant marketplace for health sensors, driven by the growing awareness of health and wellness, increasing healthcare costs, and technological advancements. The market size was valued at $4.0 billion in 2022, with a CAGR of 16.8% during the forecast period (2023-2032) with an expectation of reaching worth $18.9 billion by 2032.

The Asia-Pacific region is predicted to ascertain significant growth within the health sensors market, driven by the increasing incidence of chronic diseases, rising healthcare costs, and therefore the adoption of advanced technologies. The market size was valued at $4.5 billion in 2022, with a CAGR of 19.2% during the forecast period (2023-2032) with an expectation of reaching worth $26.4 billion by 2032.

The Latin American marketplace for health sensors is predicted to grow at a big rate, driven by the increasing awareness of health and wellness, the adoption of advanced technologies, and rising healthcare costs. The market size was valued at $1.2 billion in 2022, with a CAGR of 15.4% during the forecast period (2023-2032) with an expectation of reaching worth $5.0 billion by 2032.

The Middle East & Africa market for health sensors is expected to grow at a moderate rate, driven by the increasing prevalence of chronic diseases and rising healthcare costs. The market size was valued at $694.0 million in 2022, with a CAGR of 12.3% during the forecast period (2023-2032) with an expectation of reaching worth $2.2 billion by 2032.

Japan Health Sensors Market Regional Synopsis

Japan may be a significant marketplace for health sensors, driven by the increasing aging population, the prevalence of chronic diseases, and the governments specializing in digital health. The market size for health sensors in Japan was valued at $1.8 billion in 2022, with a CAGR of 17.9% during the forecast period (2023-2032) with an expectation of reaching worth $9.3 billion by 2032.

The healthcare sector is the largest end-user of health sensors in Japan, with hospitals and clinics using health sensors for various applications, like patient monitoring, chronic disease management, and wellness monitoring. The wearable fitness tracker segment is the largest product type within the Japanese market, with a big adoption rate among consumers.

Tokyo is the largest marketplace for health sensors in Japan, followed by Osaka and Kyoto with a high concentration of hospitals, clinics, and research institutions driving health sensor adoption.

|

Health Sensors Market: Report Scope |

|

|

Base Year Market Size |

2021 |

|

Forecast Year Market Size |

2022-2032 |

|

CAGR Value |

17.2% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Health Sensors Market Key Challenges:

Although the health sensors market presents several growth opportunities, there are also some key challenges that the industry faces including:

- High development costs: Developing and manufacturing health sensors are often costly, which may make it difficult for brand-spanking new players to enter the market, limiting innovation and development of the latest products.

- Lack of standardization: There's a scarcity of standardization within the health sensors market, making it difficult for healthcare providers to match and choose different products which can cause interoperability issues when integrating health sensors into healthcare systems.

- The limited accuracy of some health sensors: The limited accuracy of some health sensors can cause inaccurate measurements and false alarms, which may cause confusion and anxiety for patients and healthcare providers.

- Limited battery life: Some health sensors have limited battery life and need frequent charging, which may be an inconvenience for users.

- Limited expertise in handling and interpreting data: Many users might not have expertise in handling and interpreting data from health sensors, which may limit their usefulness.

- Limited reimbursement: Healthcare payers often don't reimburse health sensors, making it difficult for patients to afford these products which will limit market growth and adoption, particularly in regions with lower healthcare spending.

- Privacy and security concerns: As health sensors collect sensitive health data, there's a risk of knowledge breaches or misuse of private information. Maintaining the privacy and security of this data is important to put together trust with patients and healthcare providers.

- Regulatory hurdles: Health sensors are subject to varied regulatory requirements, which may vary by country and region. Obtaining regulatory approvals are often a lengthy and dear process, which may delay product launches and limit market access.

Health Sensors Market Key Global Players:

Health fitness trackers, continuous glucose monitoring systems, sign monitors, and remote patient monitoring systems are just a couple of the health sensors and related products offered by key global players within the health sensors market. These businesses have extensive programs for research and development to encourage innovation and make new products to satisfy the changing requirements of the healthcare sector.

Some key global players in the health sensors market along with their notable products include:

- Abbott Laboratories - FreeStyle Libre continuous glucose monitoring system, FreeStyle Libre 2, FreeStyle Libre Pro, i-STAT Alinity System

- BioTelemetry Inc. - MCOT (Mobile Cardiac Outpatient Telemetry) system, MCOT Patch, event monitoring devices

- Fitbit Inc. - Fitbit Charge 4, Fitbit Inspire 2, Fitbit Versa 3, Fitbit Sense

- Garmin Ltd. - Garmin Venu, Garmin Venu Sq, Garmin Forerunner 945 LTE, Garmin Enduro

- GE Healthcare - CARESCAPE ONE, CARESCAPE R860, Engström Carestation, Omniscan

- Honeywell International Inc. - EDA sensor, ECG sensor, SpO2 sensor, temperature sensor

- Masimo Corporation - Masimo MightySat, Masimo Radius-7, Masimo Root Patient Monitoring & Connectivity Hub

- Medtronic plc - Guardian Connect continuous glucose monitoring system, iPro2 professional continuous glucose monitoring system, MiniMed 670G insulin pump system

- Philips Healthcare - Biosensor BX100, Philips Respironics Alice NightOne, Philips Patient Monitoring System, Philips Avalon fetal & maternal monitors

- Roche Holding AG - Accu-Chek Guide blood glucose monitoring system, Accu-Chek Instant S blood glucose monitoring system, Accu-Chek Mobile blood glucose monitoring system

- Samsung Electronics Co. Ltd. - Samsung Galaxy Watch3, Samsung Galaxy Fit2, Samsung Galaxy Buds Pro, Samsung SmartThings Tracker

- Siemens Healthcare GmbH - ADVIA Centaur CP, Dimension EXL, Dimension Vista 500, RapidPoint 500 Blood Gas System

- Smiths Group plc - Delta multiparameter patient monitor, CADD-Solis ambulatory infusion pump, Medfusion 4000 syringe infusion pump, Portex tracheostomy tubes

- Texas Instruments Inc. - AFE4490 pulse oximetry front end, AFE4404 blood pressure

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -