Active Implantable Medical Devices Market By Product (Implantable Cardioverter Defibrillators (Transvenous & Subcutaneous), Cardiac Pacemaker, Ventricular Assist Device, Implantable Heart Monitors, Neurostimulator, Implantable Hearing Devices); By End-Users (Hospitals, Clinics, Ambulatory Surgical Centers, Others) And By Geographic Regions (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Global Market Analysis, Trends, Opportunity and Forecast, 2023-2032

Active Implantable Medical Devices Market Size and Overview

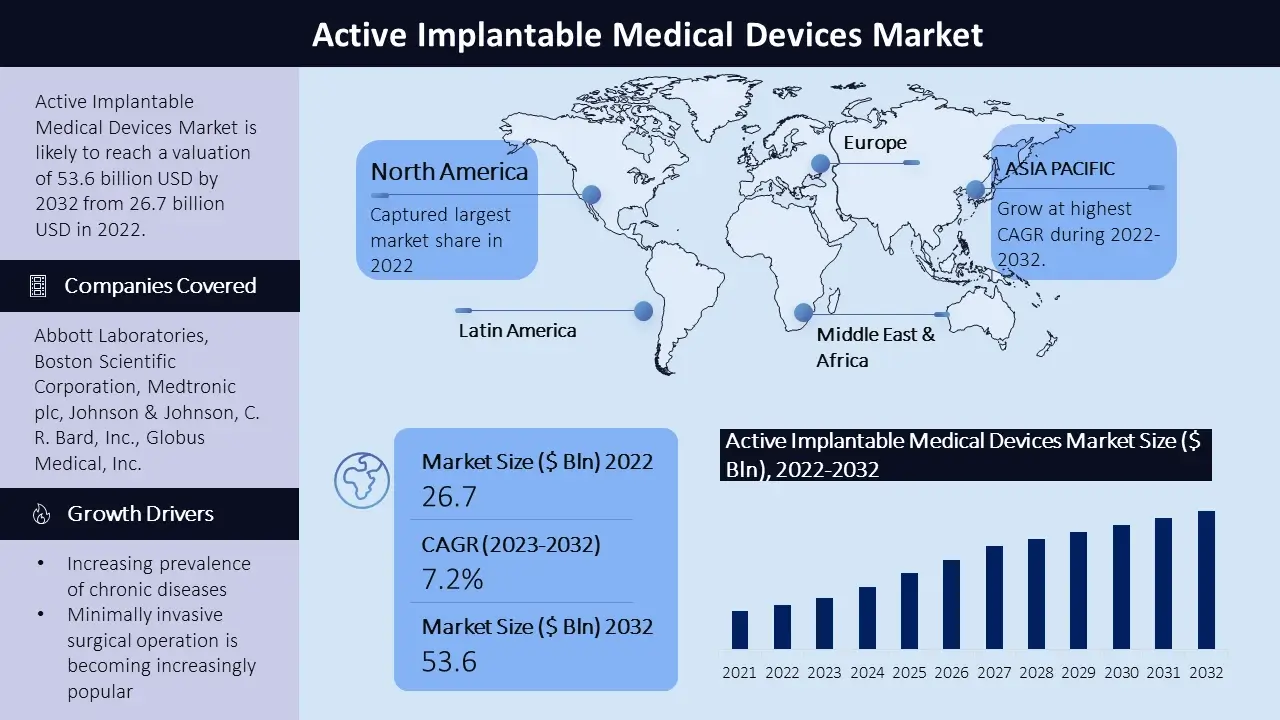

The active implantable medical devices market size is poised to reach USD 53.6 billion by the end of 2032, growing at a CAGR of 7.2% during the forecast period, i.e., 2023 – 2032. In the year 2022, the industry size of active implantable medical devices market was USD 26.7 billion. The reason behind the growth can be attributed to the increasing prevalence of chronic diseases such as cardiovascular diseases and neurological disorders, minimally invasive surgical operation is becoming increasingly popular, the expanding healthcare infrastructure and increasing healthcare expenditure in developing regions, the advent of smart technology integration in active implantable medical devices. The marketplace incorporates a wide range of devices. The market is highly competitive with key players striving to meet evolving customer demands.

Active Implantable Medical Devices Market: Report Scope |

|

|

Base Year Market Size |

2022 |

|

Forecast Year Market Size |

2023-2032 |

|

CAGR Value |

7.2% |

|

Segmentation |

|

|

Challenges |

|

|

Growth Drivers |

|

Active Implantable Medical Devices Market Segmentation:

By Product

- Implantable Cardioverter Defibrillators

- Transvenous Implantable Cardioverter Defibrillators

- Biventricular Implantable Cardioverter Defibrillators/Cardiac Resynchronization Therapy Defibrillators

- Dual-Chamber Implantable Cardioverter Defibrillators

- Single-Chamber Implantable Cardioverter Defibrillators

- Subcutaneous Implantable Cardioverter Defibrillators

- Transvenous Implantable Cardioverter Defibrillators

- Ventricular Assist Devices

- Implantable Heart Monitors/Insertable Loop Recorders

- Neurostimulators

- Spinal Cord Stimulators

- Deep Brain Stimulators

- Sacral Nerve Stimulators

- Vagus Nerve Stimulators

- Gastric Electrical Stimulators

- Implantable Hearing Devices

- Active Hearing Implants

- Non-active/Passive Hearing Implants

By End-Users:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

By Geographic Regions:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

On the basis of Product in the active implantable medical devices market the implantable cardioverter defibrillator (ICD) segment accounted the highest market share in 2022. The implantable cardioverter defibrillators section accounted for the most significant percentage of the implantable and life-sustenance devices market in 2022, owing to the increasing incidence of cardiovascular conditions, improvement of technologically advanced gadgets, and growing demand for these devices in emerging international locations. Within the ICD marketplace, the transvenous implantable cardioverter defibrillator (T-ICD) phase had the largest marketplace percentage.

Active Implantable Medical Devices Market Regional Analysis

North America stands as one of the major markets for active implantable medical devices, driven through the emphasis on healthcare infrastructure and technological advancements in medical devices. Additionally growing prevalence of chronic diseases make contributions to the region’s dominance. The United States, primarily, is a key contributor on this marketplace. Europe is one of the leading marketplaces for active implantable medical devices because of the region’s mix of public and private healthcare providers. The European market showcases a growing interest in active implantable medical devices, fueled by advancements in technology and favorable government policies. The Asia Pacific active implantable medical devices market is estimated to witness significant growth, during the forecast timeframe led by, rising healthcare infrastructure, increasing disposable incomes, and a growing geriatric population. The demand for active implantable medical devices is anticipated to rise in countries like China and India, given their expanding healthcare systems and rising prevalence of chronic diseases. Latin America and the Middle East and Africa display steady growth inside the active implantable medical devices market, fueled via improving healthcare infrastructure and a rising middle class, and a growing demand for advanced medical technologies in these regions. Key participants to the market's growth in these areas encompass Brazil, Mexico, the United Arab Emirates, and South Africa.

Active Implantable Medical Devices Market Growth Drivers

The growing occurrence of chronic illnesses, including cardiovascular diseases and neurological problems, propel the demand for implantable clinical devices for treatment. Additionally, technological improvements have brought about the development of superior clinical tools, which includes leadless pacemakers and neurostimulators, attracting healthcare carriers and sufferers alike. The developing geriatric population and sedentary lifestyle additionally make contributions to market growth. The expanding healthcare infrastructure and increasing healthcare expenditure in developing regions force the demand for active implantable clinical devices. Healthcare carriers invest in advanced scientific era for disease management, boosting the sales of implantable medical devices inclusive of pacemakers and defibrillators. Minimally invasive surgical operation is becoming increasingly popular due to its many benefits over conventional surgical strategies. Active Implantable Medical Devices (AIMDs) are minimally invasive devices that may be implanted within the frame without essential surgical operation, making them a famous preference for sufferers. The advantages of minimally invasive surgical procedure consist of smaller incisions, less trauma and blood loss, much less scarring, and a shorter hospital stay. The introduction of smart technology integration in active implantable medical gadgets has converted the market panorama. Smart capabilities, together with far off tracking and actual-time data evaluation, enhance patient experience and healthcare company productivity, using marketplace growth.

Active Implantable Medical Devices Market Challenges

High cost of devices and complex regulatory requirements are hindering the growth of market. In developing regions, this factor has resulted in limited demand for product. Moreover, the reimbursement policies for AIMDs are also restricting the growth of market.

Active Implantable Medical Devices Market Key Companies

The active implantable medical devices market is poised by several main corporations, each making big contributions to the industry through their sturdy market presence and progressive product offerings. Among these principal players are Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Johnson & Johnson, C. R. Bard, Inc., Globus Medical, Inc., LivaNova PLC, CONMED Corporation, Biotronik SE and Co. KG, Cardinal Health, Inc., Integra LifeSciences Holdings Corporation, Cochlear Limited, MED-EL, Sonova Holding AG, William Demant Holding A/S, and Nurotron Biotechnology Co. Ltd. And other players. These essential players constantly try and revamp their marketplace percentage and meet the desires of a diverse investor base. Their competitive techniques encompass product innovation, forging strategic partnerships, undertaking mergers and acquisitions, and increasing their distribution networks.

In March 2023, Medtronic announced the launch of its new MiniMed 780G insulin pump, which is the first hybrid closed-loop system to be approved by the FDA.

In April 2023, Boston Scientific announced the launch of its new WATCHMAN FLX implantable cardiac defibrillator, which is the smallest and lightest ICD on the market.

Need Customized Report for Your Business ?

Utilize the Power of Customized Research Aligned with Your Business Goals

Request for Customized Report- Quick Contact -

- ISO Certified Logo -