Coagulation Analyzers Market By Product (Clinical Laboratory Analyzers, and Point of Care Analyzers) Test Type (Prothrombin Time Testing, Fibrinogen Testing, Activated Clotting Time Testing, Activated Partial Thromboplastin Time Testing, D-dimer Testing, Platelet Function Tests, Anti-Factor XA Tests, Heparin & Protamine Dose-response Tests for ACT, Other Coagulation Tests), Technology (Optical, Mechanical, Electrochemical, and Others), End-User (Clinical Laboratories, Hospitals, Other End Users) And Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2023-2032

Coagulation Analyzers Market Size and Overview

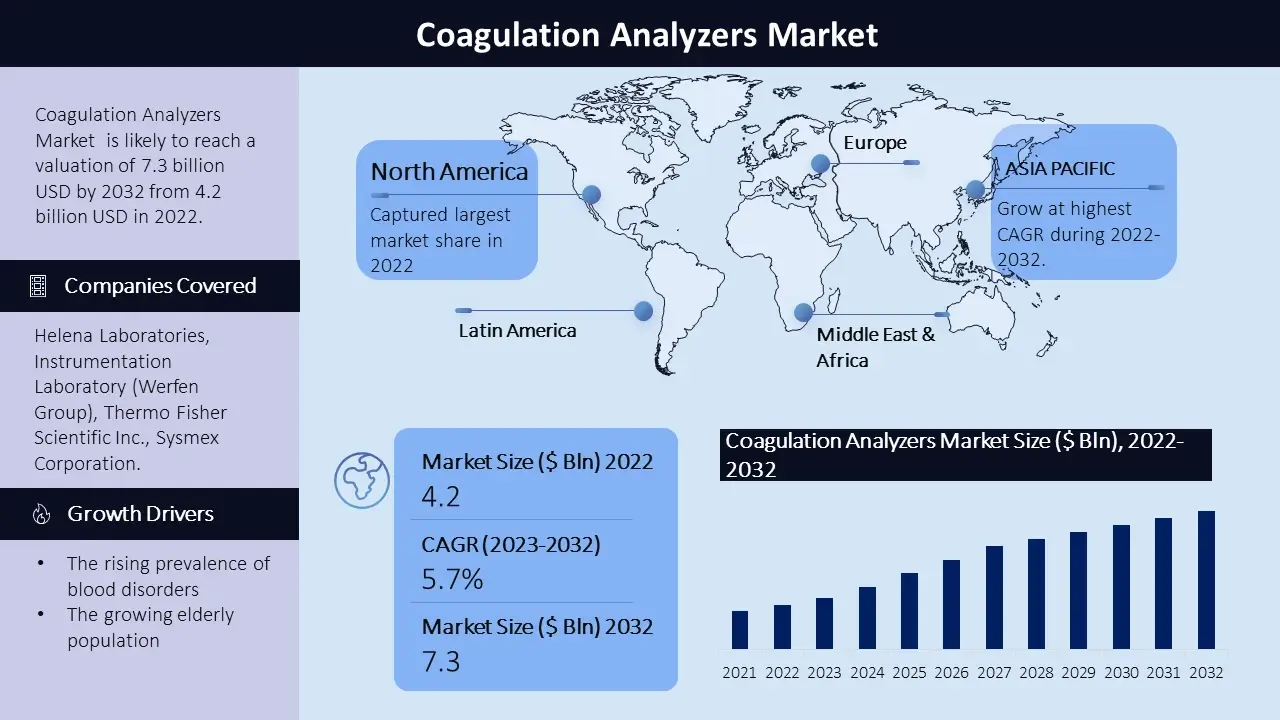

The coagulation analyzers market size is poised to reach USD 7.3 billion by the end of 2032, growing at a CAGR of 5.7% during the forecast period, i.e., 2023 – 2032. In the year 2022, the industry size of coagulation analyzers market was USD 4.2 billion. The growth can be attributed to factors, including the increasing prevalence of blood disorders, advancements, in technology the growing elderly population and the healthcare industries adoption of automation. Additionally point of care testing has become increasingly popular. In this marketplace there is a range of products and tests. The market is highly competitive as key players strive to meet the evolving demands of customers.

Coagulation analyzers Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

5.7% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Coagulation Analyzers Market Segmentation

By Product

- Clinical Laboratory Analyzers

- Consumables

- Reagents

- Standards, Controls, and Calibrations

- Systems

- Automated Systems

- Manual Systems

- Semi-automated Systems

- Point-of-care Testing Analyzers

- Consumables

By Test

- Prothrombin Time Testing

- Fibrinogen Testing

- Activated Clotting Time Testing

- Activated Partial Thromboplastin Time Testing

- D-dimer Testing

- Platelet Function Tests

- Anti-Factor XA Tests

- Heparin & Protamine Dose-response Tests for ACT

- Other Coagulation Tests

By Technology

- Optical

- Mechanical

- Electrochemical

- Other Technologies

By End User

- Clinical Laboratories

- Hospitals

- Other End Users

By Geographic Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

On the basis of product in the coagulation analyzers market the clinical laboratory analyzers segment accounted the highest market share in 2022. The clinical laboratory analyzers segment has the market share, in the coagulation analyzers market. This is because there is an increasing number of tests being done in laboratories and a rising demand for automated analyzers. As blood disorders become more prevalent and the need for timely diagnosis continues to grow the demand, for laboratory analyzers is expected to see steady growth.

Coagulation Analyzers Market Regional Analysis

North America stands as one of the major markets for coagulation analyzers, driven through the well-established healthcare infrastructure. Additionally, emphasis on healthcare and medical research activities in hospitals and clinics make contributions to the region’s dominance. The United States, primarily, is a key contributor on this marketplace. Europe is one of the leading marketplaces for coagulation analyzers because of the regions with a mix of public and private healthcare facilities. The European market showcases a developing interest in point-of-care testing, fueled by the need for faster and more accurate diagnosis. The Asia Pacific coagulation analyzers market is estimated to witness significant growth, during the forecast timeframe led by, rising prevalence of blood-related disorders, increasing government initiatives for the improvement of healthcare infrastructure. The demand for coagulation analyzers is anticipated to rise in countries like China and India, in which expanding healthcare infrastructure and rising prevalence of blood disorders. Latin America and the Middle East and Africa display steady growth inside the coagulation analyzers market, fueled via increasing number of surgeries and the need for advanced diagnostic equipment and focus on improving healthcare access and quality in these regions. Key participants to the market's growth in these areas encompass Brazil, Mexico, the United Arab Emirates, and South Africa.

Coagulation Analyzers Market Growth Drivers

The rising prevalence of blood disorders, like hemophilia and thrombosis is fueling the need for reliable equipment. Moreover, advancements in technology have led to the development of portable analyzers, which are attracting both healthcare providers and patients. For instance, the prevalence of hemophilia and thrombosis, in Canada is documented by the Public Health Agency of Canada (PHAC). In a study published in 2019 it was reported that, around 2,500 Canadians have been diagnosed with hemophilia A while 600 Canadians have been diagnosed with hemophilia B. This trend is further accelerated by the increasing number of surgeries and the requirement for timely diagnoses. The growing elderly population presents opportunities for market growth. Older individuals are more susceptible to blood disorders. Require monitoring and diagnosis. The shift towards point of care testing aligns with the emphasis on more diagnoses particularly in emergency scenarios. The healthcare industry is increasingly adopting automation to enhance efficiency while reducing errors. Coagulation analyzers, which are automated devices are experiencing a surge in demand due to the adoption of automation in healthcare. Point of care testing refers to conducting tests on blood and other bodily fluids at the patient’s bedside or in a clinic setting. This form of testing is gaining popularity due to its convenience and rapid results. coagulation analyzers play a role in point of care testing, which further drives their demand due to the increasing preference, for this type of approach.

Coagulation Analyzers Market Challenges

High cost of coagulation analyzers and technical complexity are hindering the growth of market. In developing regions, this factor has resulted in limited demand for product. Moreover, the lack of skilled operators is also restricting the growth of market.

Coagulation Analyzers Market Key Companies

The coagulation analyzers market is poised by several main corporations, each making big contributions to the industry through their sturdy market presence and progressive product offerings. Among these principal players are Helena Laboratories, Instrumentation Laboratory (Werfen Group), Thermo Fisher Scientific Inc., International Technidyne Corporation (ITC), Siemens Healthcare (AG), Nihon Kohden Corporation, Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Alere Inc., Sysmex Corporation, Diagnostica Stago Sas And other players. These essential players constantly try and revamp their marketplace percentage and meet the desires of a diverse investor base. Their competitive techniques encompass product innovation, forging strategic partnerships, undertaking mergers and acquisitions, and increasing their distribution networks.

In January 2023, Roche Diagnostics announced the launch of its new coagulation analyzer, the cobas c 812.

In February 2023, Sysmex Corporation announced the launch of its new coagulation analyzer, the CS-2500i.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -