Biobanks Market - Global Size, Share, Trends, Growth and Forecast Year ( 2022 – 2032 )

Biobanks Market Dynamics

Biobanks Market by Product & Service (Equipment, Consumable, Services, Software), Sample Type (Blood Products, Human Tissues, Cell Lines, Nucleic Acids, Biological Fluids, Human Waste Products), Storage Type(Manual Storage, Automated Storage), Application ( Regenerative Medicine, Life Science Research, Clinical Research) and Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa): Industry Trends and Global Forecasts, 2023-2032.

Market Size and Overview:

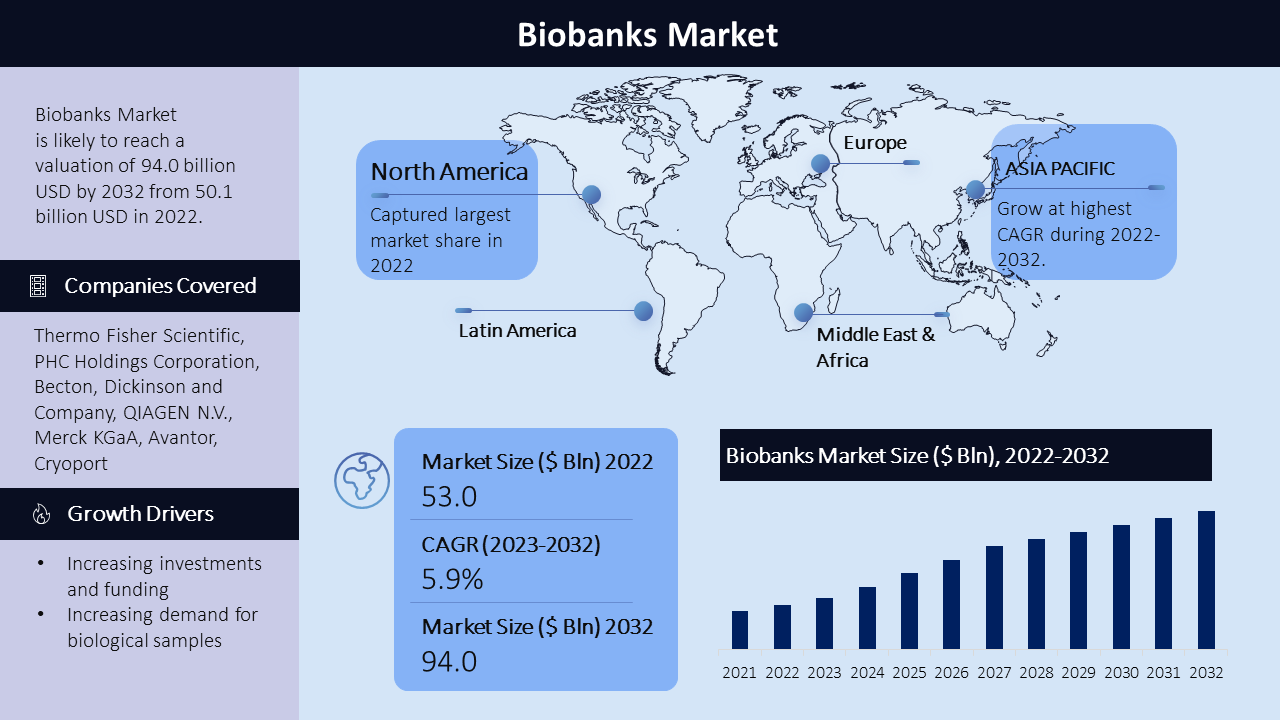

The biobanks market has experienced significant growth, with a compound annual growth rate (CAGR) of 5.9% from 2022 to 2032, reaching a market value of $94.0 billion in 2032. This growth can be attributed to the increasing investments and funding for biobanks, the focus on genetic testing and precision medicine, and the rising trend in the preservation of cord blood stem cells., demand for biological samples and data in various research and development activities, such as drug discovery, personalized medicine, and genomics research. Biobanks play a crucial role in storing and preserving biological samples, including tissues, blood, and DNA, along with associated patient data. The market comprises a wide range of biobanks, including public, private, and academic institutions. The market is highly competitive, with key players continually investing in infrastructure, technology, and partnerships to meet the growing needs of researchers and pharmaceutical companies.

|

Biobanks Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

5.9% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Market Segmentation:

Product & Service

- Equipment

- Storage Equipment

- Sample Analysis Equipment

- Sample Processing Equipment

- Sample Transport Equipment

- Consumables

- Storage Consumables

- Analysis Consumables

- Processing Consumables

- Collection Consumables

- Services

- Storage Services

- Processing Services

- Transport Services

- Supply Services

- Software

Sample Type

- Blood Products

- Human Tissues

- Cell Lines

- Nucleic Acids

- Biological Fluids

- Human Waste Products

Storage Type

- Manual Storage

- Automated Storage

Application

- Regenerative Medicine

- Life Science Research

- Clinical Research

Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Equipment: The equipment segment plays a dominant role in the biobanking market, encompassing various specialized products necessary for the processing, analysis, storage, and transport of biological samples. This includes storage equipment, sample analysis equipment, sample processing equipment, and sample transport equipment. The demand for equipment is driven by the increasing number of biobanks and biosamples, as well as the need for efficient and reliable tools to ensure the integrity and proper handling of biospecimens.

Tissues: The tissues segment dominates the market for biobanks due to the high demand for well-preserved tissue samples for research purposes. Tissue biobanks enable researchers to study diseases, develop new therapies, and advance precision medicine initiatives.

Regional Analysis:

The regional analysis of the biobanks market reveals diverse trends and dynamics across different parts of the world. Starting with North America, this region has witnessed significant growth in the biobanks market, driven by increasing investments and funding, strong research infrastructure, and government support. The United States holds a dominant position in the North American market. Moving to Europe, countries like Germany, the United Kingdom, and France have well-established biobanks and research initiatives. The European market emphasizes genetic testing, precision medicine, and the preservation of biological samples. In the Asia Pacific region, countries such as China, Japan, and India have experienced rapid growth in biobanking. The rising prevalence of chronic diseases, investments in research and development, and expanding healthcare infrastructure contribute to market expansion in this region. Latin America and the Middle East and Africa are emerging markets for biobanks, with increasing investments in healthcare infrastructure and research activities. Brazil, Mexico, and South Africa are key contributors to the market's growth in these regions.

Growth Drivers:

Several factors drive the growth of the biobanks market. Firstly, increasing investments and funding for biobanks have propelled market growth. Governments, research organizations, and funding agencies worldwide recognize the importance of biobanks, leading to substantial investments in infrastructure and research initiatives. The increasing demand for biological samples and associated data for research purposes fuels market growth.

Furthermore, the focus on genetic testing and precision medicine has significantly contributed to market expansion. Biobanks provide researchers with a vast collection of biological samples and associated data, enabling them to understand diseases, develop personalized medicine, and advance healthcare practices.

Moreover, the rising trend in the preservation of cord blood stem cells from newborns has fueled market growth. The storage of cord blood provides a valuable resource for stem cell transplantation and regenerative medicine, driving the demand for biobanking services.

Additionally, the favorable funding scenario for research related to regenerative medicine has played a significant role in market growth. Researchers and pharmaceutical companies are increasingly exploring regenerative therapies, creating a demand for high-quality biological samples and data.

Challenges:

The high cost of automated equipment poses a challenge to the biobanks market. While automation can improve the efficiency and quality of biobanking operations, Regulatory issues pose a market challenge in the biobanks industry.

Key Companies:

The report profiles leading companies in the biobanks market, including Thermo Fisher Scientific, PHC Holdings Corporation, Becton, Dickinson and Company, QIAGEN N.V., Merck KGaA, Avantor, Cryoport, Tecan Trading AG, Azenta, Greiner Holding AG, Hamilton Company, Micronic, AMSBIO, Bay Biosciences LLC, BioKryo, SPT Labtech, ASKION GmbH, Cell&Co BioServices, Ziath Ltd., CTIBiotech, Cureline, Firalis Group, Sopachem, ProteoGenex, and US Biolab Corporation, Inc. Among other players These companies have established themselves as key players in the industry, with extensive expertise in biobanking operations, infrastructure, and collaborations. Their competitive strategies focus on product innovation, strategic partnerships, and expanding their market share to cater to the evolving needs of researchers and medical facilities.

On February 2023, PHC Corporation of North America launched the PHCbi Brand VIP ECO SMART Ultra-low Temperature Freezer, which offers industry-leading energy efficiency and enhances biobanking capabilities.

In September 2022, Cryoport entered into a strategic partnership with BioLife Plasma Services to provide supply chain solutions and bioservices for the preservation and transportation of biospecimens.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -