1,4 Butanediol Market By Application (Polyurethanes, Tetrahydrofuran (THF), Polybutylene Terephthalate (PBT), Gamma Butyrolactone (GBL), Others); By End-Use Industry (Automotive, Textiles, Electronics, Pharmaceuticals, Others); By Production Technology (Acetylene-Based, Maleic Anhydride-Based); By Product Grade (Industrial Grade, Pharmaceutical Grade, High-Purity Grade); By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

1,4 Butanediol Market and Insights

1,4 Butanediol (BDO), a useful chemical compound, finds employment in various activities and industries. It is created through the catalytic hydrogenation of maleic anhydride and also through the Reppe process, which utilizes acetylene and formaldehyde. BDO finds wide usage as a detergent and chemical intermediate. Furthermore, it serves as a vital raw material for producing polymers such as polybutylene terephthalate (PBT) and polyurethanes.

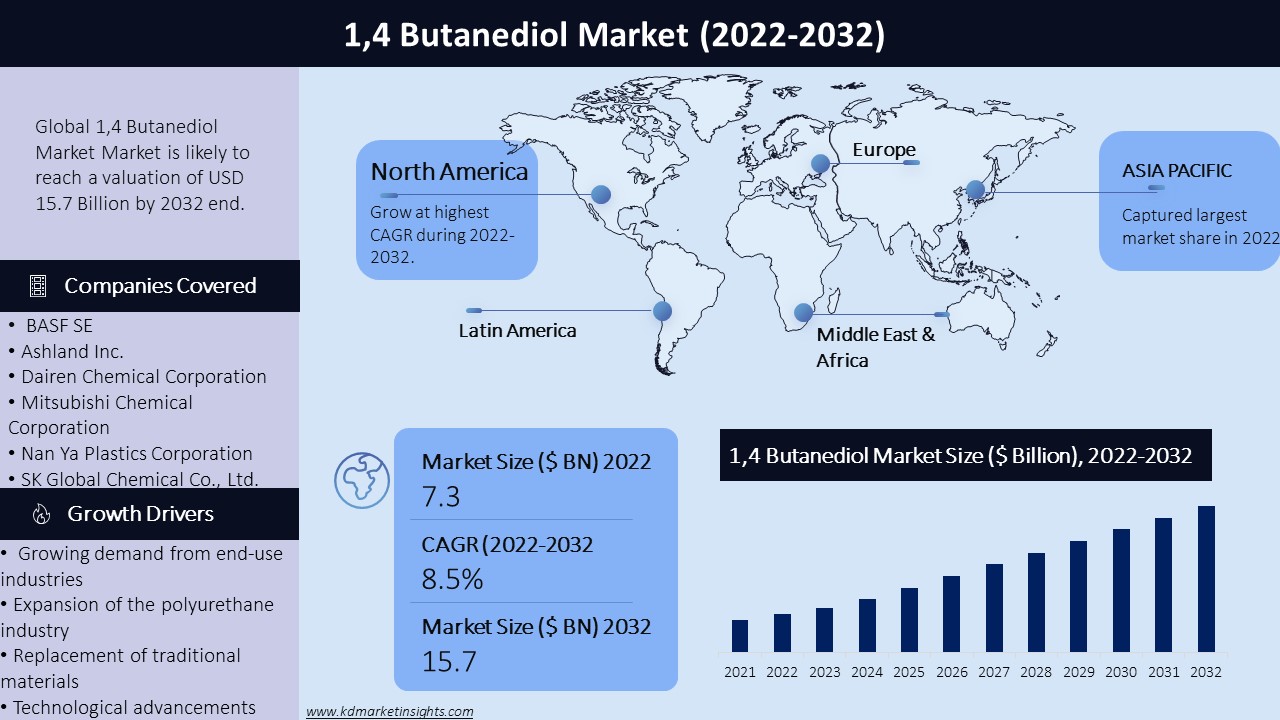

The global 1,4 butanediol market was valued at USD 7.3 billion in 2022 and is projected to reach USD 15.7 billion by the end of 2032, growing at a CAGR 8.5% from 2022 to 2032.

1,4 Butanediol Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

8.5% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

1,4 Butanediol Market Driving Factors

- The 1,4 butanediol (BDO) market experiences the impact of several driving factors, primarily attributed to the growing demand from end-use industries. BDO finds utilization across various sectors, including automotive, textiles, electrical and electronic, pharmaceutical, and building. The demand for BDO is fueled by the expansion and success of these industries. Population growth, urbanization, and consumer spending also aid in driving the increasing demand for BDO-based products.

- The positive growth of the polyurethane industry significantly influences the demand for BDO. BDO is a crucial raw ingredient used to create polyurethanes, which are employed in a variety of processes such lathers, coatings, bonding, and elastomers. As a result, the demand for BDO is particularly boosted by the growth of the polyurethane sector, including its applications in industries like automotive and construction.

- Replacement of traditional materials: Products based on BDO, such as polybutylene terephthalate (PBT) and polyurethanes, usually offer better performance and features than conventional materials. Advantages such as practicality, durability, and lightweight components act as key factor in switching from conventional materials with BDO-based alternatives.

- Technological advancements: Improvements in product technology and process inventions in the BDO market can fuel growth. Enhanced BDO product processes, in terms of efficacy, affordability, and scalability, have an influence on market expansion. Additionally, exploration and development initiatives that enhance the distribution and operations of BDO-based goods can also impact demand.

- Environmental regulations and sustainability initiatives: The BDO market is significantly impacted by environmental legislation and sustainability factors. There is an increasing demand for environmentally friendly and sustainable accessories, as industry works to lessen their impact on the environment. BDO, a key component in polyurethane lathers and other products, can improve the efficiency of energy use and the sustainability of the environment.

- Geographical factors: The BDO market is also impacted by regional factors, such as industrial development, economic conditions, and government actions. The rising industrialization and urbanization in developing countries, along with infrastructure development systems, is acting as a primary driver of the demand for BDO.

1,4 Butanediol Market Challenges

The 1,4 butanediol (BDO) market faces several challenges:

- Raw material availability and price volatility: The availability and cost fluctuations of raw materials such as acetylene, maleic anhydride, and formaldehyde can impact the cost and stability of BDO products.

- Environmental and regulatory pressures: Environmental regulations and sustainability demands drive the need for greener alternatives. BDO producers must navigate tighter environmental standards and develop new environmentally friendly manufacturing techniques.

- Competition from alternative materials: BDO faces competition from alternative materials that offer similar performance and advantages. Bio-based compounds and other polymers provide more sustainable or cost-effective solutions, challenging the BDO market.

- Technological advancements and product innovation: Rapid technological advancements and the introduction of new products can disrupt the BDO market. New production methods and essential compounds have the potential to replace or reduce the demand for BDO.

- Economic uncertainties and market fluctuations: Economic factors and market oscillations, such as global recessions or domestic uncertainties, can impact the demand for BDO-based products. Unpredictable market conditions make it challenging for BDO producers to anticipate demand, pricing, and profitability.

- Health and safety concerns: Due to its hazardous nature, BDO requires strict adherence to safety regulations to protect both workers and the environment. Proper storage and transportation of BDO can pose difficulties.

1,4 Butanediol Market Regional Synopsis

North America: The BDO market has reached maturity in North America. The United States, along with industries like automobile, textiles, and electronics, acts as a significant consumer and supporter of BDO. Technological advancements, exploration and development conditions, and the demand for sustainable and bio-based alternatives all contribute to the market's growth in this region.

Europe: The BDO demand is well-established in Europe, with countries like Germany, France, and Italy leading in terms of consumption and production. End-use industries such as automobile, construction, and packaging drive the market. Stringent environmental regulations and sustainable business practices shape the demand dynamics in the region.

Asia Pacific: The Asia-Pacific region accounts for a significant portion of BDO's client base. India, China, Japan, and South Korea accounted for major market share in the Asia Pacific BDO market. The demand for BDO is propelled by the region's robust manufacturing sector, rapid industrialization, and increasing need for automotive and construction components.

Latin America: The Latin American BDO demand is driven by industrial growth, infrastructure development, and rising consumer demand. Countries like Brazil and Mexico play a significant role in the market. The pharmaceutical, textile, and automotive industries fuel the demand for BDO in the region.

Middle East and Africa: The Middle East and Africa region are witnessing a growing number of BDO markets. Demand for BDO is driven by diversification efforts, infrastructure development, and industrial growth in countries such as Saudi Arabia, the United Arab Emirates, and South Africa. The construction and automobile industries significantly influence the demand for BDO in this region.

1,4 Butanediol Market Segmentation

The 1,4 butanediol (BDO) market is segmented based on:

By Application

- Polyurethanes

- Tetrahydrofuran (THF)

- Polybutylene Terephthalate (PBT)

- Gamma Butyrolactone (GBL)

- Others

By End-Use Industry

- Automotive

- Textiles

- Electronics

- Pharmaceuticals

- Others

By Production Technology

- Acetylene-Based

- Maleic Anhydride-Based

By Product Grade

- Industrial Grade

- Pharmaceutical Grade

- High-Purity Grade

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1,4 Butanediol Market Key Players

Some leading companies in the BDO industry includes:

- BASF SE

- Ashland Inc.

- Dairen Chemical Corporation

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- SK Global Chemical Co., Ltd.

- Bioamber Inc.

- Mitsui Co. & Ltd.

- Chongqing Jian Feng Chemical Industry Co. Ltd

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -