Blood Group Typing Market By Product Type (Instruments, Consumables, Services); By Technique (PCR-based and Microarray Techniques, Assay-based Techniques, Massively Parallel Sequencing Techniques, Other Techniques); By Test Type (Antibody Screening, HLA Typing, Cross-matching Tests, ABO Blood Tests, Antigen Typing); By End-user (Hospitals and Clinics, Blood Banks, Diagnostic Laboratories, Other End Users); By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Market Analysis, Trends, Opportunity and Forecast, 2022-2032

Blood Group Typing Market Size and Overview

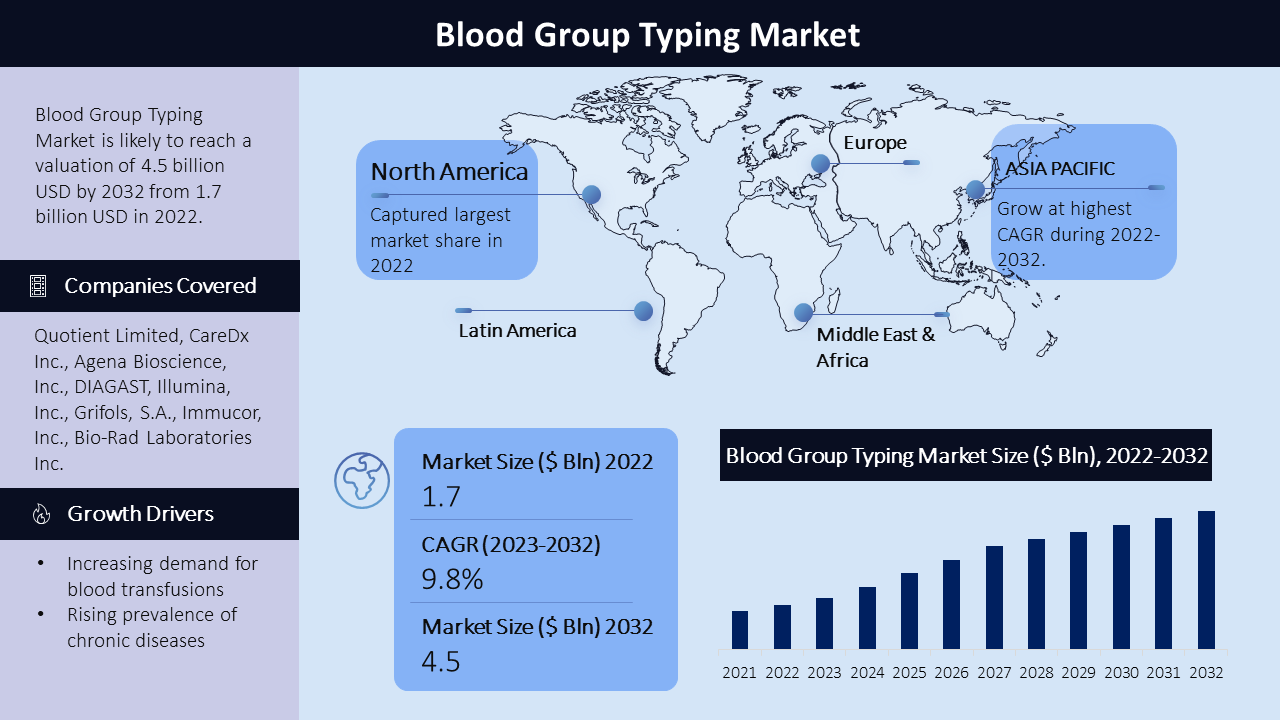

The blood group typing market has witnessed steady growth, with a compound annual growth rate (CAGR) of 9.8% from 2023 to 2032, reaching a market value of USD 4.5 billion in 2032. This growth can be attributed to the increasing demand for blood transfusions, rising prevalence of chronic diseases requiring regular blood typing, and the importance of accurate blood typing in medical procedures. The market comprises a wide range of products and solutions for blood group typing, including instruments, consumables, and services. Key players in the market are continually investing in research and development to enhance the accuracy and efficiency of blood group typing methods and expand their product portfolios.

|

Compression Therapy Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

9.8% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Market Segmentation:

Product Type

- Instruments

- Consumables

- Services

Technique

- PCR-based and Microarray Techniques

- Assay-based Techniques

- Massively Parallel Sequencing Techniques

- Other Techniques

Test Type

- Antibody Screening

- HLA Typing

- Cross-matching Tests

- ABO Blood Tests

- Antigen Typing

End-Users

- Hospitals and Clinics

- Blood Banks

- Diagnostic Laboratories

- Other End Users

Geographic Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Consumables: The consumables segment dominated the blood group typing market in 2022 and is expected to maintain its leadership during the forecast period. This is driven by the rise in surgical procedures and utilization of serological fluids and reagents in labs, along with increased blood sample analysis due to high donation rates.

Hospitals and Clinics: The hospitals and clinics segment represent a significant portion of the blood group typing market. Blood typing is essential in clinical settings for various medical procedures, including blood transfusions, organ transplantation, and prenatal testing. The growing prevalence of chronic diseases and the increasing number of surgeries worldwide contribute to the demand for blood typing services in hospitals and clinics.

Regional Analysis:

North America, region leads the global market, driven by significant demand for blood transfusions, higher adoption of automated blood typing instruments, and favorable reimbursement policies. The regulatory approvals for advanced products further contribute to market growth in North America. In Europe, the market holds the second-largest share, with increased numbers of procedures and rising awareness among individuals regarding blood donations. The U.K. has implemented strategies to become a world leader in organ donation and transplantation. The Asia Pacific market is expected to witness remarkable growth due to increasing research and development initiatives for advanced blood group typing technologies. Japan, in particular, is anticipated to see novel product launches as a result of these initiatives. Latin America has shown growth in the market, driven by increasing awareness of blood and organ donations, particularly in Mexico and Brazil. The region has witnessed the establishment of new blood-collection systems plants, enabling companies like Grifols to expand their presence. The Middle East and Africa region presents growth prospects, fueled by rising awareness of blood donations and an increase in the number of blood transfusions in hospital trauma centers.

Blood Group Typing Market Growth Drivers

Several factors drive the growth of the blood group typing market. Firstly, the increasing demand for blood transfusions and the rising prevalence of chronic diseases contribute to the need for accurate blood typing methods. Blood typing is essential to ensure compatible and safe blood transfusions, reducing the risk of adverse reactions and complications. The blood group typing market is driven by the increasing demand for blood group typing in prenatal testing. Determining the blood group and Rh factor of a pregnant woman is crucial for managing potential complications during pregnancy, such as hemolytic disease of the newborn. The need for accurate blood group typing in prenatal care contributes to market growth. The rising number of road accidents, emergencies, and trauma cases worldwide creates a significant demand for blood transfusions. Blood group typing is essential to ensure compatibility between donors and recipients, thereby facilitating safe and successful transfusions. The market for blood group typing benefits from the rising number of blood donations globally. Increased awareness about the importance of blood donation and campaigns promoting voluntary blood donation have led to a higher availability of blood samples for typing and cross-matching.

Moreover, the growing focus on personalized medicine and precision healthcare has increased the importance of accurate blood typing. Blood group information is crucial in determining suitable blood transfusions, organ transplantation compatibility, and identifying potential risks during pregnancy.

Blood Group Typing Market Challenges

The blood group typing market faces challenges related to the complexity of blood group systems, poor infrastructure for blood services in certain regions, the need for skilled professionals to perform tests accurately, and the high cost associated with advanced blood typing methods.

Blood Group Typing Market Key Companies

The blood group typing market is comprised of leading companies that have established a strong presence and possess extensive distribution networks, offering a wide range of products and services to cater to diverse customer needs. These key companies include Quotient Limited, CareDx Inc., Agena Bioscience, Inc., DIAGAST, Illumina, Inc., Grifols, S.A., Immucor, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Merck KGaA, QIAGEN, Beckman Coulter, Inc., and QuidelOrtho Corporation and other players.

These companies employ competitive strategies such as product innovation, strategic partnerships, mergers, and acquisitions to enhance their market share and stay ahead in the blood group typing industry. They continuously invest in research and development to develop advanced technologies and expand their product portfolios.

in July 2022, Quotient Limited signed an agreement with InfYnity Biomarkers to expand the infectious disease menu of its MosaiQ platform, which includes blood screening tests.

In April 2022, Grifols acquired 100% share capital of Tiancheng (Germany) Pharmaceutical Holdings AG, including Biotest AG, to expand its product range, improve patient access to plasma medicines, and operate the largest private European network of plasma facilities (87 sites).

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -