Epigenetics Market By Product (Kits, Reagents, Enzymes, Instruments), By Application (Oncology, Metabolic Diseases, Immunology, Developmental Biology, Cardiovascular Diseases, Other Applications), By End User (Academic and Research Institutes, Pharmaceutical and Biotechnology Companies, Contract Research Organizations) And By Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Global Market Analysis, Trends, Opportunity and Forecast, 2023-2032

Market Size and Overview

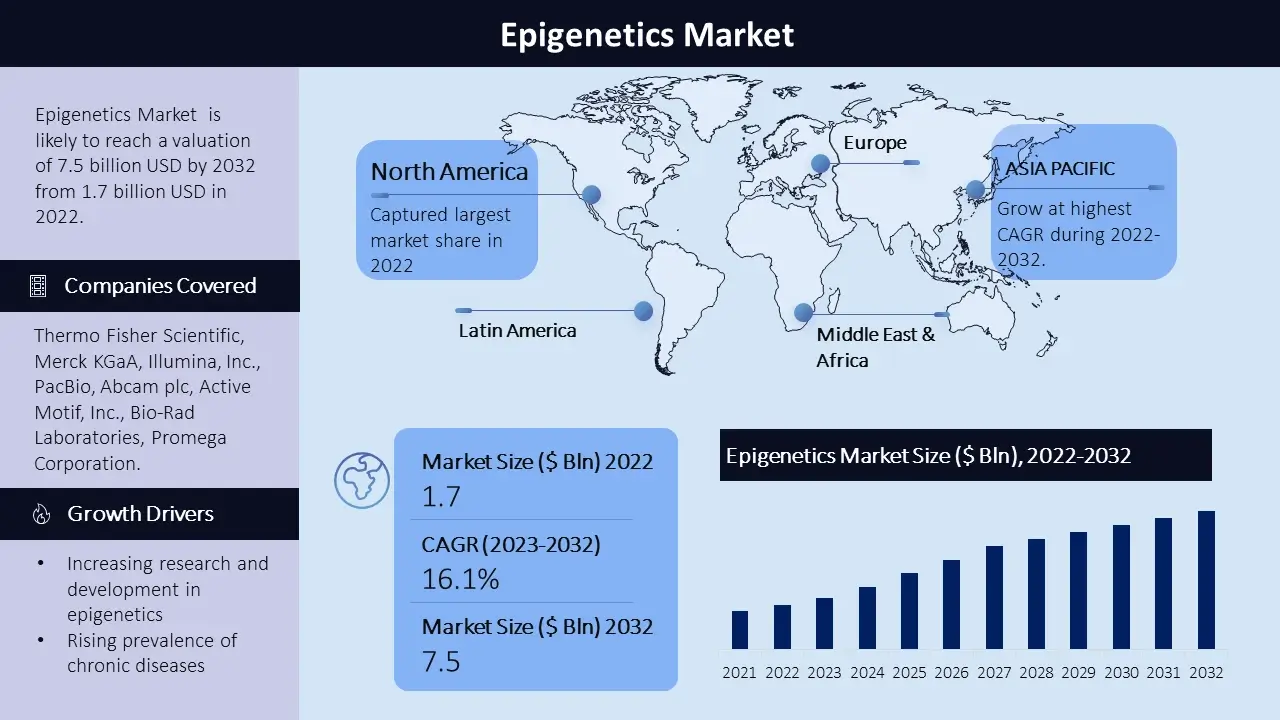

The epigenetics market size is poised to reach USD 7.5 billion by the end of 2032, growing at a CAGR of 16.1% during the forecast period, i.e., 2023 – 2032. In the year 2022, the industry size of epigenetics market was USD 1.7 billion. The reason behind the growth can be attributed to the considerable advancements in research and development in epigenetics, Chronic ailments such as cancer, cardiovascular diseases, metabolic illnesses, and neurological diseases are on the upward push globally, Personalized medication demand on the rise, technological advancements in epigenetics and increasing funding for epigenetics research. The marketplace incorporates a wide range of products. The market is highly competitive with key players striving to meet evolving customer demands

Epigenetics Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

6.5% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Epigenetics Market Segmentation

By Product

- Reagents

- Enzymes

- Instruments

- Kits

By Application

- Oncology

- Metabolic Diseases

- Immunology

- Developmental Biology

- Cardiovascular Diseases

- Other Applications

By End User

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations

By Geographic

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

On the basis of application in the epigenetics market the oncology segment accounted the highest market share in 2022. The oncology segment holds the biggest market proportion inside the epigenetics marketplace. This may be attributed to the increasing prevalence of most cancers and the developing demand for epigenetic remedies for most cancers remedy. Improvements in technology, along with next-generation sequencing and excessive-throughput screening, have further fueled the growth capacity of this segment.

Epigenetics Market Regional Analysis

North America stands as one of the major markets for epigenetics, driven through the emphasis on cancer research. Additionally drug discovery in academic and research institutes make contributions to the region’s dominance. The United States, primarily, is a key contributor on this marketplace. Europe is one of the leading marketplaces for epigenetics because of the region’s increasing focus on diseases management and early diagnosis. The European market showcases a mix of academic and research institutes and pharmaceutical and biotechnology companies. The Asia Pacific epigenetics market is estimated to witness significant growth, during the forecast timeframe led by, increasing prevalence of cancer and the growing demand for epigenetic therapies. The demand for epigenetics is anticipated to rise in countries like China and India, given their expanding pharmaceutical and biotechnology industries. Latin America and the Middle East and Africa display steady growth inside the epigenetics market, fueled via rising prevalence of chronic diseases and the growing demand for epigenetic therapies, focus on cancer research and drug discovery in academic and research institutes. in these regions. Key participants to the market's growth in these areas encompass Brazil, Mexico, the United Arab Emirates, and South Africa.

Epigenetics Market Growth Drivers

The focus of epigenetics has visible great improvements in research and development, leading to a deeper understanding of epigenetic mechanisms and their feature in numerous diseases. This has fueled the demand for epigenetic treatments and interventions. Chronic ailments such as cancer, cardiovascular diseases, metabolic illnesses, and neurological diseases are on the upward push globally. Epigenetic dysregulation has been implicated inside the improvement and development of those illnesses, leading to a developing want for epigenetic-based treatments. Personalized medication aims to tailor clinical remedies to precise patient based on their specific genetic and epigenetic profiles. Epigenetic markers can provide precious insights into disease susceptibility, prognosis, and treatment reaction, driving the demand for personalized medication processes. Advances in technology, such as next-generation sequencing, high-throughput screening, and epigenome mapping, have revolutionized the sphere of epigenetics. These technological improvements have enabled researchers to look at epigenetic adjustments in an extra complete and efficient manner, key to the improvement of novel epigenetic remedies. Governments, research institutions, and private agencies are increasingly making an investment in epigenetics studies because of its potential for large scientific advancements. The availability of investment has facilitated the exploration of recent epigenetic objectives and the development of modern therapeutic procedures.

Epigenetics Market Challenges

High cost and limited awareness about epigenetics are hindering the growth of market. In developing regions, this factor has resulted in limited demand for product. Moreover, the ethical concerns related to epigenetics research is also restricting the growth of market.

Epigenetics Market Key Companies

The epigenetics market is poised by several main corporations, each making big contributions to the industry through their sturdy market presence and progressive product offerings. Among these principal players are Thermo Fisher Scientific, Merck KGaA, Illumina, Inc., PacBio, Abcam plc, Active Motif, Inc., Bio-Rad Laboratories, Promega Corporation, PerkinElmer, Qiagen, New England Biolabs, Zymo Research Corporation, Diagenode, F. Hoffmann-La Roche Ltd And other players. These essential players constantly try and revamp their marketplace percentage and meet the desires of a diverse investor base. Their competitive techniques encompass product innovation, forging strategic partnerships, undertaking mergers and acquisitions, and increasing their distribution networks.

In 2022, PacBio introduced DNA methylation capabilities via its product line, Sequel, in the US. Introducing this feature to the Sequel systems is expected to extend the accessibility of epigenomes via HiFi sequencing developed by the company.

In January, 2023, Thermo Fisher Scientific Launched the EpiTYPER™ Methylation Enrichment Kit.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -