Botulinum Toxin Market: Latest Trends and Business Opportunities from 2022 to 2032

Market Size and Overview:

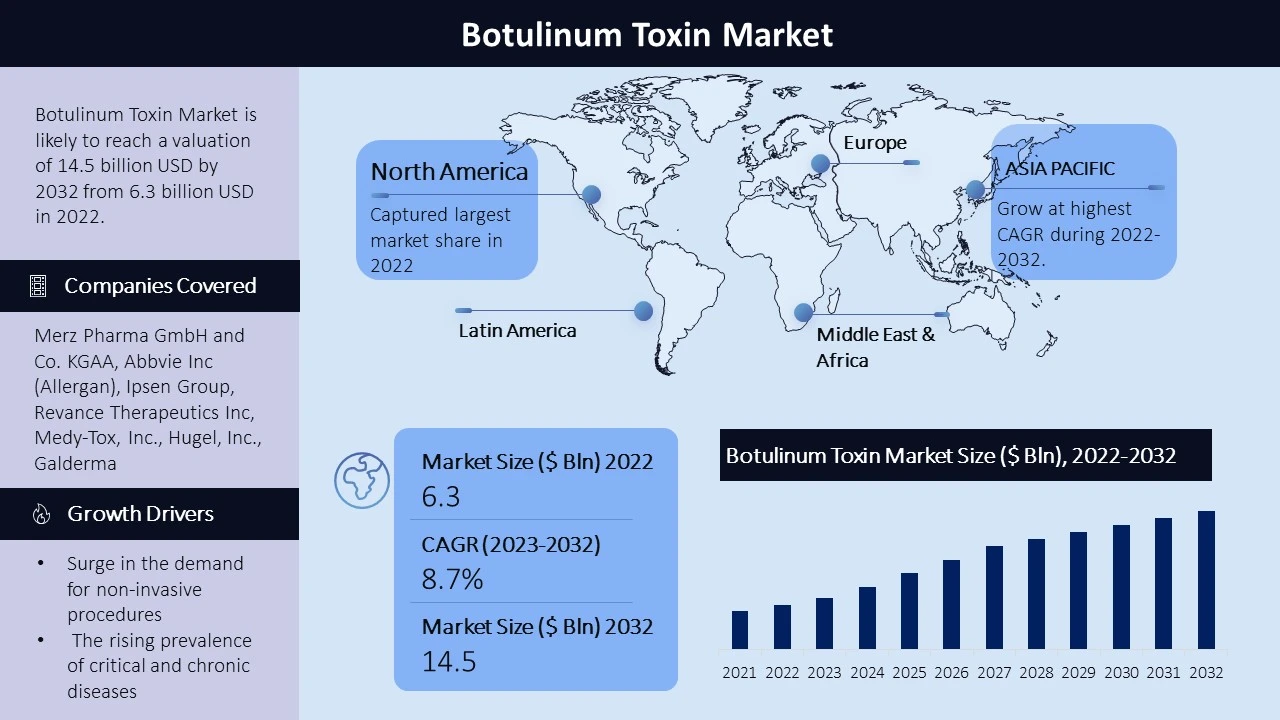

The global botulinum toxin market was valued at USD 6.3 billion in 2022 and is projected to grow at a CAGR of 8.7% from 2023 to 2032. Botulinum toxin, produced by the bacterium Clostridium botulinum, is a protein and neurotoxin that selectively blocks acetylcholine release from nerves, resulting in the inhibition of neural transmission. Botulinum toxin is one of the most exceptional substances encountered in medicine and science. The adoption of botulinum toxin in cosmetology has grown rapidly over the decade, and at present it is one of the most common and widely performed aesthetic procedures in the world. The adoption of botulinum toxin in cosmetology has seen rapid growth, making it one of the most common aesthetic procedures worldwide. The increasing focus on aesthetic features in developed and developing regions has driven the demand for cosmetic procedures, contributing to the market's expansion.

Market Segmentation:

Product Type:

- Botulinum Toxin Type-A

- Botulinum Toxin Type-B

Application:

- Aesthetic

- Therapeutic

End-Users:

- Hospitals

- Dermatology Clinics

- Spas and Cosmetic Clinics

Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Botulinum Toxin Type-A: The botulinum toxin Type-A segment accounted for the largest revenue share in 2022. This type of botulinum toxin is preferred due to its advantages, including minimal pain, lack of scarring, and no blood loss during procedures. It is extensively used for both therapeutic and aesthetic applications, such as the treatment of chronic migraine and other primary neurological disorders.

Aesthetic Application: The aesthetic segment is expected to witness significant growth during the forecast period. Rising awareness for aesthetic appearance and technological advancements in developed and developing countries have led to an increase in cosmetic surgeries. Botulinum toxin plays a crucial role in cosmetology procedures, addressing concerns such as glabellar lines, forehead lines, and chemical browlifts.

Hospitals: The hospitals segment accounted for the largest revenue share of 50.6% in 2022. The availability of advanced care facilities and the increasing awareness of aesthetic procedures contribute to the segment's growth. Therapeutic procedures, such as dystonia and chronic migraine treatments, are predominantly performed in hospitals.

Regional Analysis:

North America, this region holds the largest market share, driven primarily by the United States. The region's growth is attributed to the increasing number of product launches, the presence of major companies, and the high adoption rate of botulinum toxin procedures among the population.

Europe captures the second-largest market share, driven by the growing preference for these procedures among individuals in key European countries. The region also invests substantially in research and development initiatives to introduce new products into the market.

The Asia Pacific region presents substantial growth potential due to the increasing incidence of chronic diseases, growing consciousness about physical appearance, and a growing number of specialty and dermatological clinics contributing to the popularity of botulinum toxin procedures in the region.

Latin America demonstrates a growing market, with countries like Brazil leading the adoption of botulinum toxin procedures for aesthetic purposes. The region observes a rising trend in product adoption and increasing awareness among the population. The Middle East and Africa region is expected to witness an increase in the number of botulinum toxin procedures. The region's growing per capita spending on healthcare and the rising health and beauty standards contribute to the expansion of the global market.

Growth Drivers:

There are several factors driving the growth of the botulinum toxin market. There has been a surge in the demand for non-invasive and minimally invasive procedures worldwide. The increasing preference for procedures that provide youthful and healthy appearances without the risks associated with invasive surgeries has led to a significant growth in botulinum toxin procedures. The total amount of nonsurgical procedures, including botulinum toxin, hyaluronic acid, and laser hair removal, had a considerable increase.

In addition to aesthetic applications, botulinum toxin products also find therapeutic uses. The rising prevalence of critical and chronic diseases such as spasticity, cervical dystonia, and chronic migraine has further contributed to the market's growth. Pharmaceutical companies are investing in research and development initiatives to provide treatment options for these diseases, driving the expansion of the global market.

Another driving factor is the increasing focus on research and development activities to expand the therapeutic and aesthetic applications of botulinum toxin. Ongoing clinical trials by key industry players aim to explore new uses and expand the market.

Challenges:

One of the challenges faced by the botulinum toxin market is the availability of counterfeit products. As the demand for these products increases, so does the availability of counterfeit versions. Counterfeit products pose significant risks to consumers, as they are unregulated and manufactured illegally, leading to harmful side effects.

Key Companies:

The major players in the botulinum toxin market include Merz Pharma GmbH and Co. KGAA, Abbvie Inc (Allergan), Ipsen Group, Revance Therapeutics Inc, Medy-Tox, Inc., Hugel, Inc., Galderma, Us Worldmed, Llc, Evolus Inc., and Daewoong Pharmaceutical. These corporations have a robust market presence, extensive R&D capabilities, and a wide range of products. They focus on strategic partnerships, mergers, and acquisitions to develop their market share and expand their product portfolios.

In July 2020, Tenjin Pharma and Merz Pharma collaboratively signed up for a sale of Xeomin (incobotulinumtoxinA) of Tenjin Pharma for intramuscular injection in 50, 100, and 200 units for the treatment of lower limb spasticity and is also approved by Japan’s Ministry of Health. This strategy of the company will promote the organization to add value to their business products portfolio, thereby strengthening its revenue generation stream.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -