Commercial Telematics Market By Solution (Fleet Management, Navigation & Location-based, Safety & Compliance, V2X (vehicle-to-everything) Solutions, Remote Diagnostics & Maintenance); By Service (Professional Services, Managed Services); By Provider Type (OEM (Original Equipment Manufacturer) Solutions, Aftermarket Solutions); By End-use Industry (Transportation & Logistics, Construction, Healthcare, Automotive, Agriculture & Forestry, Mining); By Component (Hardware, Software, Services); By Technology (GPS, GSM/GPRS, Satellite); By Deployment (Cloud-based, On-premise); By Vehicle Type (Light commercial vehicles, Heavy commercial vehicles); By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

Commercial Telematics Insights

Commercial telematics is a technology that mixes telecommunications and informatics to enable the remote exchange of data between commercial vehicles and a central system. This technology allows for the monitoring and management of a variety of auto and driver-related data, like location, speed, fuel consumption, and vehicle maintenance. it's commonly employed by businesses that operate fleets of vehicles, like trucking companies, delivery services, and public transportation systems. The technology can provide businesses with real-time visibility into their operations, allowing them to optimize routes, reduce fuel costs, and improve driver safety and compliance.

Commercial telematics systems typically contain hardware devices that are installed in vehicles and software applications that enable data management and analysis. Some common features of economic telematics systems include GPS tracking, vehicle diagnostics, driver behavior monitoring, and real-time reporting.

Commercial Telematics Market

The commercial telematics market refers to the utilization of technology to transmit information from commercial vehicles to a central information system for monitoring and analysis. The worldwide commercial telematics market is predicted to grow significantly within the coming years, driven by the increasing demand for efficient fleet management solutions in various industries like transportation, logistics, construction, and healthcare, and by the growing trend toward digitization and automation within the transportation industry.

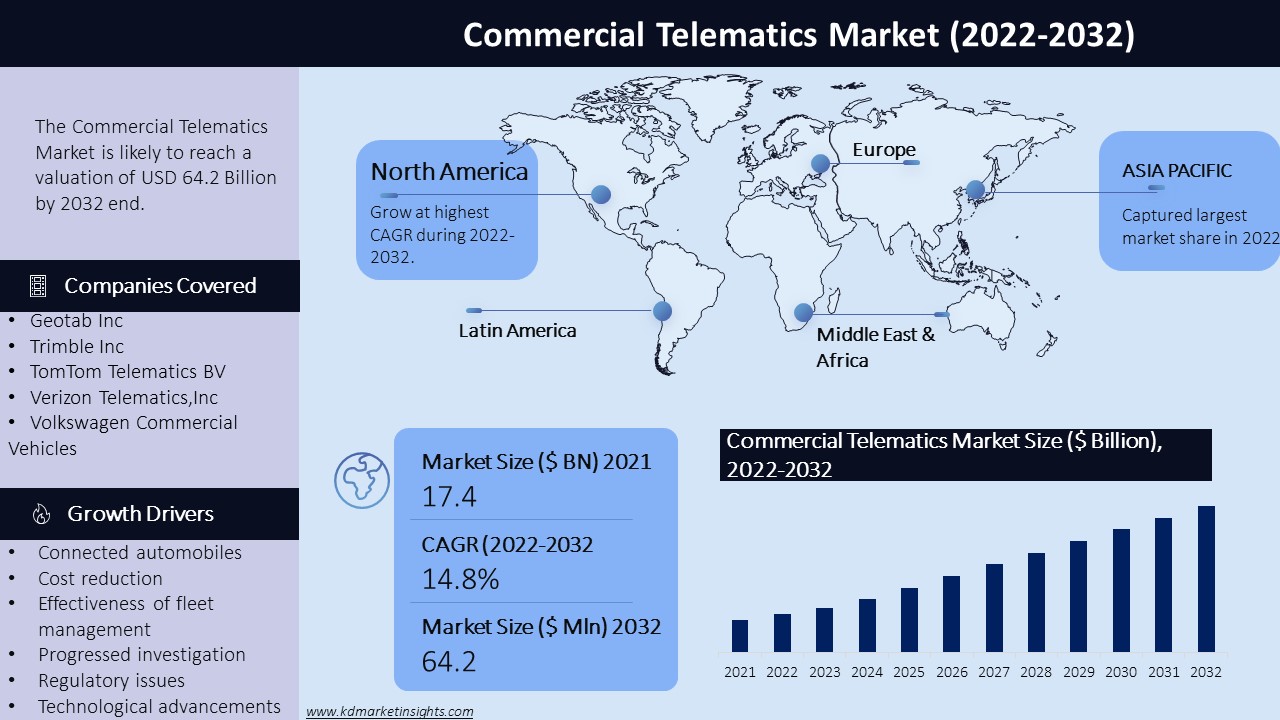

The global Commercial Telematics market size was valued at around USD 17.4 billion in 2021 and is projected to grow at a compound annual rate of growth (CAGR) of around 14.8% from 2022 to 2032.The market size is projected to succeed in USD 64.2 billion by 2032. North America is predicted to be the most important marketplace for commercial telematics thanks to the increasing adoption of connected vehicle technologies within the region. However, the Asia Pacific region is predicted to witness the very best rate of growth during the forecast period, due to the growing demand for advanced fleet management solutions in emerging economies like China and India.

The major players within the market include Geotab Inc, Trimble Inc,Trimble Inc, TomTom Telematics BV, among others. These companies are investing heavily in research and development to introduce new and innovative products and services within the market to remain before the competition.

Commercial Telematics Market Key Drivers

The global commercial telematics market is driven by various key drivers contributing to its growth in recent years. Some of the key drivers of the are:

- Connected automobiles: The commercial telematics market is expanding due to the rising popularity of connected vehicles which can communicate with one another and the central information system with the assistance of telematics solutions, resulting in increased road safety and efficiency.

- Cost reduction: By cutting down on downtime, lowering costs associated with maintenance, and increasing fuel efficiency, economical telematics solutions can assist businesses in lowering operational costs.

- Effectiveness of fleet management: Fleet managers can monitor vehicle performance, driver behavior, and route optimization in real time with the help of telematics solutions, resulting in increased fleet efficiency and decreased operational costs.

- Increasing awareness of the benefits of telematics: The need for these solutions is expected to grow as more businesses realize the benefits of telematics.

- Progressed investigation: Economic telematics solutions are being used more and more because of the availability of cutting-edge analytics tools. Knowledge analytics can help fleet managers make better decisions by giving them insight into driver behavior, vehicle performance, and operational efficiency.

- Regulatory issues: The transportation industry's growing demand for regulatory compliance is driving the adoption of economical telematics solutions. Solutions for telematics help fleet managers comply with safety, emissions, and driver service hours regulations.

- Technological advancements: The progressions in innovation like IoT, 5G, and distributed computing has been giving a far superior stage to business telematics arrangement suppliers to make more complex and productive arrangements.

Commercial Telematics Market Key Trends and Developments

Some key trends and developments in the commercial telematics market include:

- Adoption of AI and machine learning: The utilization of AI and machine learning is becoming increasingly prevalent within the commercial telematics market. These technologies are getting used to research data and supply insights into vehicle performance, driver behavior, and route optimization, resulting in improved operational efficiency.

- Integration with other technologies: Commercial telematics solutions are being integrated with other technologies like IoT, big data analytics, and blockchain to supply more comprehensive solutions for fleet management.

- Focus on driver safety: Telematics solutions are getting used to watching driver behavior, providing real-time feedback, and detecting fatigue and distraction, resulting in improved driver safety to ensure driver’s safety.

- Predictive maintenance: Telematics solutions such as predictive maintenance are getting used to watch vehicle performance and detect potential issues before they become major problems, resulting in reduced downtime and maintenance costs.

- Shift towards electric vehicles: The growing adoption of electric vehicles is driving the event of telematics solutions tailored for these vehicles. These solutions specialize in monitoring battery performance, optimizing charging, and providing real-time range information, resulting in improved efficiency and reduced operating costs.

Commercial Telematics Market Segmentation

The commercial telematics market can be segmented based on the following factors:

- By Solution

- Fleet Management

- Navigation & Location-based

- Safety & Compliance

- V2X (vehicle-to-everything) Solutions

- Remote Diagnostics & Maintenance

- By Service

- Professional Services

- Managed Services

- By Provider Type

- OEM (Original Equipment Manufacturer) Solutions

- Aftermarket Solutions

- By End-use Industry

- Transportation & Logistics

- Construction

- Healthcare

- Automotive

- Agriculture & Forestry

- Mining

- By Component

- Hardware

- Software

- Services

- By Technology

- GPS

- GSM/GPRS

- Satellite

- By Deployment

- Cloud-based

- On-premise

- By Vehicle Type

- Light commercial vehicles

- Heavy commercial vehicles

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Commercial Telematics Market: Report Scope |

|

|

Base Year Market Size |

2021 |

|

Forecast Year Market Size |

2022-2032 |

|

CAGR Value |

14.8% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Commercial Telematics Market Key Challenges

The commercial telematics market faces several key challenges that could potentially impact market growth and profitability. Some of the key challenges include:

- Cost and ROI: The high upfront costs of implementing commercial telematics solutions, like hardware installation and software licensing, are often a big barrier to adoption for a few customers as customers got to demonstrate a transparent return on investment (ROI) to justify the investment in telematics solutions.

- Data privacy and security: As commercial telematics solutions involve the gathering and transmission of sensitive data, like vehicle location, driver behavior, and cargo information, data privacy, and security remain significant concerns for patrons. Ensuring that data is shielded from breaches and unauthorized access may be a major challenge.

- Dependence on the cellular network and GPS availability: Telematics systems believe cellular networks and GPS for data transmission and site tracking, respectively. In areas with poor network coverage or GPS signal quality, telematics systems might not function properly.

- Integration with existing systems: Integrating telematics technology with existing systems is often complex and time-consuming, and should require significant investment.

- Interoperability challenges: The mixing of various telematics systems and devices from different vendors are often challenging, and should cause compatibility issues.

- Limited standardization: There's limited standardization across the commercial telematics industry, which may make it difficult for companies to match and choose from different solutions.

- Limited technical expertise: Some companies may lack the technical expertise to properly implement and utilize telematics technology, which may limit its effectiveness.

- Regulatory compliance: Commercial telematics solutions got to suit relevant regulations and industry standards, like those associated with data privacy, road safety, and environmental protection.

- Technical challenges: Developing and maintaining advanced telematics solutions require investment in research and development (R&D) to keep up with the latest technologies and ensure that their solutions remain relevant and competitive.

Commercial Telematics Market Global Key Players

- Geotab Inc

- Trimble Inc

- TomTom Telematics BV

- Verizon Telematics,Inc

- Volkswagen Commercial Vehicles

- Continental AG

- Cartrack

- Daimler Fleetboard GmbH

- Fleet Complete

- Microlise

- Masternaut Limited

- Mix Telematics

- Navistar, INC

- Omnitracs

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -