Glucose Analysis Tubes Market - Global Size, Share, Trends, Growth and Forecast Year ( 2022 – 2032 )

Glucose Analysis Tubes Market Dynamics

Glucose Analysis Tubes Market by Product (Sodium Fluoride, Potassium Fluoride, Fluoride Oxalate), Material (PET/Plastic, Glass), End-user Industry (Diagnostic Laboratories, Hospitals & Clinics, Research & Academic Institutes, Veterinary Hospital & Clinics), and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032.

Glucose Analysis Tubes Market Size and Overview:

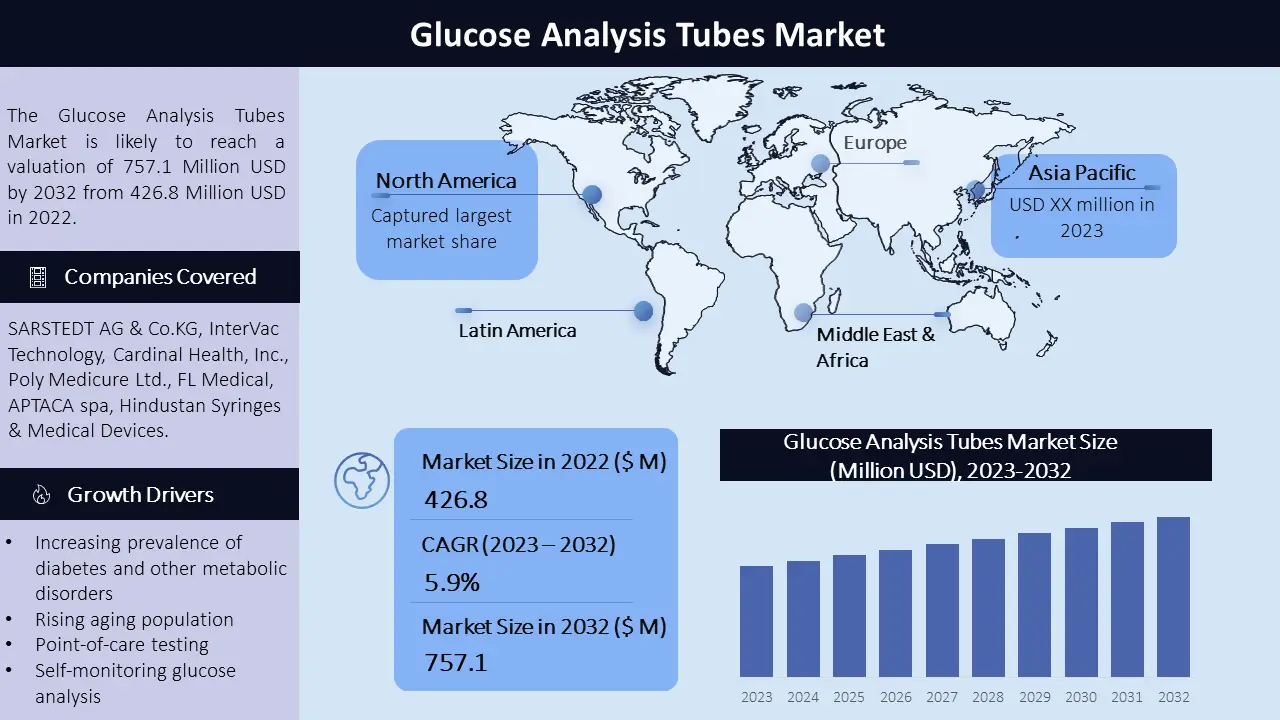

Based on KD Market Insights' data, the glucose analysis tubes market is expected to demonstrate steady growth from 2023 to 2032, with a compound annual growth rate (CAGR) of 5.9%. The market value reached USD 757.1 million by 2032. This growth can be attributed to the increasing prevalence of diabetes and the increasing aging population. The market is divided into various segments like product, material, end-user industry and geographical regions. Various technological advancements are taking place in the glucose analysis market like self-monitoring glucose analysis, which is increasing the market demand. The manufacturing companies are also taking several initiatives to boost the growth of the market.

|

Glucose Analysis Tubes Market Report Scope |

|

|

Base Year Market Size |

2022 USD 426.8 Million

|

|

Forecast Year Market Size

|

2032 USD 757.1 Million |

|

CAGR Value

|

5.9% from 2023 to 2032 |

|

Segmentation

|

•By product •By material •By end-user industry •By geography

|

|

Challenges

|

•High cost of glucose analysis tubes •Lack of trained professionals •Availability of alternatives |

|

Growth Drivers

|

•Increasing prevalence of diabetes and other metabolic disorders •Rising aging population •Point-of-care testing •Self-monitoring glucose analysis |

Market Segmentation:

The glucose analysis tubes market is segmented by:

Product:

- Sodium Fluoride

- Potassium Fluoride

- Fluoride Oxalate

Material:

- PET/Plastic

- Glass

End-user Industry:

- Diagnostic Laboratories

- Hospitals & Clinics

- Research & Academic Institutes

- Veterinary Hospital & Clinics

Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Sodium Fluoride: Based on the product, the sodium fluoride segment holds the largest share in the glucose analysis tubes market. When extremely precise glucose measurements are desired, it is kept in tubes containing fluoride as they are used to limit glycolysis. Sodium Fluoride tubes are helpful if the process of separating plasma from cell components takes a longer time.

PET/Plastic: Based on material, PET/Plastic material occupies the largest share in the glucose analysis tubes market. PET material is usually used to manufacture glucose analysis tubes because of its excellent properties, that it is indestructible, and can sustain a vacuum for a longer time.

Regional Analysis:

The regional analysis of the Glucose Analysis Tubes Market reveals diverse trends and dynamics across different parts of the world. North America accounts for the largest share of the glucose analysis tube market. The market demand is rising due to the presence of key players in the region, modifications in people’s lifestyles, and unhealthy eating habits. Russia is occupying the largest share in the European region. This is because of the rising number of diabetic patients in the region and the presence of key manufacturers. In the Asia-Pacific region, China held the largest share of the glucose analysis tube market. The growing aging population and increasing incidences of chronic illness are driving the market growth.

Growth Drivers:

The increasing prevalence of diabetes is driving the glucose analysis tube market. The causes of diabetes are substantial changes in people’s lifestyles, such as irregular sleeping patterns and bad eating habits. There are other metabolic disorders as well that require frequent monitoring of blood sugar levels. In addition, glucose analysis tubes are used in a variety of biological samples in research and laboratories. The point-of-care testing is also adding growth to the glucose analysis market. It allows users to have rapid and accurate results that reduces the time for the results. Moreover, the new technique of self-monitoring glucose analysis is also driving the market demand.

Challenges:

The major challenges faced by the glucose analysis tube market are the lack of trained professionals and the high cost of care. The lack of trained professionals is a major concern as it takes special techniques to take out blood using a glucose analysis tube. The issues could be created due to a lack of trained professionals, like erroneous identification, the use of unsuitable tubes, and inadequate sample size. The high cost is another limitation as a diabetic patient needs regular testing of blood sugar, which increases the costs, and the patient tries to adopt a less expensive procedure, which is the availability of alternatives. These challenges negatively impact the market growth for glucose analysis tubes.

Key Companies:

- Becton, Dickinson, and Company

- Greiner Bio-One International GmbH

- AB Medical Inc.

- Guangzhou Improve Medical Instruments Co. Ltd.

- SARSTEDT AG & Co.KG

- InterVac Technology

- Cardinal Health, Inc.

- Poly Medicure Ltd.

- FL Medical

- APTACA spa

- Hindustan Syringes & Medical Devices

- Others

The report profiles leading companies in the Glucose Analysis Tubes Market, such as SARSTEDT AG & Co.KG, InterVac Technology, Cardinal Health, Inc., and others. The companies are expanding and adopting new, improved strategies to increase the production and grow in the market.

In February, 2023, Dexcom launched its new product Dexcom G7continuous glucose monitoring (CGM) system, which is designed for use in hospitals and clinics to help healthcare professionals to manage patients' glucose levels.

On February 9, 2023, Roche announced its collaboration with Jansson Biotech Inc. (Jansson) that will strengthen their research and innovation activities and introduce new diagnostics for some specific therapies.

On April 21, 2023, Medtronic announced the launch of its MiniMed 770G insulin pump system, approved from FDA, which includes a continuous glucose monitoring system and automated insulin delivery technology.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -