Companion Animal Specialty Drugs Market - Global Size, Share, Trends, Growth and Forecast Year ( 2022 – 2032 )

Companion Animal Specialty Drugs Market Dynamics

Companion Animal Specialty Drugs Market by Product Type (Anti-Inflammatory Drugs, Vaccines, Antibiotics, Animal Feed Additives, Parasiticides, Skin Care Products, Others); Distribution Channel (Hospital Pharmacies, Veterinary Clinics, Drug Stores, Others) Animal Type (Dogs, Cats, Horses, Others) Route of Administration (Oral, Injectable, Topical, Others) and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032.

Market Size and Overview:

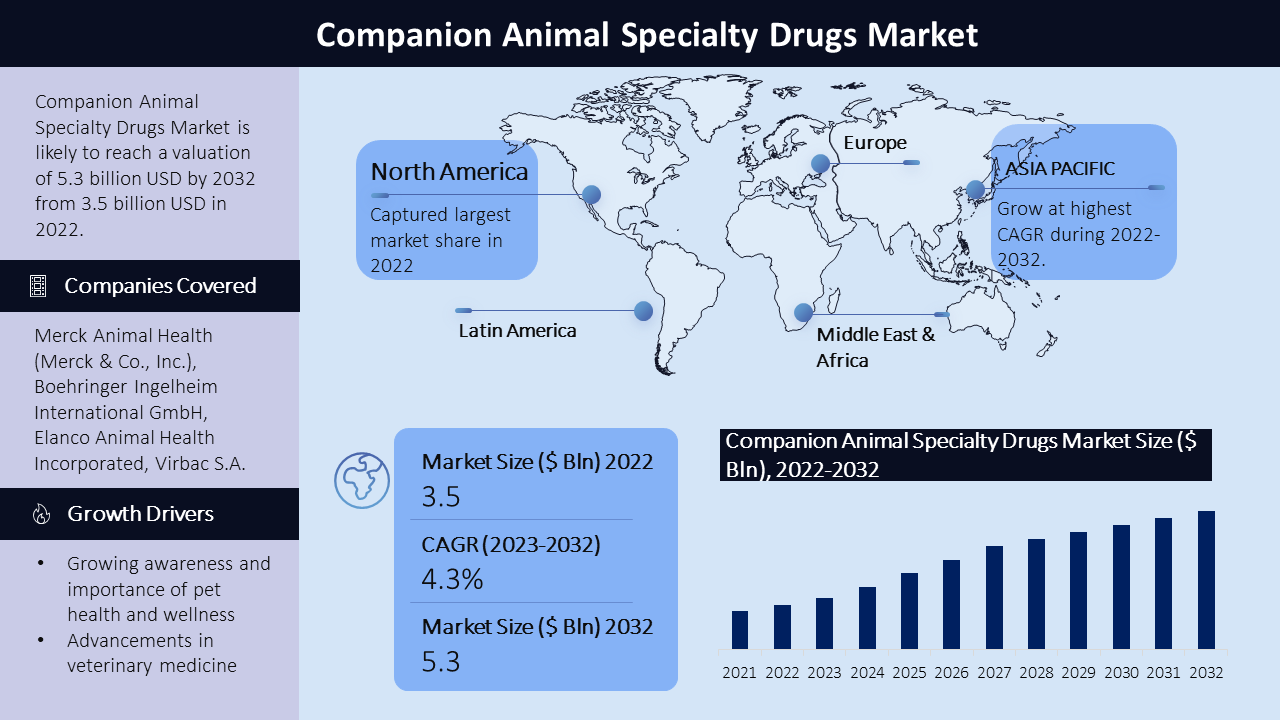

The companion animal specialty drugs market has witnessed steady growth, with a compound annual growth rate (CAGR) of 4.3% from 2023 to 2032, reaching a market value of $5.3 billion in 2032. This growth can be attributed to the increasing focus on pet health and wellness, leading to a rise in demand for specialized medications. The market comprises a wide range of specialty drugs designed specifically for companion animals, including medications for chronic conditions, behavioral disorders, and preventive care. Additionally, the growing trend of pet humanization, where pets are considered family members, has further fueled the demand for high-quality specialty drugs. The market is highly competitive, with key players continuously innovating to meet the unique healthcare needs of companion animals and cater to the evolving preferences of pet owners.

|

Companion Animal Specialty Drugs Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

4.3% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Market Segmentation:

Product Type:

- Anti-Inflammatory Drugs

- Vaccines

- Antibiotics

- Animal Feed Additives

- Parasiticides

- Skin Care Products

- Others

Distribution Channel:

- Hospital Pharmacies

- Veterinary Clinics

- Drug Stores

- Others

Animal Type:

- Dogs

- Cats

- Horses

- Others

Route of Administration:

- Oral

- Injectable

- Topical

- Others

Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Vaccines: The vaccines segment holds a significant market share in the companion animal specialty drugs market. This can be attributed to the increasing research and development activities focused on developing curable vaccines for companion animals. The emergence of new technologies, such as recombinant DNA vaccines, has further fueled the growth of this segment. These vaccines provide enhanced disease prevention to pet animals, driving their demand in the market.

Veterinary Hospitals: Veterinary hospitals represent a significant portion of the companion animal specialty drugs market. These facilities provide comprehensive veterinary care and have well-equipped pharmacies to dispense specialized medications for companion animals. The availability of a wide range of specialty drugs and the expertise of veterinary professionals contribute to the dominance of this segment.

Regional Analysis:

North America holds the largest market share, driven by the high number of companion animals in households and increased urbanization, which leads to a greater reliance on pets for emotional support. The United States, in particular, is a major market for specialized medications for companion animals, contributing to the dominance of North America. Europe is projected to be the second-largest market for companion animal specialty drugs, with countries like Germany, the United Kingdom, and France holding notable market shares. The region benefits from a growing awareness of disease control and pet insurance, promoting the expansion of the market. In Asia Pacific region, the increasing pet population, rising disposable incomes, and changing attitudes towards pet ownership are driving market expansion. Countries like China, Japan, and India are key contributors to the growth of the companion animal specialty drugs market in this region. Latin America demonstrates steady growth, propelled by urbanization, a rising middle class, and a growing demand for specialized medications for companion animals. Brazil, Mexico, and Argentina stand out as key markets within the region. Middle East and Africa exhibit a developing market with a focus on pet health and wellness. The United Arab Emirates, Saudi Arabia, and South Africa are notable contributors to the market's growth in this region, driven by factors such as increased awareness, tourism, and a growing emphasis on pet care and veterinary services.

Growth Drivers:

The growing awareness and importance of pet health and wellness among pet owners have led to an increased demand for specialized medications to address various health conditions in companion animals. Additionally, advancements in veterinary medicine and pharmacology have resulted in the development of innovative drugs and treatment options, further fueling market growth. The increasing prevalence of chronic diseases in companion animals, such as cancer and arthritis, has also contributed to the demand for specialty drugs for pain management and oncology.

The increasing adoption of companion animals, such as dogs, cats, and horses, is a significant driver for the market. As more households choose to own pets, the demand for specialty drugs to ensure their health and well-being also increases. This trend is particularly prominent in urban areas and among nuclear families, where pets are considered valued members of the family.

The expanding veterinary services sector, including veterinary hospitals and clinics, has created a conducive environment for the growth of the companion animal specialty drugs market. The availability of well-equipped pharmacies within veterinary facilities and the expertise of veterinary professionals in prescribing and administering specialized medications have contributed to market expansion. Furthermore, the expansion of product offerings in the companion animal specialty drugs market has played a crucial role in driving its growth. Pharmaceutical companies are continuously developing and enhancing their drug portfolios, introducing new drug approvals and innovations to meet the evolving needs of pet owners and veterinarians.

Challenges:

One of the key challenges is the risk of side effects associated with certain medications. While these drugs are effective in treating specific conditions, another challenge is the high cost associated with companion animal specialty drugs. The lack of awareness about these drugs and their benefits hinders market penetration in certain regions.

Key Companies:

The Companion Animal Specialty Drugs market is led by several prominent companies, including Merck Animal Health (Merck & Co., Inc.), Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, Virbac S.A., Biogenesis Bago SA, Piramal Group, Zoetis, NEOGEN Corporation, Vetoquinol S.A., and Ceva Santé Animale among other players. These companies have established themselves as leaders in the market, possessing strong market presence, extensive distribution networks, and a diverse product portfolio.

To maintain their competitive edge, these companies employ various strategies such as continuous product innovation, strategic partnerships, mergers, and acquisitions. By investing in research and development, they constantly strive to introduce advanced and effective specialty drugs for companion animals. In recent news, ALR Technologies SG Pvt. Ltd. made an announcement in June 2021 regarding the establishment of their new business division, the world's first and only Continuous Glucose Monitoring (CGM) for diabetic companion animals, known as the 'ALRT Animal Health Division.' This development showcases their dedication to advancing medical technologies for the benefit of companion animals.

Similarly, in February 2021, Vetoquinol acquired the Canadian rights for the Profender product family from Elanco Animal Health. This strategic acquisition not only expands Vetoquinol's product offerings but also presents opportunities for business development in untapped economies.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -