Flatbread Market By Distribution Channel; By Application; By Ingredient Type; By Consumer Preference; By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

Flatbread Market Overview and Definition

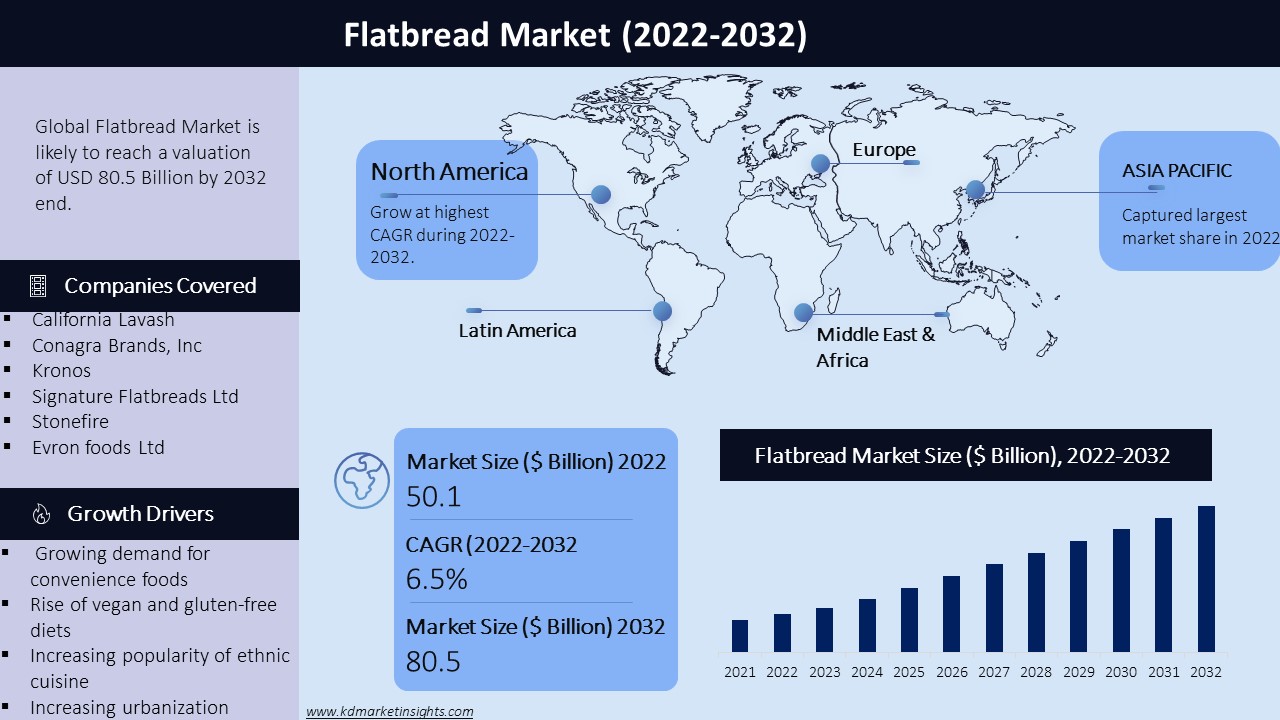

The global flatbread market is projected to reach USD 50.1 billion in 2022 to USD 80.5 billion by 2032, at a CAGR of 6.5% during the forecast period 2022-2032. A flatbread is a bread made using wheat, water, milk, yoghurt, or another liquid, and salt before being rolled out into a flattened dough. Some flatbreads, such as pizza and pita bread, are leavened, while others, such as pizza and pita bread, are unleavened. Flatbreads are thin, ranging in thickness from less than one mm to a few centimeters, and can be eaten whole. Flatbreads are very thin, ranging from less than one millimeter to a few centimeters in thickness, and can be eaten whole. Foods that require little to no processing and can be prepared fast and easily are known as convenience foods. There has been a surge in the demand for readily available on-the-go food products as a result of changes in eating patterns and a busy lifestyle.

The flatbread market is a rapidly growing segment of the global baked goods market. Flatbreads are thin, unleavened breads that are typically baked on a hot griddle or in a tandoor oven, and are a staple food in many parts of the world, including the Middle East, South Asia, and Africa.

In terms of product type, the flatbread market can be segmented into tortillas, wraps, pita, naan, lavash, and others. Tortillas and wraps are the most widely consumed types of flatbread, owing to their versatility and suitability for a variety of fillings and toppings. Pita and naan are also popular, particularly in the Middle East and South Asia, respectively.

Flatbread Market Key Drivers

The flatbread market is driven by a variety of factors, including:

Growing demand for convenience foods: Flatbreads are a convenient and easy-to-eat option, making them a popular choice among consumers who are looking for quick, easy and portable meals. This trend is particularly pronounced in urban areas where people have busy lifestyles and little time to prepare meals.

Increasing popularity of ethnic cuisine: Flatbreads are a staple in many ethnic cuisines, such as Indian, Middle Eastern, and Mexican. As consumers become more adventurous in their food choices, the demand for these cuisines and their associated flatbreads is also increasing.

Rise of vegan and gluten-free diets: Flatbreads are naturally vegan and can also be made gluten-free, making them an appealing option for consumers who follow these dietary lifestyles.

Growing demand for healthy and natural foods: Flatbreads are generally considered to be a healthier option than other types of bread, as they are typically lower in calories and carbohydrates. In addition, some flatbreads are made with whole grains and other natural ingredients, making them a more nutritious choice.

Increasing urbanization and changing lifestyles: As more people move to urban areas and lead busy lifestyles, they are looking for quick and convenient meal options that can be easily prepared and eaten on-the-go.

COVID-19 pandemic: The COVID-19 pandemic has led to an increase in demand for shelf-stable and non-perishable food items, including flatbreads, as people stock up on food supplies and seek out options that have a longer shelf life.

Covid Impact Analysis

In 2022, bakery consumption in Europe decreased by 7%. Packaged goods should expand by over 6% in 2022 compared to 2023, whereas fresh food consumption could drop by 11% or more, depending on the scale of COVID-19's second wave. The COVID-19 outbreak has had an impact on bread product supply plans as well. During the lockdown, bake-off usage surged at the expense of scratch baking on the premises, which faced labour shortages and additional sanitary restrictions. Due to the difficulty of securing regular supplies, fresh bakery product deliveries (for resale) have dropped during the lockdown. However, in other nations, new potential for industrial fresh products have emerged. Due to the lockdown, sales of non-edible products such as disinfectants, toilet paper, paper goods, and hand sanitizer were in high demand at the start of 2022, while sales of edible products such as bakery, meat products, and many others were up to par, as the supply of bakery was insufficient due to a labour shortage.

Additionally, the interruption in logistical facilities as a result of the lockout has caused additional challenges in the market, as consumers were unable to obtain products that met their needs, causing the market to suffer. Another reason that has had an impact on the market is the scarcity of raw materials, which has resulted in substandard product creation. According to Mago, who is also the president of the All-India Bread Manufacturers Association, smaller bakers in the unorganised category are the worst hit by these challenges. The coronavirus pandemic has increased demand for bakery items in the domestic sector by bringing in internal bakers. As a result, the demand for bread and cookies is expanding.

Top Impacting Factors

Because of unrestricted access to online information, consumers in developed and emerging countries such as the United States, Canada, Germany, France, China, and Japan are becoming more health-conscious. This has had a favourable impact on the expansion of firms that sell flatbread goods. Consumers who are concerned about their health are more inclined to hunt for detailed information on the foods they are buying. Consumer awareness of health is driving demand for healthy flatbread products with reduced fat and sugar content. Consumer awareness of health issues, rising personal finances, a greater emphasis on exercise, and rapid urbanisation are all driving demand for nutritious flatbread products. To cater to a new customer segment in developed countries, major industry companies are always focused on generating nutrient-dense flatbread products. The flatbread industry is growing due to the health benefits provided by a select variety of flatbreads, as well as rising demand for healthy flatbread products. In affluent countries, demand for organic, non-GMO, and gluten-free flatbread products has increased dramatically in recent years. Consumers in these countries are ready to spend a greater premium for health-related products. The demand for organic flatbread is mostly driven by consumer worries about food safety.

Latest Trends

Today, a whole new world of flatbreads is presenting itself. The great success of hummus is one important factor here, as it has spurred a lot of innovation in plant-based purées. Flatbreads, whether fluffy and doughy or thin and crunchy, are the perfect accompaniment to various dips and spreads. Another factor is the growing popularity of Eastern Mediterranean cuisine. Chefs like Alon Shaya of Saba in New Orleans and the newly opened Safta in Denver, as well as Michael Solomonov of Philadelphia's Zahav and Goldie, have championed the flatbread legacy in countries like Lebanon, Turkey, Israel, and Syria. They're flatbread experts, and owing to their impeccable technique and attention to cultural detail, they've shown diners that flatbreads can be captivating, comforting, and very craveable.

Flatbread Market Challenges

While the flatbread market is growing, there are also some challenges that the industry is facing. Some of these challenges include:

Price sensitivity: Flatbreads are often perceived as a low-cost food option, which means that consumers may be less willing to pay a premium for high-quality or artisanal flatbreads.

Competition from other types of bread: While flatbreads are gaining in popularity, they still face competition from other types of bread, such as sliced bread and buns, which are often more familiar to consumers.

Supply chain disruptions: The COVID-19 pandemic has led to disruptions in global supply chains, which can affect the availability and cost of ingredients used in flatbread production.

Shelf life and storage issues: Flatbreads are typically made without preservatives, which means that they have a shorter shelf life than other types of bread. This can make storage and transportation more challenging, particularly for companies that distribute products over long distances.

Lack of product differentiation: Flatbreads can be relatively simple products, which can make it challenging for companies to differentiate their offerings from those of competitors.

Health concerns: While flatbreads are generally considered to be a healthier option than other types of bread, they can still be high in calories, sodium, and carbohydrates, which may be a concern for some consumers. In addition, the use of certain ingredients, such as hydrogenated oils or high-fructose corn syrup, can also be a source of concern for health-conscious consumers.

Flatbread Market Report Scope |

|

|

Base Year Market Size |

2021 |

|

Forecast Year Market Size |

2022-2032 |

|

CAGR Value |

6.5 % |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Flatbread Market Segmentation

The flatbread market can be segmented in several ways, including:

Product Type: The flatbread market can be segmented based on the type of flatbread, such as tortillas, wraps, pita, naan, lavash, and others.

Distribution Channel: The flatbread market can be segmented based on the distribution channel, such as supermarkets and hypermarkets, convenience stores, online channels, and others.

Application: The flatbread market can be segmented based on its application, such as retail and food service. Retail applications include households and individual consumers, while food service applications include restaurants, cafes, and other food outlets.

Ingredient Type: The flatbread market can be segmented based on the type of ingredients used in production, such as wheat, corn, rice, and others.

Geography: The flatbread market can be segmented based on geography, including regions such as North America, Europe, Asia Pacific, and Rest of the World.

Consumer preference: The flatbread market can be segmented based on the preferences of the consumers such as organic, gluten-free, vegan, low-calorie, high-protein, and others.

Flatbread Market Regional Synopsis

The United States leads the flatbread market in North America, followed by Canada. The market's expansion in this region is mostly due to rising demand from fast-food chains and restaurants in nations like the United States, Canada, and Mexico. In addition, due to a busy lifestyle and a greater standard of living and purchasing power among consumers, the demand for convenience and ready-to-eat food products is expanding in the region. This factor is expected to boost flatbread demand in North American countries. The flatbread market in North America is being boosted by rising awareness of the nutritional benefits of flatbread products like as tortilla and pita, as well as a surge in demand for organic and non-GMO flatbread goods. The demand for organic, non-GMO, and gluten-free flatbread has increased as consumer knowledge of the health benefits of these goods has grown. Furthermore, customers in developed countries such as the United States, Canada, Germany, France, the United Kingdom, Australia, and China are expected to have greater spending power, which will increase demand for organic products.

Flatbread Market Key Players

- California Lavash

- Conagra Brands, Inc

- Kronos

- Signature Flatbreads Ltd

- Stonefire

- Evron foods Ltd

- GRUMA

- S.A.B. DE C.V

- Klosterman Baking Company

- Kontos Foods Inc.

- American Flatbread Company Inc

Flatbread Market: Recent Developments

The flatbread market has seen several recent developments, including:

Growing Demand for Healthier and Gluten-Free Options: With an increasing focus on health and wellness, consumers are seeking out healthier options, including flatbreads that are gluten-free, low in calories, and high in fiber. Many manufacturers are introducing new varieties of flatbreads that are free from gluten, wheat, and other allergens.

Innovative Flavors and Ingredients: Manufacturers are experimenting with different flavors and ingredients to make their flatbreads more appealing to consumers. This includes using ancient grains like quinoa and spelt, as well as adding herbs, spices, and other flavorings to the dough.

Plant-Based and Vegan Options: With the rise of veganism and plant-based diets, many flatbread manufacturers are introducing plant-based and vegan options to cater to this growing market. These flatbreads are typically made with ingredients like chickpea flour, almond flour, and coconut flour.

Convenience and Portability: Flatbreads are gaining popularity because of their convenience and portability. They can be easily carried in a lunchbox or used as a wrap for a quick and healthy meal on the go. Manufacturers are introducing smaller, individually wrapped flatbreads to make them even more portable and convenient.

Sustainability: Consumers are increasingly concerned about the environmental impact of their food choices, and flatbread manufacturers are responding by using sustainable ingredients and packaging. This includes using organic and locally sourced ingredients, as well as using recyclable and biodegradable packaging materials.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -